During stock market turmoil, many investors look for safe-haven assets, like gold, to protect their wealth. Aside from investing in physical gold, investors can also gain exposure to gold through gold stocks and gold ETFs (Exchange Traded Funds).

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

According to the World Gold Council, gold demand grew 34% year-over-year in Q122 amid the Ukraine-Russia crisis and high inflation. Q122 demand was driven by strong gold ETF inflows, while bar and coin investments, as well as jewelry consumption declined.

Gold prices in the days ahead could be further impacted by rising U.S. interest rates and a strong dollar. Rising interest rates impact gold’s appeal as they increase the opportunity cost of holding non-interest-bearing assets, like gold.

Bearing these dynamics in mind, we used the TipRanks Stock Comparison tool to compare Barrick Gold, Newmont Mining, and Kinross Gold and discuss Wall Street’s views on these gold stocks.

Barrick Gold Corporation (NYSE:GOLD) (TSE:ABX)

Toronto-based Barrick is a leading gold and copper producer, with mines and projects in 18 countries across North and South America, Africa, Papua New Guinea, and Saudi Arabia.

According to a mid-April preliminary update, Barrick’s Q122 production declined 17.7% from Q421 to 990,000 ounces. Q122 production was hit by lower production at the Carlin and Cortez mines following the depletion of higher-grade underground ore stockpiles, planned maintenance at Kibali and Turquoise Ridge, and mine sequencing in Tongon.

Barrick’s had previously guided for its gold production to be the lowest in Q122 and increase through the year. It expects copper production to be higher in the second half of the year. The company stated that it is on track to achieve its full-year gold and copper guidance.

The company’s Q122 performance and the impact of higher costs will be clearer once the company announces its results on May 4.

Recently, Bernstein analyst Bob Brackett downgraded Barrick to a Hold from a Buy with a price target of CAD 27. The analyst noted that the 10-year TIPS (Treasury Inflation-Protected Securities) yield has shot up “radically towards positive and is likely to increase”, indicating that gold prices could fall and bring down gold stocks with it.

Meanwhile, Barclays analyst Matthew Murphy raised his price target on Barrick to $28 from $26 and maintained a Buy rating. Murphy noted, “While a global recession appears unlikely, there are multiple headwinds dragging on the growth outlook.”

Murphy believes that copper still appears to be headed towards a surplus, while the gold “geopolitical premium gets a boost.” Murphy remains upbeat on select miners, with a gold preference, like Barrick.

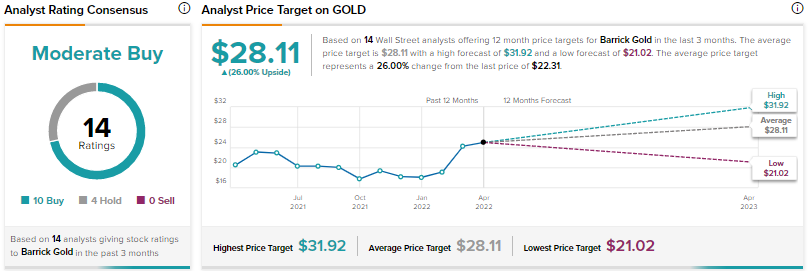

The other analysts on the Street are cautiously optimistic, with a Moderate Buy consensus rating based on 10 Buys and four Holds. The average Barrick Gold price target of $28.11 suggests 26% upside potential from current levels. The U.S. listed shares of Barrick have advanced over 17% this year.

Newmont Mining (NYSE: NEM) (TSE:NGT)

Newmont is a leading gold company and also produces copper, silver, zinc, and lead. It has assets and projects across North America, South America, Australia, and Africa.

Newmont’s Q122 sales grew 5.3% to $3 billion, while adjusted EPS declined 6.8% to $0.69. Despite higher gold prices and increased copper sales volumes, Q122 results were hit by lower gold volumes, reflecting the impact of Omicron-induced labor challenges. Also, higher costs and supply-chain disruptions impacted the Q122 results.

However, Newmont reassured investors that it is well-positioned to deliver strong results in the second half of the year and expects to produce 6.2 million ounces of gold in 2022.

Last month, National Bank analyst Mike Parkin downgraded Newmont to a Hold from a Buy but raised the price target to CAD 119 from CAD 107. While Parkin believes that Newmont “remains a quality name to own”, he feels that shares are likely to trade more in line with peers over the near term, given the recent rise in price.

Parkin stated that he could become more constructive on Newmont as 2023 approaches based on his expectations of a stronger operational and financial performance.

On TipRanks, Newmont scores a Hold consensus rating based on two Buys and 11 Holds. Given the 17.5% year-to-date rise in shares, the average Newmont price target of $75.24 implies a modest 3.28% upside potential from current levels.

Kinross Gold (NYSE: KGC) (TSE: K)

Canada-based Kinross is a gold mining company with operations in the U.S., Brazil, Russia, Mauritania, Chile, Ghana, and Canada.

Given the ongoing Ukraine-Russia crisis, last month, Kinross announced the sale of its Russian assets to Highland Gold Mining for $680 million, including deferred payments. The transaction, which is subject to the approval of the Russian government, could impact the company’s production over the near term.

Further, Kinross recently announced an agreement to sell its 90% interest in the Chirano mine in Ghana to Asante Gold Corporation for $225 million in cash and shares.

Kinross will update its 2022 and three-year guidance to reflect the impact of the recently announced asset-sale transactions in Russia and Ghana as part of its upcoming Q122 results, scheduled for May 10. The company’s previously announced guidance indicated gold production of 2.65 million ounces in 2022 (up 28% from 2021), 2.8 million ounces in 2023, and 2.6 million ounces in 2024.

Reacting to the Chirano sale, BMO Capital analyst Jackie Przybylowski stated, “This transaction also importantly streamlines the Kinross portfolio — Chirano is a relatively small, short-life mine in an operating jurisdiction with no synergies other Kinross assets.”

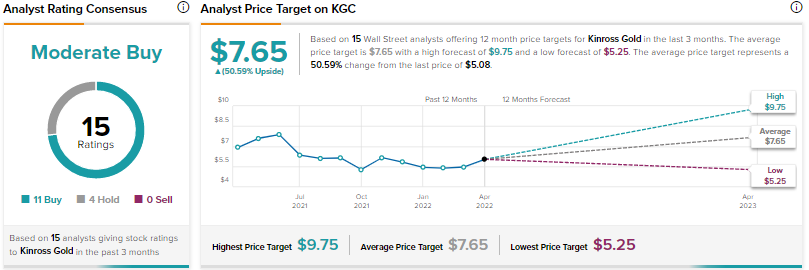

The analyst reiterated a Buy rating on Kinross and raised the price target to $9.75 from $9.50.

Meanwhile, the Street has a Moderate Buy consensus rating that breaks down into 11 Buys and four holds. At $7.65, the average Kinross Gold price target implies 50.59% upside potential from current levels. Shares have declined nearly 13% year-to-date.

Conclusion

Gold miners have been facing higher costs, labor challenges, as well as supply chain disruptions, which could partially offset the impact of higher gold prices. Moreover, the Fed’s decision to combat inflation through interest rate hikes could affect gold prices in the days ahead. However, on the other hand, persistent geopolitical tensions could support an increase in gold prices.

Under the current circumstances, analysts see higher upside potential in Kinross stock over the next 12 months.

Discover new investment ideas with data you can trust

Read full Disclaimer & Disclosure