Shares of EV (electric vehicle) maker Rivian (NASDAQ:RIVN) are up 28% year-to-date despite macro headwinds impacting EV demand. Additionally, the end of the exclusive agreement with Amazon (NASDAQ:AMZN) last month allows Rivian to broaden its customer base, which should positively impact its revenue. As Rivian is expected to benefit from the end of its exclusivity pact with AMZN, it led us to wonder: who owns RIVN?

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Now, according to TipRanks’ ownership page, RIVN is mostly owned by Other Institutional Investors at 35.78%, followed by insiders, Public Companies and individual investors, and mutual funds at 26.30%, 19.49%, and 18.43%, respectively.

Digging Deeper into Rivian’s Ownership Structure

Upon digging deeper into institutional ownership, Vanguard Index Funds stands out as the top shareholder of RIVN stock, holding a stake of approximately 6.50%. Following closely is Vanguard, with a notable ownership stake of 6.44% in the company.

Among the other institutions, the Hedge Fund Confidence Signal is Very Negative on RIVN stock based on the activity of 10 hedge funds. Of all the hedge fund managers tracked by TipRanks, Daniel Sundheim of D1 Capital Partners has the largest position in RIVN on an absolute basis at roughly $327.4 million. This equates to about 4.72% of his total portfolio.

While the hedge fund confidence signal remains Very Negative, investor sentiment is Positive on Rivian stock in the short term. Moreover, of the 707,900 portfolios monitored by TipRanks, 2.5% have invested in RIVN stock.

Is Rivian Stock Expected to Rise?

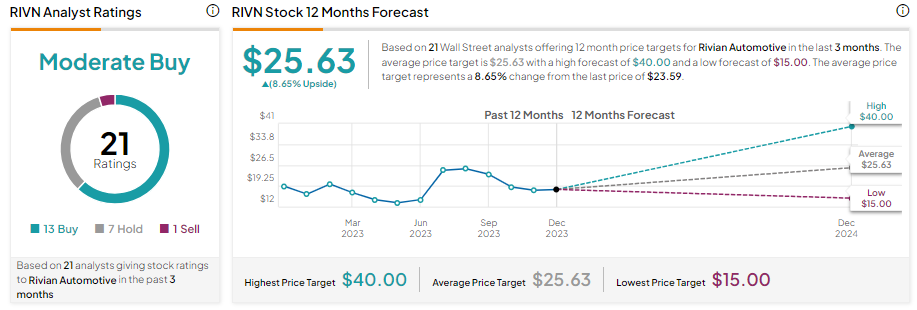

Rivian stock is expected to increase by 8.65% over the next 12 months based on analysts’ average price target of $25.63 per share. Further, analysts are cautiously optimistic about RIVN’s prospects.

It has received 13 Buy, seven Hold, and one Sell recommendations for a Moderate Buy consensus rating.

Bottom Line

The ownership structure of Rivian stock demonstrates a diversified mix of institutional, insider, and individual investors. Rivian is taking measures to ramp up production, improve cost efficiency, and strengthen its balance sheet, which is positive. However, macro challenges keep analysts cautiously optimistic about its prospects.