Shares of the leading software company Palantir Technologies (NYSE:PLTR) have marked a stellar recovery so far this year. For instance, Palantir stock has gained over 208% year-to-date. This explosive rally reflects the company’s ability to capitalize on AI (artificial intelligence). As the company is poised to gain from the strong demand for its AI platform, it prompts the question: who owns PLTR?

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

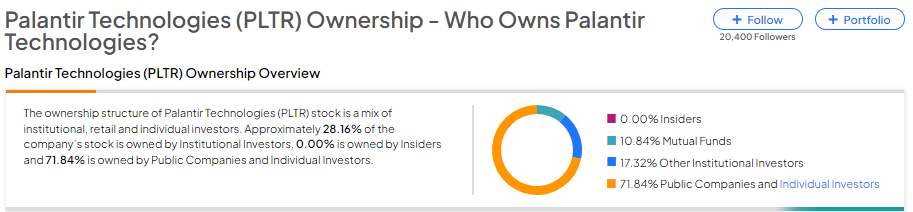

Now, according to TipRanks’ ownership page, it’s mostly owned by public companies and individual investors at 71.84%, followed by other institutional investors and mutual funds at 17.32% and 10.84%, respectively.

Digging Deeper into Palantir’s Ownership Structure

Upon a detailed examination of institutional ownership, Vanguard emerges as the top shareholder of Palantir stock, holding a stake of approximately 8.76%. Following closely is Vanguard Index Funds, with a notable ownership stake of 7.13% in the company.

Among the other institutions, the Hedge Fund Confidence Signal is Negative on PLTR stock based on the activity of 18 hedge funds. Nonetheless, of all the hedge fund managers tracked by TipRanks, Cathie Wood of ARK Investment Management has the largest position in Palantir stock, owing about 0.46%.

Along with the hedge funds, individual investors also have a negative view of the company. Among the 700,939 portfolios monitored by TipRanks, only 2.5% have invested in PLTR stock. This suggests that investors aren’t upbeat about Palantir’s prospects, at least in the near term.

What is Palantir Stock Prediction?

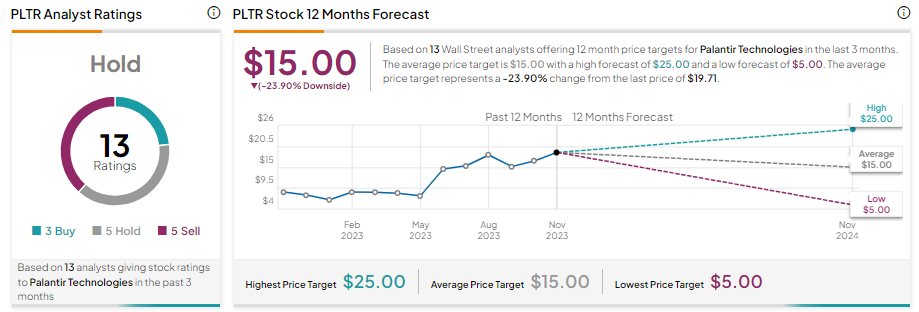

Given the significant rise in Palantir stock, Wall Street analysts prefer to remain sidelined. With three Buy, five Hold, and five Sell recommendations, PLTR stock has a Hold consensus rating. Further, the average RKLB stock price target of $15 implies 23.9% downside potential from current levels.

Bottom Line

The ownership composition of Palantir stock showcases a mix of institutional, retail, and individual investors. PLTR stock has gained over 208% and is poised to benefit from its AI initiatives. However, analysts’ average price target indicates a pullback is due in PLTR stock.