Amid strong gas demand fears over the war in Ukraine, the sabotage of the Nord Stream pipeline, and discussions within the EU about a possible price cap to calm energy bills, the price of gas is rising much faster than the price of oil. Given such a framework, investors are spoiled for choice among U.S.-listed oil and gas stocks. Two energy stocks to consider are EQT Corporation (NYSE:EQT) and Tourmaline Oil (OTC:TRMLF) (TSE:TOU). However, EQT appears to have superior near-term growth potential.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

This can be attributed to the acquisition of certain mineral properties, due to be completed by 2022, which will position its operations much better to take advantage of the rapid rise in natural gas.

EQT Corporation

EQT generated a sales volume of 502 billion cubic feet equivalent (Bcfe) of natural gas in the second quarter of 2022 (an increase of 81% year-over-year), sold at an average realized price of $3.21 per thousand cubic feet per day (an increase of 35.4% on an annual basis).

Among other things, the combination resulted in pro forma free cash flow of $543 million, or a 2.5x increase year-over-year, after CapEx of $376 million (up 52.8% year-over-year).

Free cash flow will be a relevant catalyst for EQT’s share price in the coming months once the company completes the purchase of a 90,000-acre property in Southwest Appalachia for a total purchase price of $5.2 billion.

The transaction, which includes the acquisition of related midstream operations, is expected to close before the end of 2022. It is estimated to generate free cash flow at a minimum natural gas price of ~$1.35/MMBtu.

As such, EQT will have significant incremental free cash flow that can be returned to shareholders and used to deleverage the balance sheet. This can strong upside potential for shares.

Is EQT Stock a Good Stock to Buy?

On Wall Street, EQT Corporation has a Strong Buy consensus rating based on 12 Buys, one Hold, and zero Sells assigned over the past three months. At $63.08, the average EQT price target implies upside potential of 59.6%.

In addition, the forward EV/EBITDA ratio, which usually serves better than any other financial indicator to assess stocks of capital-intensive companies, comes in at 4.4x for EQT Corp, indicating an attractive stock compared to the industry median of 4.9x.

Tourmaline Oil Corp.

Tourmaline Oil produced 502,937 barrels of oil equivalent per day (boe/d) from its mineral resources in the second quarter of 2022, representing a 23% growth compared to the same period in 2021. The increase in production, combined with strong commodity prices, allowed various financial targets to be pursued, including reducing net debt through cash flow.

This will allow Tourmaline Oil to continue funding its dividend of C$0.22 per common share and other special dividends. In addition, the lower net debt makes it easier to plan a long-term growth strategy. Indeed, the company targets long-term cash flow of C$31 billion and free cash flow of approximately C$18 billion by 2028.

However, the 2023 cash flow growth target is C$5.1 billion, which is only a marginal improvement from the C$5 billion in 2022, despite the projected sharp rise in fossil fuel prices.

In the short term, Tourmaline Oil’s growth plan may reflect less upside potential for the stock price compared to EQT.

Is Tourmaline Oil Stock a Good Stock to Buy?

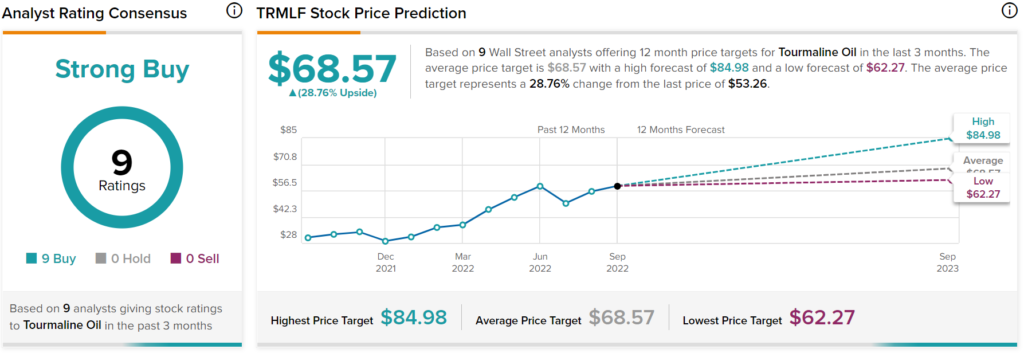

On Wall Street, Tourmaline Oil Corp has a Strong Buy consensus rating based on nine Buys assigned over the past three months. At $68.57, the average TRMLF price target implies upside potential of 28.8%.

Furthermore, Tourmaline Oil’s forward EV/EBITDA ratio is 4.3x, compared to the industry median of 4.9x.

Conclusion: EQT Stock Has More Upside Potential in the Short Term

EQT Corporation is steadily emerging as one of the oil and gas stocks that analysts strongly recommend for the upcoming period. Following the strategic acquisition of a hydrocarbon asset in the Appalachian Basin, EQT Corporation is now much better positioned to take advantage of the expected surge in natural gas. As a result, EQT offers more upside potential in the near term.