Bitcoin and the rest of the cryptocurrency markets have been quite a turbulent ride of late. Over the past few months, cryptocurrencies and their proxies have tumbled alongside the equity markets. This hurts the “millennial gold” argument in a big way. As the magnitude of speculation decreases, Bitcoin and the broader basket of cryptos could have more room to go down.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Still, for those who aren’t buying the doom and gloom thesis, recent damage looks to have produced an intriguing entry point. As Bitcoin bounces back above US$30,000, a relief rally may very well be underway. Still, it seems unlikely that cryptocurrencies will have permission to march higher unless the stock market can regain its footing.

Though the stakes are high in the crypto world, so too could be the potential rewards. In this piece, we used TipRanks’ Comparison Tool to evaluate three crypto-exposed tech stocks that have already endured painful implosions.

Coinbase (COIN)

Coinbase is a popular crypto exchange platform that could soar or flop based on the amount of interest in the cryptocurrency markets. Undoubtedly, the firm garnered a lot of hype with its Superbowl ad. The ad seemed like it was such a long time ago, with crypto and Coinbase stock now tumbling week after week.

After shedding more than 80% of its value, Coinbase stock is close to an all-time low, with a rock-bottom 6.6 times trailing earnings multiple. Undoubtedly, the low price-to-earnings multiple seems more indicative of a value trap at this juncture, given the bursting of various speculative bubbles in the stock market and the erosion in the value of popular crypto assets, including Bitcoin—the gold standard.

Coinbase stock still looks like one of the best publicly-traded ways to bet on crypto infrastructure. The NFT (non-fungible tokens) marketplace could provide subtle relief amid crypto’s recent rolling over. Still, the stock is unlikely to bottom until interest in crypto reignites again.

Given how hard consumer budgets have been hit of late, it’s hard to imagine a scenario that sees retail traders putting up the same amount of disposable income to speculate on volatile assets like Bitcoin. Has the ship sailed? The market certainly seems to think so, given the pain dealt to Coinbase shareholders.

In the meantime, short-seller Jim Chanos will continue to talk down the “tremendously overvalued” stock amid its tumble. Talk about rubbing salt in the wounds!

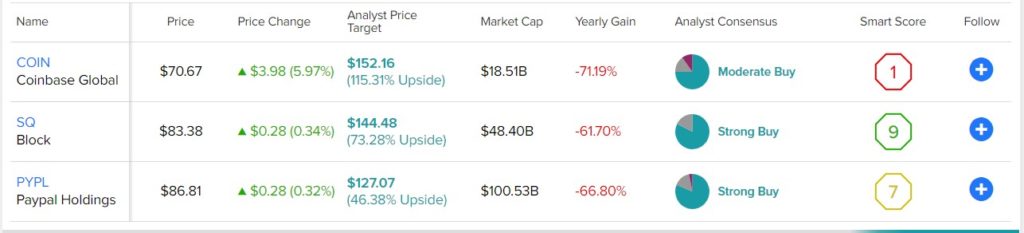

Wall Street remains bullish, with a Moderate Buy rating based on 15 Buys, three Holds, and two Sells assigned in the past three months. The average Coinbase price target of $152.16 implies 115.3% upside potential from current levels.

Block (SQ)

Block, formerly Square, is ready to move onto new frontiers. Its CEO Jack Dorsey has set his sights on Bitcoin and other blockchain technologies that could help take his fintech empire to the next level.

Square Payments and Cash App are intriguing innovations that are bound to grab the most attention from investors and analysts. The latter is a primary growth engine, while the former is a cash cow that could face rising competitive and macroeconomic pressures over the next few years.

Block’s inclusion of cryptocurrency trading on mobile apps isn’t the only reason the firm is an intriguing crypto tech play. Block is hard at work on various Bitcoin and crypto projects with Spiral and TBD. These businesses (or building blocks) may prove to be moonshot bets. Investors want cash flow these days, and they’re not as willing to pay for forward-looking growth unless there’s some assurance of future profitability.

The market’s fallen appetite for growth hasn’t fazed Dorsey. The man shed more light on his firm’s Bitcoin focus on its recent investor day. Dorsey made it loud and clear that Block isn’t just a payments company anymore.

Whether or not efforts like Spiral and TBD will pay off remains a mystery. In any case, investors seem unenthused by SQ stock, which has now lost more than 70% of its value.

Turning to Wall Street, analysts remain bullish, having a Strong Buy rating on SQ stock based on 28 Buys and six Hold ratings assigned in the past three months. The average Block price target of $144.48 suggests 73.3% upside potential from current levels.

PayPal (PYPL)

Sticking with the theme of payments, we have PayPal, which, like Block, is down over 70% and is attempting to excite investors with crypto. Though PayPal isn’t as much of a crypto-centric play as Block, which changed its name to emphasize its new focus. However, the company does have some interesting crypto plans.

Whether crypto is a distraction to divert attention away from the ailing payments business remains to be seen. Regardless, crypto does seem like a natural next step for fintech innovators like PayPal. It’s not just crypto trading that PayPal is capable of offering. CEO Dan Schulman emphasized the importance of cryptocurrencies and PayPal’s future.

For now, PayPal’s longer-term crypto-related plans remain uncertain. However, it seems likely that PayPal is likely to follow in Block’s footsteps should any of its crypto projects show promise.

Looking ahead, PayPal will be juggling other efforts, such as improving the functionality of its app and looking to take a deeper dive into digital payments. It seems like an acquisition is a natural next step for the firm. For so much promising potential, the 28.6 times earnings multiple seems a tad too low. However, given consumer payments could slow drastically as a part of a looming recession, an even further discount is possible as well.

Wall Street is staying bullish, giving PYPL a Strong Buy rating based on 26 Buys, five Holds, and one Sell rating assigned in the past three months. The average PayPal price target of $127.07 implies 46.4% upside potential from current levels.

Conclusion

Wall Street remains upbeat on the fallen tech stocks with cryptocurrency exposure. Of the three companies outlined in this piece, they expect the most from Coinbase stock over the next year.