Shares of the athletic footwear and apparel company Nike (NYSE:NKE) are down over 7% in one year, underperforming the S&P 500’s (SPX) nearly 25% gain. The short-term margin headwinds and increased competition from emerging brands took a toll on NKE stock. However, with Nike taking measures to improve its inventory and focusing on speeding up its product innovation cycle, it’s the right time to delve into NKE’s ownership structure.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

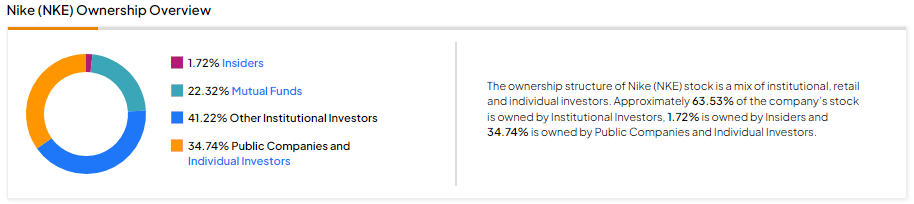

Now, according to TipRanks’ ownership page, Nike is mostly owned by Other Institutional Investors at 41.22%, followed by public companies and individual investors, mutual funds, and insiders at 34.74%, 22.32%, and 1.72%, respectively.

Digging Deeper into Nike’s Ownership Structure

Looking closely at institutions (Mutual Funds and Other Institutional Investors), Vanguard owns the most significant stake in NKE stock, which stands at 7.83%. This is followed by Vanguard Index Funds, which holds a 6.5% stake in the company.

Among the institutions, the Hedge Fund Confidence Signal is Neutral on Nike based on the activity of 25 hedge funds. Notably, Hedge Funds increased holdings by 28.9K shares in the last quarter.

Meanwhile, individual investors have a Very Positive view of the company, given that in the last 30 days, the number of portfolios (tracked by TipRanks) holding the stock increased by 6.1%. Overall, among the 708,696 portfolios monitored by TipRanks, 1% have invested in NKE stock.

What is the Price Target for Nike?

Nike has a Moderate Buy consensus rating based on 20 Buys, nine Holds, and one Sell rating assigned over the last three months. Further, the average NKE stock price target of $124 implies about 14.21% upside potential from current levels.

Conclusion

The Ownership tool from TipRanks offers valuable insights into Nike’s category-wise ownership structure, empowering investors to make informed investment choices.