Inflation is not going anywhere soon, with inflation hitting double figures for the first time in 40 years in Britain – so could it be a good time to invest in high-paying dividend stocks?

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

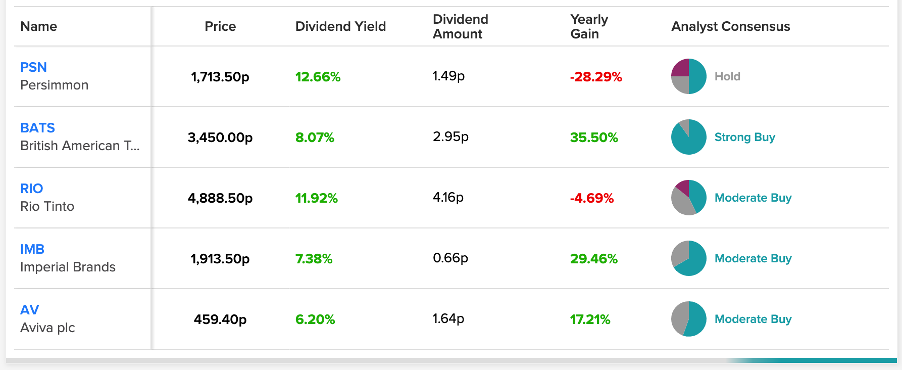

We have used the TipRanks stock comparison tool to list the high dividend stocks. This tool can be used by investors to compare stocks on any specific criteria (like dividends in this case).

Can you get rich off dividend stocks?

1. Persimmon

Persimmon (GB:PSN) is one of the UK’s largest builders for the residential sector. The company owns brands such as Persimmon, Charles Church, and Westbury Partnerships.

The company has a very attractive dividend yield of 12.72%, which provides a cushion against the current harsh inflation rates in the UK market. It paid a dividend of 110p per share in July 2022.

According to its recent trading update, the company’s revenue was slightly down, mainly due to supply disruptions of labour and raw material shortages. However, this was offset by higher home prices, leading to improved margins. Therefore, Persimmon is expecting its profits for the half-year to beat expectations.

2. British American Tobacco

Cigarette manufacturer British American Tobacco (GB:BATS) is among the best dividend payers in the market. It has a dividend yield of 8.07% as compared to its sector average of 1.65%. The company’s stock also performed well last year, beating the market with a 35.5% return.

The company has transitioned smoothly into the smoke-free market, as the demand for cigarettes is falling. It expects to generate £5 billion in revenue for this category and remain profitable by 2025. The company remains confident in its guidance numbers, including its dividends.

The solid cash position and a stronghold in both combustible and traditional markets make the dividend story more appealing.

3. Rio Tinto

Rio Tinto (GB:RIO) is the second largest miner in the world, dealing in iron ore, aluminium, copper, and more. The company has been a solid dividend payer and a favourite among shareholders. Rio has a dividend yield of 11.9% which is impressive as compared to the sector average of 1.9%

The stock has been a bit shaky of late, mainly due to volatility in commodity prices.

The company’s last interim results, posted in July 2022, clearly showed how profits were impacted due to falling iron ore prices. As a result, it slashed its interim dividend by 29% to $2.67 per share. Despite this, this year’s interim dividend was among the company’s best.

The company has a healthy balance sheet and it is looking to expand into greener energy, which will reduce its dependency on fossil fuels.

4. Imperial Brands

Another dividend payer from the tobacco industry is Imperial Brands (GB:IMB). Even though its position is not as strong as BATS in the smoke-free market, the company’s dividends make up for it.

Currently, the stock has a dividend yield of 7.4%. The company follows a progressive dividend policy and increased its dividend by 1%. It approved an interim dividend of 48.4p per share paid in two equal parts.

Talking about the share prices, the company has performed fairly well and is up by 28.2% in the last year.

5. Aviva

British insurance company Aviva (GB:AV) posted a solid set of results last week, which pushed its stock prices up by 11%.

The results show the company’s sound health and profitability, along with a nice dividend story. The company announced an interim dividend of 10.3p per share in its results, which is in line with its full-year guidance number of 31.0p. Compared to the sector average of 2.1%, Aviva’s dividend yield of 6.2% is quite attractive.

The company’s cash position is strong because of its cost restructuring and debt repayment which gives it ample scope to reward shareholders with dividends. This also allows Aviva to finance its acquisitions, which boosts its top line.