This is the second article in a series. The first article can be found here: “GOLD: Should Investors Add Some Shine to Their Portfolios?”

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Contrary to popular belief, gold is a risk asset, and as such, cannot serve as a reliable store of value. It also doesn’t offer better protection from inflation than equities. That is true for the long term; however, in shorter periods, the yellow metal can be a profitable trade, specifically at times of declining real interest rates and when the economy is weak. Besides, gold, with its zero-to-negative correlation to equities, can help achieve a broad portfolio diversification, which is important, as each asset class can help mitigate different risks in times of increased economic, political, and market uncertainty.

Now might be a good time to add some shine to your portfolio. Although gold prices are near an all-time high, the tailwinds that have propelled it to these levels are still intact, including the worsening economic outlook, banking turmoil, debt-ceiling stalemate, and market turbulence.

High inflation is also one of the factors behind the appeal of the yellow metal in the past year – although the Federal Reserve’s tightening campaign has worked in the opposite direction, as higher real yields tend to depress the attractiveness of non-interest-yielding gold versus bonds. However, the recent reading pointed to lessening inflation pressures, raising bets that the Fed may have room to end the interest rate increases as prices cool.

With all other factors held constant, this might provide further support for gold prices for a while – until the economy accelerates and/or we see a meaningfully broad stock market rally. Please note that, although in most cases, gold prices don’t tend to crash as much as other risk assets, they may decline notably when sentiment improves and the demand for safe havens dwindles.

Gold Investing: Who, What, How?

There are many ways to invest in the yellow metal, from bullion and coins to derivatives, but the most popular and easiest types of gold investments are gold-backed ETFs (exchange-traded funds) and ETFs related to gold mining stocks. Here’s a brief comparison of the two:

» Gold-backed ETFs are designed to track the price of gold. They invest in physical gold bullion, so their performance is directly tied to the spot price of gold. They’re generally less risky than gold mining stocks since they aren’t affected by company-specific issues. However, their upside potential is limited to the increase in gold prices in the markets. Basically, in terms of returns, investing in a gold-backed ETF is like buying physical gold, but with the added liquidity of a stock and no need for storage of the metal.

» Gold-mining stock ETFs invest in a basket of companies involved in the mining and production of gold. Their performance is influenced by the price of gold but also by factors such as the operational efficiency of the mining companies, management decisions, regulatory changes, geopolitical risks, etc. This makes them more volatile and potentially riskier than gold-backed ETFs. However, they can provide higher returns if the mining companies perform well, especially during times of rising gold prices.

Gold-Backed ETFs: All That Glitters

Gold-backed ETFs were first introduced in 2004 as an easy and inexpensive means to invest in gold by the general public that is unable or unwilling to hold the physical metal or expose themselves to risks involved in buying gold futures. These investment vehicles quickly gained popularity, thanks to the fact that they can offer exposure to gold in portfolios of all sizes, making the metal accessible to everyone. Besides, gold-backed ETFs trade like regular stocks, which means that this type of investment is much better in terms of liquidity than buying the shiniest of all metals by the ounce.

Gold ETFs are designed to track the price of the metal, and they do this by holding physical gold bullion or other forms of physical gold in a vault on behalf of their investors. Gold ETF investors don’t own the commodity directly, but they hold proportional shares that represent their rights to the gold owned by the ETF. Because of this, the value of these shares tends to rise and fall with the spot price of gold.

Gold is often viewed as a “safe-haven” asset, meaning investors turn to it in times of economic uncertainty or market volatility when they expect the value of other investments to decline. In more stable economic conditions, when other investments like stocks might be expected to provide higher returns, the price of gold often remains relatively stable or may even decline. Therefore, while a gold ETF can provide a counterweight to the market’s declines, its potential for significant price appreciation is generally more limited compared to other types of investments.

The largest gold-backed ETFs, by far, are SPDR Gold Shares (GLD) and iShares Gold Trust (IAU) – each one of them surpasses all of their competitors’ combined assets under management. They track the price of physical bullion, therefore, returns from investment in these vehicles have the same limited upside potential as the metal. The price of gold, while it can fluctuate, typically doesn’t experience the same sharp increases that can be seen in stocks, including broad-market indexes.

