Uber (NYSE:UBER) stock has gained substantially in value and is up about 153% year-to-date. The rally in the shares of this ride-hailing giant is led by its solid financial performances so far this year. The company is benefitting from the acceleration in trip growth. Moreover, the number of active consumers on its platform has been increasing. As Uber stock has witnessed a stellar recovery in 2023 and is delivering solid financials, it led us to wonder: who owns UBER?

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

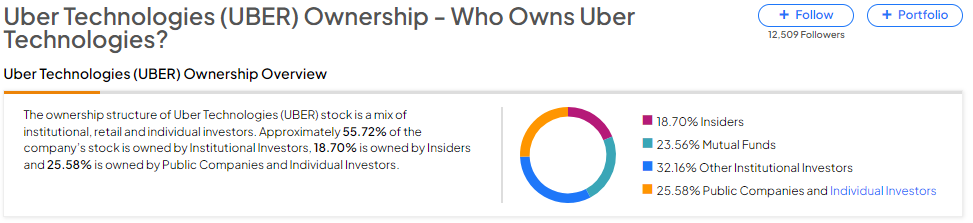

Now, according to TipRanks’ ownership page, Uber is mostly owned by Other Institutional Investors at 32.16%, followed by public companies and individual investors, mutual funds, and insiders at 25.58%, 23.56%, and 18.70%, respectively.

Digging Deeper into Uber’s Ownership Structure

Upon digging deeper into institutional ownership, Vanguard stands out as the top shareholder of Uber stock, holding a stake of approximately 5.73%. Following closely is Vanguard Index Funds, with a notable ownership stake of 5.25% in the company.

Among the other institutions, the Hedge Fund Confidence Signal is Very Negative on Uber stock based on the activity of 49 hedge funds.

While the Hedge Fund Confidence Signal is Very Negative on UBER, it has a Positive signal from individual investors. However, of the 706,666 portfolios monitored by TipRanks, only 1.3% have invested in Uber stock. This limited participation suggests investors aren’t confident about Uber’s long-term prospects.

What is the Forecast for Uber Stock?

Given Uber’s strong financial and operating performance, Wall Street analysts are optimistic about its stock. With 34 unanimous Buy recommendations, Uber stock has a Strong Buy consensus rating.

Meanwhile, the average UBER stock price target of $63.94 indicates that it has the potential to go up by 2.3% from current levels.

Bottom Line

The ownership structure of Uber stock shows a balanced mix of institutional, retail, insider, and individual investors. Uber is executing well and is growing its gross bookings at a solid pace. Further, its rigorous cost discipline positions it well to deliver sustainable profitability in the long term, which is reflected in analysts’ bullish outlook.