Investing in Walt Disney (NYSE:DIS) hasn’t proven lucrative, even for those who exhibited some patience with the stock. For instance, DIS stock is down about 35% in three years. Meanwhile, the stock has lost over 17% of its value in five years. Nonetheless, Disney is focusing on improving the profitability of the direct-to-consumer business while its theme parks continue to generate solid growth. This implies that Disney is poised to deliver strong growth ahead. As Disney could witness better days ahead, it prompts the question: who owns DIS?

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

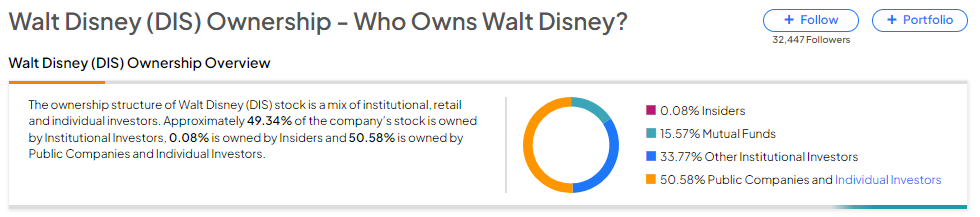

Now, according to TipRanks’ ownership page, Disney is mostly owned by public companies and individual investors at 50.58%, followed by other institutional investors, mutual funds, and insiders at 33.77%, 15.57%, and 0.08%, respectively.

Digging Deeper into Disney’s Ownership Structure

Upon a detailed examination of institutional ownership, Vanguard stands out as the top shareholder of Disney stock, holding a stake of approximately 7.01%. Following closely is Vanguard Index Funds, with a notable ownership stake of 6.45% in the company.

Among the other institutions, the Hedge Fund Confidence Signal is Very Positive on DIS stock based on the activity of 23 hedge funds. Meanwhile, of all the hedge fund managers tracked by TipRanks, Nelson Peltz of Trian Fund Management LP has the largest position in Disney stock, owing about 1.8%.

While the Hedge Fund Confidence Signal is Very Positive on DIS, individual investors have a negative outlook. Of the 703,231 portfolios monitored by TipRanks, only 3% have invested in Disney stock. This suggests that investors aren’t confident about Disney’s prospects, at least in the near term.

Is Disney Stock Expected to Rise?

Disney stock has shown a recovery in the recent past. However, analysts’ average price target suggests a limited upside potential in DIS stock over the next 12 months.

With 18 Buy, six Hold, and one Sell recommendations, Walt Disney stock has a Moderate Buy consensus rating on TipRanks. Further, the average DIS stock price target of $106.52 implies a 13.14% upside potential from current levels.

Bottom Line

The ownership composition of Disney stock demonstrates a solid mix of institutional, retail, insider, and individual investors. Disney is taking initiatives to boost profitability and is benefitting from the strength of the theme parks business. However, heightened competition in the streaming business and weaknesses in linear TV ads continue to pose challenges in the short term.