Gold-Backed ETFs vs. the Stock Market: The Performance Conundrum

Comparing the performance of gold-backed ETFs (GLD and IAU are very similar in this regard) with that of the S&P 500 (SPX), as represented by SPDR S&P 500 ETF Trust (SPY), we can see that year-to-date, gold ETFs are slightly better, notching a gain of 10.4% versus SPY’s 8.4%. The differences widen when looking at a 12-month period, which includes the sharp declines in stock markets in the second part of 2022. While SPY is up 5% in the past year, GLD and IAU have both delivered a 9.3% gain.

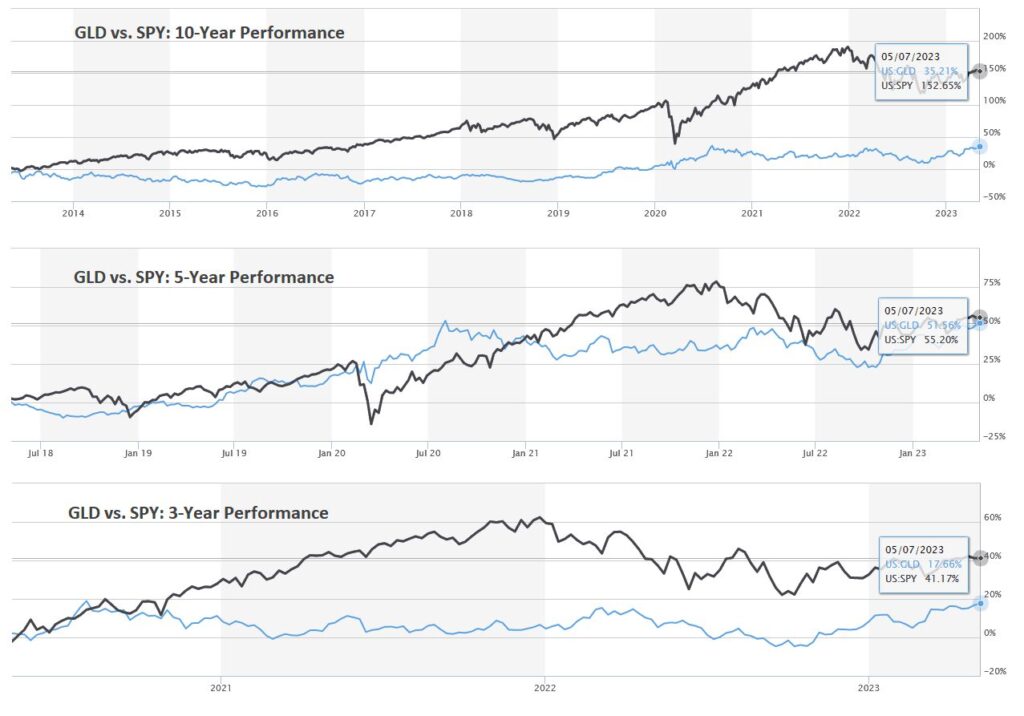

However, in medium to long-term periods, gold ETFs don’t display any clear advantages to the S&P 500 in terms of returns, though GLD is significantly less volatile than SPY:

Gold Mining ETFs: To Buy or Not to Buy? That is the Question

Another way for investors to gain exposure to the yellow metal is by investing in shares of gold producers or in ETFs following these stocks.

In theory, the shares of gold mining companies follow gold prices, as they directly affect the value of the company’s gold inventory. Keep in mind, though, that the performance of each individual gold mining stock, although tightly correlated with the price of the metal, is also strongly affected by the fundamentals related to each company’s current profitability and expenses.

Gold mining is an industry with very high fixed costs, including machinery, mining infrastructure, and administrative overhead. These costs must be paid regardless of how much gold is produced. Meanwhile, revenues are variable, depending on the price of gold. When gold prices rise, the company’s revenue increases, but its fixed costs stay the same. As a result, a large portion of the revenue increase flows through to profit, leading to a magnified effect on the company’s profitability and, potentially, its stock price.

So, when gold prices rise, gold mining companies can experience significant increases in profitability due to their operational leverage. Conversely, when gold prices fall, the effect on profitability can be severe because the high fixed costs remain, eating into profits.

