Shares of athletic apparel, footwear, and accessories company Lululemon Athletica (NASDAQ:LULU) have gained over 55% in one year. On January 16, Morgan Stanley analyst Alexandra Straton raised LULU stock’s price target to $539 from $493 and maintained a Buy rating. As the analyst is optimistic about Lululemon’s prospects, it’s the right time to delve into its ownership structure.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

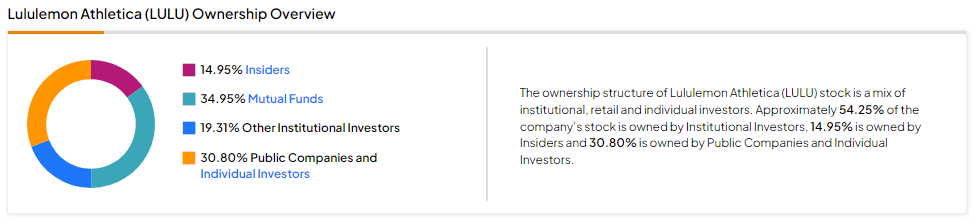

Now, according to TipRanks’ ownership page, mutual funds own 34.95% of LULU. They are followed by public companies and individual investors, other institutional investors, and insiders at 30.80%, 19.31%, and 14.95%, respectively.

Digging Deeper into Lululemon’s Ownership Structure

Looking closely at institutions (Mutual Funds and Other Institutional Investors), Vanguard owns a 7.03% stake in LULU stock. Next up is Fidelity Mt. Vernon Street Trust, which holds a 6.42% stake in the company.

Among the institutions, the Hedge Fund Confidence Signal is Very Negative on Lululemon stock based on the activity of 18 hedge funds. Notably, Hedge Funds decreased their holdings by 784.3K shares in the last quarter.

While the hedge fund confidence signal is very negative, individual investors have a Neutral view of the company. However, in the last 30 days, the number of portfolios (tracked by TipRanks) holding the stock increased by 0.9%. Overall, among the 711,293 portfolios monitored by TipRanks, 0.4% have invested in Lululemon stock.

Is Lululemon Stock a Buy or Sell?

Wall Street analysts are bullish about Lululemon’s prospects. 22 out of 27 analysts covering LULU stock recommend a Buy. Four have a Hold, and one maintains a Sell rating. Overall, Lululemon stock has a Strong Buy consensus rating.

Analysts’ average price target of $525 implies an upside potential of 9.96% over the next 12 months.

Conclusion

TipRanks’ Ownership tool offers a breakdown of Lululemon’s ownership structure by category, empowering investors to make well-informed decisions when considering investments.