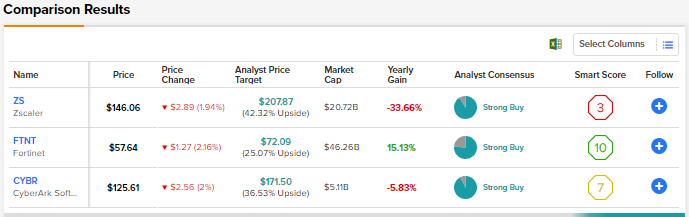

An impending recession is expected to impact the IT spending budgets of organizations. That said, the spending on cybersecurity solutions is expected to be more resilient given the growing instances of cyber attacks amid increased digitization and the ongoing Russia-Ukraine war. While cybersecurity stocks are down year-to-date due to the broader market sell-off, Wall Street analysts continue to be bullish on the sector. Given this backdrop, we used the TipRanks Stock Comparison tool to compare Zscaler, Fortinet, and CyberArk to pick the stock that could fetch higher returns.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Zscaler (NASDAQ: ZS)

Zscaler is a cloud-native cybersecurity company, with a dominant position in the zero-trust space. In late May, the company announced market-beating fiscal third quarter (ended April 30, 2022) results and robust guidance. Zscaler’s fiscal third quarter revenue increased 63% to $287 million, while adjusted EPS grew 13% to $0.17.

Zscaler continues to focus on capturing business from large enterprises. As per the company, 40% of the Fortune 500 and 30% of Global 2000 companies rely on its products to secure their digital transformation. At the end of the fiscal third quarter, Zscaler had 288 customers with more than $1 million in Annual Recurring Revenue (ARR), reflecting a 77% year-over-year growth.

Following Zscaler’s annual user conference, Zenith Live, in June, Stifel analyst Adam Borg stated that the company’s product announcements on the first day of the event focused on extending Zscaler Cloud Protection (ZCP). The analyst noted that while ZCP is a small contributor today, it represents an increasing up-sell/cross-sell opportunity over time.

Borg stated, “At the investor briefing, Zscaler reiterated its optimistic macro commentary including that it is not seeing any macro headwinds and continues to aggressively invest across the business, while also having a number of levers to pull based on evolving macro conditions.”

Overall, Borg continues to view Zscaler as a “best-in-class asset”, having a number of drivers that will help sustain over 30% growth in the coming years. In line with his optimism, Borg reiterated a Buy rating on Zscaler stock with a price target of $200.

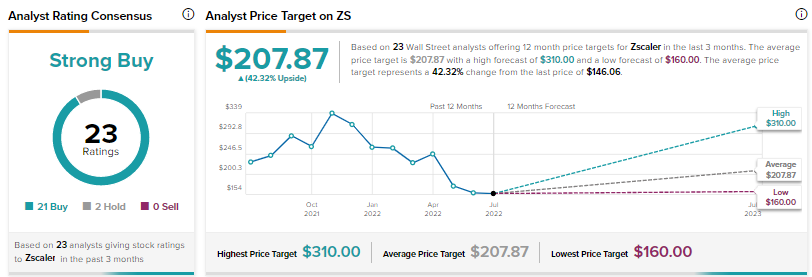

All in all, the Street has a Strong Buy consensus rating on Zscaler stock, backed by 21 Buys and two Holds. At $207.87, the average Zscaler price target suggests 42.32% upside potential from current levels.

Fortinet (NASDAQ: FTNT)

Fortinet offers cybersecurity and networking solutions for organizations. The company’s first-quarter performance and upbeat forecast reflected robust demand for its products. Revenue grew 34.4% to nearly $955 million. Further, adjusted EPS increased 16% to $0.94.

Fortinet’s order backlog increased by $116.4 million in the first quarter to $278.3 million, reflecting improved visibility for the remainder of the year. Overall, Fortinet’s goal is to deliver $8 billion in revenue and $10 billion in billings by 2025.

Recently, Wedbush analyst Daniel Ives added Fortinet and Check Point Software (CHKP) to the firm’s Best Ideas List. Ives maintained a Buy rating on Fortinet with a price target of $76. The analyst is optimistic about the company’s ability to achieve its long-term vision of continued market expansion.

Ives noted that Fortinet is benefiting from strong tailwinds and its proprietary ASIC (application-specific integrated circuits) technology, with its ability to bundle SD-WAN (software-defined wide area network) and OT (operational technology) security offerings with network security products.

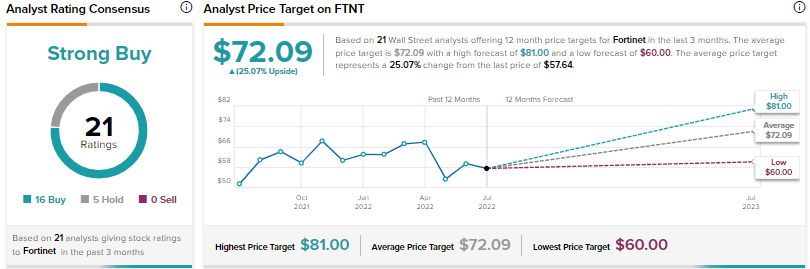

Overall, Fortinet scores a Strong Buy consensus rating backed by 16 Buys and five Holds. The average Fortinet price target of $72.09 implies upside potential of 25.07% from current levels.

CyberArk Software (NASDAQ: CYBR)

CyberArk is a leading provider of identity security solutions, centered on Privileged Access Management (PAM). The company’s first-quarter revenue grew 13% to $127.6 million, but fell short of analysts’ expectations. That said, the adjusted loss per share of $0.30 was better than analysts’ estimates.

Also, CyberArk raised its full-year ARR growth guidance to the range of 36% to 38%, up from the prior outlook range of 35% to 36%, reflecting strong momentum in its business.

Morgan Stanley analyst Hamza Fodderwala believes that CyberArk is among the cybersecurity companies that are set to deliver “favorable” quarterly results, due to strong demand for its PAM software. Fodderwala highlighted that the growing adoption of software-as-a-service and increased spending by customers “have also made CyberArk’s (CYBR) offerings more accessible and easier to deploy.”

With CyberArk completing its transition to subscription-based offerings, Fodderwala expects management to raise its full-year revenue guidance and display more strength heading into 2023. Overall, Fodderwala maintained a Buy rating on CyberArk stock based on his optimistic outlook.

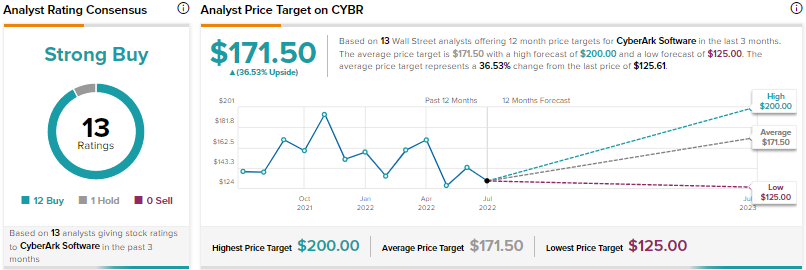

On TipRanks, CyberArk scores a Strong Buy consensus rating based on 12 Buys and one Hold rating. The average CyberArk price target of $171.50 implies 36.53% upside potential from current levels.

Conclusion

Despite a challenging macro backdrop, Wall Street analysts are bullish on cybersecurity stocks as they expect them to benefit from continued demand for their products amid rising cyber-attacks. Based on the upside potential from current levels, Zscaler seems to be a better pick than Fortinet and CyberArk.