As opposed to physical gold-backed ETFs, when the price of gold is falling, a gold producer can try to cut back on spending to prop up profitability. Also, some of these companies may pay dividends – which gold-backed ETFs don’t do. On the other hand, gold mining stock returns are dependent on the company’s projected future returns, with the gold price representing one of the many factors affecting the stock.

In short, stocks of individual gold companies carry risks similar to any other stock and may experience volatility related to the company’s fundamentals and the price of the underlying metal. Investors who don’t want to drill down into each company’s balance sheet should consider choosing a diversified gold mining stock ETF as a way to negate the volatility of individual stocks.

Gold Miners: a Gold Mine of Returns?

There are 6 gold mining stock ETFs available in the U.S., excluding leveraged ETFs, and not counting funds with assets under management of $50 million or less. Leveraged gold ETFs are particularly complicated and can be very risky for novice investors because they can magnify losses, while small ETFs can experience sudden drains of liquidity. Considering this, it may be wise to focus on large “plain-vanilla” gold mining stock ETFs.

The biggest (by far) and the most popular is the VanEck Gold Miners ETF (GDX), which offers investors exposure to some of the largest gold mining companies in the world, such as Newmont Corporation (NEM), Barrick Gold Corporation (GOLD), Franco-Nevada Corporation (FNV), and more. Another ETF that invests in a similar array of large-cap gold producers is the iShares MSCI Global Gold Miners ETF (RING). Also, an ETF popular with investors that have a higher risk tolerance is the VanEck Junior Gold Miners ETF (GDXJ), which invests worldwide in small and mid-cap gold mining equities.

Looking at a performance comparison in the medium to long term, it’s easy to notice that gold mining ETFs don’t always beat the physical gold-backed ETFs while registering notably higher volatility.

In shorter periods of time, though, gold miners, specifically the ETFs that focus on large, stable gold producers (like GDX or RING), can sometimes provide much better results. Year-to-date, GDX is up 14.6%, and RING has risen 14%, versus GLD’s 9.3% gain.

However, gold mining stocks are just that – stocks. Their correlation with the general market is way more pronounced than that of the funds investing in the physical metal. GDX, RING, and all other gold mining ETFs suffered large losses in the second half of last year when the S&P 500 registered significant declines. That is why the returns of gold mining ETFs in the past 12 months are subpar to that of bullion-backed SPDR Gold Trust. In this period, GDX rose 7.3%, and RING rose 3.6%, compared to GLD’s +8.4%.

Conclusion: Beware the Risks, Recognize the Opportunities

Investors that believe gold prices will continue to rise on the back of ongoing economic, political, and market uncertainties can gain exposure to the sunshine metal in different ways, with the most popular of them being gold-backed ETFs and ETFs tracking gold mining companies.

When choosing the investment vehicle, it’s important to understand how it is affected by a wide range of factors. For instance, during periods of economic stability and growth, gold prices may stagnate or decline, which can negatively affect both gold-backed ETFs and gold mining ETFs. However, the latter may still perform well if the mining companies are efficient, well-managed, and have strong fundamentals.

On the other hand, during periods of economic uncertainty, recession, or high inflation, gold prices often rise as investors seek safe-haven assets. This can benefit both gold-backed ETFs and gold miner stocks ETFs, but the latter may see more significant gains due to operational leverage.

Here are some points to consider when deciding between these two investments:

» Risk Tolerance: If you’re more risk-averse, a gold-backed ETF might be a better choice. If you can tolerate higher risk for the potential of higher returns, you might want to opt for a gold mining stock ETF.

» Market Conditions: If you believe that gold prices will rise significantly, a gold mining stock ETF could provide higher returns due to operational leverage. If you’re unsure about the direction of gold prices or believe the market will be volatile, a gold-backed ETF could be a safer choice.

» Investment Goals: If you’re investing primarily for diversification and hedging purposes, a gold-backed ETF could be a better fit. If you’re investing for growth and are willing to accept higher volatility, a gold mining stock ETF might be more suitable.

Whatever you choose, let that be an educated decision based on trustworthy data and analysis.