Shares of Advanced Micro Devices (NASDAQ:AMD) are up over 82% year-to-date. The AMD stock surge indicates investors’ optimism over AI (Artificial Intelligence). In line with AMD’s AI initiatives, the company recently introduced a range of new chips, including the Ryzen 8040 series. Also, its processors for data centers and gaming should continue to drive its stock price. Since the company is a solid long-term player, it led us to wonder who owns AMD.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

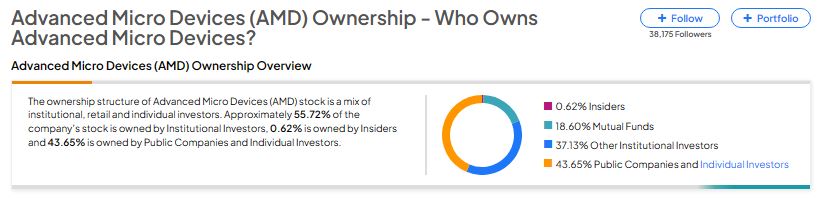

According to TipRanks’ ownership page, it’s mostly owned by public companies and individual investors at 43.65%, followed by other institutional investors, mutual funds, and insiders at 37.13%, 18.60%, and 0.62%, respectively.

Looking closely at institutions (Mutual Funds and Other Institutional Investors), Vanguard owns the most significant stake in AMD stock. This is followed by Vanguard Index Funds, which holds a 6.49% stake in the company.

Among the institutions, the Hedge Fund Confidence Signal is Very Positive on AMD based on the activity of 35 hedge funds. Of all the hedge fund managers tracked by TipRanks, Ken Fisher of Fisher Asset Management LLC has the largest position in AMD stock at roughly $3.07 billion. Next is Philippe Laffont of Coatue Management, whose investment is valued at $1.59 billion.

Although the Hedge Fund Confidence Signal strongly favors AMD stock, it’s noteworthy that individual investors have a negative view of the company. Among the 697,147 portfolios monitored by TipRanks, 3.7% have invested in AMD stock. Despite the prevailing negative sentiment among short-term investors, what stands out is that investors allocate 7.24% of their portfolios to AMD. This suggests that investors are confident about its long-term prospects.

What is the Price Target for AMD Stock?

Advanced Micro Devices has a Strong Buy consensus rating based on 21 Buys, five Holds, and zero Sell ratings assigned over the last three months. Further, the average AMD stock price target of $128.60 implies about 10% upside potential from current levels.