Shares of financial technology company Upstart (NASDAQ:UPST) have dropped nearly 71% from its 52-week high of $72.58. Further, this AI (Artificial Intelligence)-driven lending platform could continue to face challenges due to the high interest rate environment, resulting in lower loan origination and revenue growth. As Upstart stock wiped out massive shareholders’ value, it prompts the question: who owns UPST?

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

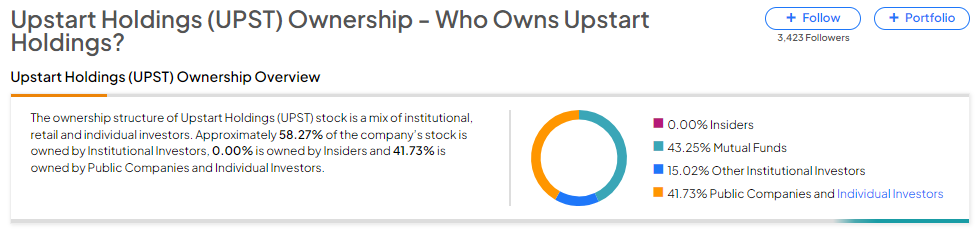

Now, according to TipRanks’ ownership page, UPST stock is mostly owned by mutual funds at 43.25%, followed by public companies and individual investors, and other institutional investors at 41.73% and 15.02%, respectively.

Digging Deeper into UPST’s Ownership Structure

Upon a detailed examination of institutional ownership, Janus Investment Fund emerges as the top shareholder of UPST stock, holding a stake of approximately 25.14%. Following Janus Investment Fund is Vanguard, which has a notable ownership stake of 7.78% in the company.

Among the other institutions, the Hedge Fund Confidence Signal is Positive on UPST stock based on the activity of three hedge funds. Moreover, of all the hedge fund managers tracked by TipRanks, Philippe Laffont of Coatue Management has the largest position in Upstart stock, owing about 1.98%.

While the Hedge Fund Confidence Signal is Positive for Upstart stock, individual investors maintain a Neutral outlook. Among the 699,989 portfolios monitored by TipRanks, only 0.7% have invested in Upstart stock. This implies that investors aren’t betting big on UPST stock.

What is the Forecast for Upstart Stock?

The elevated interest rate environment could continue to pose challenges for Upstart stock. This is why Wall Street analysts maintain a bearish outlook. With one Buy, six Hold, and five Sell recommendations, Upstart stock has a Moderate Sell consensus rating.

Further, the average UPST stock price target of $24.40 implies 14.13% upside potential from current levels.

Bottom Line

The Upstart stock’s ownership structure demonstrates a well-balanced mix of institutional, retail, and individual investors. Furthermore, UPST stock will gain from the company’s efforts to add diversified funding sources that will strengthen the reliability of loan funding on its platform. However, the higher interest rate environment and increased funding costs could pose challenges.