The second half of the year doesn’t have to be scary. Though the treacherous road could continue into late summer, one has to think that inflation will begin to wane as a result of the many disinflationary forces that could go into effect.

In any case, many intriguing high-yield stocks have become that much cheaper over the past few weeks. Despite lower prices, negative momentum, and a weaker macro outlook, many Wall Street analysts have maintained their “Strong Buy” analyst rating consensus.

Given idiosyncratic strengths in each business, I’d argue that such ratings are well-deserved, as analysts get busy lowering the bar on most other companies in the second half.

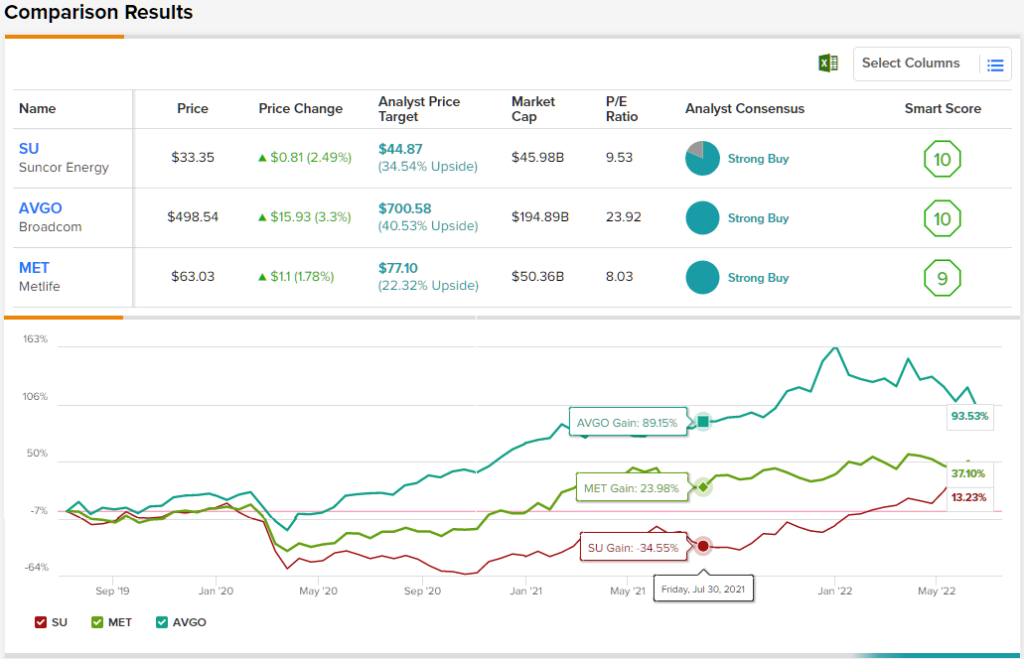

In this piece, we used TipRanks’ Comparison Tool to have a closer look at three high-yielders that Wall Street has yet to sour on.

Suncor Energy (SU)

Suncor Energy is a Canadian energy company that’s been on quite a rocky ride over the past few years. The company imploded when oil prices nosedived off a cliff back in 2020. Though the dividend was a victim of the oil price collapse, Suncor seems to be ready to make up for lost time now the tides are finally turned in its favor.

Unlike more conventional oil producers in America, Suncor is a major player in the Albertan oil sands. Western Canadian Select (WCS) oil tends to trade at a discount to West Texas Intermediate (WTI). Given high production costs and hefty emissions, energy firms with oil sands operations tend to trade at a discount to the peer group. In time, the advent of solvent-aided technologies can further enhance the underlying economics of operating in Canada’s oil sands, and slim the relative discount to conventional oil producers.

Looking ahead, I’d look for Suncor to continue making the most of the oil boom while it lasts. Even if oil is due for a recession-driven drop, the resilient integrated business should help the firm from enduring too painful of a slide.

At writing, Suncor stock trades at just south of 10.5 times trailing earnings. That’s incredibly cheap, given how much operating cash flow the firm is capable of generating over the next year. The 4.07% yield is bountiful and in line with U.S. producers.

Overall, SU shares have a Strong Buy rating from the analyst consensus, showing that Wall Street sees this company in a solid position. The rating is based on 9 Buys and 2 Holds set in the past 3 months. Shares are selling for $33.35, and the average price target, at $44.87, implies ~35% upside potential. (See SU stock forecast on TipRanks)

Metlife (MET)

Metlife is a life insurance company that offers a wide range of other financial services. The company is geographically diversified, with exposure to the U.S., Asia, and Latin America. With exceptional managers running the show, Metlife has been able to keep its quarterly strength alive. Year-to-date, Metlife stock is up just shy of 2%, while the S&P 500 is flirting with in a bear market.

Though we could be staring at a recession in 2023, Metlife seems more than able of continuing to roll with the punches. Further, higher interest rates bode well for the reinvestment yields of insurance firms. As the Fed raises interest rates while looking to minimize the impact on the economy, Metlife may be able to avert severe downside.

In any case, Metlife seems to be a great long-term investment for investors seeking greater growth to be had in the Asian market, which is experiencing a booming middle class. Though global economic weakness could persist for more than a year, the price of admission seems modest at writing.

Despite outperforming the markets this year, Metlife stock trades at 8.26 times trailing earnings. With a 3.23% dividend yield and a “Strong Buy” analyst rating consensus, MET stock seems like a terrific value for income seekers.

It’s not often that the analysts all agree on a stock, so when it does happen, take note. MET’s Strong Buy consensus rating is based on a unanimous 10 Buys. The stock’s $77.10 average price target suggests an upside of 22% from the current share price of $94. (See MET stock forecast on TipRanks)

Broadcom (AVGO)

Broadcom is a semiconductor behemoth that’s down 26% from its all-time high. Semis are quite cyclical, but the firm has made major strides to diversify into software via strategic acquisitions.

Of late, Broadcom has been making headlines for its $61 billion cash and stock takeover of VMWare. The deal makes Broadcom an infrastructure tech company that could make its stocks less cyclical come the next economic downturn, with a greater chunk of overall revenues being derived from software sales.

Looking into the second half, Broadcom looks well-positioned to move past recent supply chain woes weighing it down. The company has been quite upbeat about its earnings moving forward. As shares continue to tumble alongside the broader basket of semi stocks, I’d look for Broadcom to continue buying back its own stock.

All in all, I praised Broadcom for being more value-conscious than most other tech firms with the urge to merge or acquire. At just 23.7 times trailing earnings, Broadcom appears to be a market bargain with a promising growth and dividend profile. At writing, shares yield 3.40%.

Overall, we’re looking at a stock with a unanimous Wall Street analyst consensus – 13 reviewers have weighed in, and they have all put a seal of approval here, for a Strong Buy rating. AVGO shares are trading for $498.54, and the $700.58 average price target suggests room for 40.5% growth this year. (See AVGO stock forecast on TipRanks)

Conclusion

Strong Buy rated dividend stocks are becoming more scarce, as analysts look to lower the bar in the second half. Suncor, Metlife, and Broadcom are well-run firms that Wall Street is standing by, even amid growing macro headwinds. Of the three names, they seem most bullish on Broadcom. And I think they’re right on the money.

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The information contained in this article represents the views and opinion of the writer only, and not the views or opinion of TipRanks or its affiliates, and should be considered for informational purposes only. At the time of publication the writer did not have a position in any of the securities mentioned in this article.