A recent report by Bloomberg reveals that over 11.7 billion COVID-19 vaccine doses have been administered in 184 countries so far, including 578 million shots domestically. Rapid vaccination drives across the globe have helped in reducing the instances of hospitalization and deaths, even as new COVID-19 variants continue to be a threat.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Global demand for COVID-19 vaccines has helped several vaccine makers to generate billions of dollars. Meanwhile, booster shots and approval of vaccines for children could drive additional sales for vaccine makers.

While the uncertainty associated with COVID-19 and potential new variants remains, the demand for vaccines might slow down in the times ahead as pandemic fears start fading.

Amid this backdrop, we used the TipRanks Stock Comparison tool to compare Pfizer, Moderna and AstraZeneca and discuss Wall Street’s sentiment for the coronavirus vaccine stocks.

Pfizer (NYSE: PFE)

Pfizer has been the frontrunner in the COVID-19 vaccine race. Its Comirnaty vaccine, developed in collaboration with German firm BioNTech, was the first COVID-19 vaccine to be awarded the U.S. Food and Drug Administration’s (FDA) emergency use authorization and a full approval subsequently.

Pfizer’s revenue grew 77% to $25.7 billion in Q122, mainly due to $13.2 billion in revenue from the Comirnaty vaccine and $1.5 billion from its oral COVID-19 treatment Paxlovid. Excluding Comirnaty and Paxlovid, Q122 operational revenue growth came in at 2%. Strong top-line growth drove more than 70% increase in Q122 adjusted EPS to $1.62.

Despite incremental currency headwinds, Pfizer reaffirmed its 2022 Comirnaty revenue guidance of nearly $32 billion and sales of about $22 billion from Paxlovid. Overall, Pfizer reiterated its 2022 revenue outlook of $98 billion-$102 billion. However, it lowered 2022 adjusted EPS guidance by 10 cents to $6.25-$6.45.

Pfizer continues to focus on driving growth beyond its COVID-19 treatments, supported by a strong pipeline and strategic acquisitions, including the recently completed $6.7 billion acquisition of Arena Pharmaceuticals. Arena is a clinical stage company developing therapies for the treatment of several immuno-inflammatory diseases.

Also, Pfizer’s portfolio has several blockbuster drugs, including cancer drugs Ibrance, Prevnar pneumococcal vaccines family, blood thinner Eliquis, and rare heart disease drugs Vyndaqel and Vyndamax.

Following the Q1 print, Wells Fargo analyst Mohit Bansal lowered his price target for Pfizer stock to $55 from $60 and maintained a Buy rating. Bansal feels that buy-side expectations have come down considerably for a COVID tailwind and investors have now started focusing on the company’s core business again.

The analyst noted that Pfizer’s core business faces challenging year-over-year comparisons this year but is growing operationally at nearly 5%.

The Street is cautiously optimistic on Pfizer, with a Moderate Buy consensus rating based on six Buys and eight Holds. The average Pfizer price target of $58.92 suggests 20.15% upside potential over the next 12 months. Shares are down nearly 17% year-to-date.

Moderna (NASDAQ: MRNA)

Moderna’s mRNA-1273 COVID-19 vaccine, branded as Spikevax, is the company’s first and only commercial product.

Last week, Moderna crushed Wall Street’s Q1’22 revenue and EPS estimates backed by robust demand for its COVID-19 vaccine. Moderna’s quarterly revenue more than tripled to $6.1 billion and EPS jumped to $8.58 from $2.84 in Q1’21. Moderna reaffirmed its 2022 COVID-19 vaccine revenue outlook of $21 billion.

The robust demand for Moderna’s COVID-19 vaccine has added significant cash to its books, which the company can use to invest in research and development, as well as other activities to support future growth. CEO Stéphane Bancel believes that the company’s solid Phase 3 pipeline could result in three respiratory commercial launches over the next two to three years.

Following the Q1 results, Needham analyst Joseph Stringer reiterated a Hold rating on Moderna, as he feels that the success of Spikevax and COVID booster programs are largely priced in the stock.

The analyst is looking for success in the company’s Phase 3 Respiratory syncytial virus (RSV) vaccine, Cytomegalovirus (CMV) vaccine, and flu programs to drive the “next leg of growth.”

“Rare Disease programs are intriguing but early-stage and the initial Ph2 POC [Proof of Concept] readouts in 2H22 will give more visibility on their potential,” added Stringer.

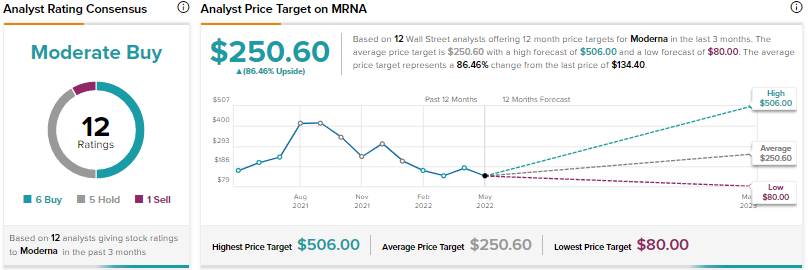

All in all, the Street’s Moderate Buy consensus rating on Moderna breaks down into six Buys, five Holds and one Sell. At $250.60, the average Moderna price target implies 86.46% upside potential from current levels. Shares have declined 47% so far this year.

AstraZeneca Plc (NASDAQ: AZN)

AstraZeneca’s COVID-19 vaccine, branded as Vaxzevria and Covishield, hasn’t seen the same success as the mRNA vaccines developed by Moderna and Pfizer. Production bottlenecks, concerns about increased risk of blood clots, and a delay in attaining the U.S. FDA approval are some factors that marred a wider acceptance of AstraZeneca’s vaccine.

AstraZeneca delivered strong Q1’22 results, with revenue rising 56% to $11.4 billion. The top-line growth was driven by sales contribution from Alexion Pharmaceuticals (a rare disease drugmaker acquired for $39 billion in 2021) and over $1.1 billion in sales from Vaxzevria, mainly from contracts that are expected to be completed in the second half of this year. Adjusted EPS grew 16% to $1.89.

However, AstraZeneca cautioned that revenue from its COVID-19 treatments is anticipated to decline by a low-to-mid twenties percentage in 2022, with an expected decline in Vaxzevria sales being partially offset by higher sales of the company’s antibody COVID-19 treatment Evusheld.

Excluding its COVID-19 treatments, AstraZeneca has a strong product portfolio addressing various diseases, including oncology drugs Tagrisso, Imfinzi, and Lynparza, and type 2 diabetes drug Farxiga. AstraZeneca also boasts a pipeline of 183 projects, including 16 new molecular entities in late-stage.

In reaction to recent results, SVB Securities analyst Andrew Berens raised his price target on AstraZeneca to $75 from $70 and maintained a Buy rating.

On TipRanks, AstraZeneca scores a Moderate Buy consensus rating based on two Buys and one Hold recommendation. The average AstraZeneca price target of $75 implies 16.53% upside potential from current levels. Shares have risen 10.5% year-to-date.

Conclusion

Given the uncertainty associated with COVID-19, Wall Street analysts are treading cautiously with regard to COVID-19 vaccine makers. Several analysts are now focusing on the growth prospects of Pfizer, Moderna and AstraZeneca beyond their flagship COVID-19 treatments.

Given the steep fall in Moderna stock so far this year, the Street’s average price target hints at a higher upside potential in Moderna compared to Pfizer and AstraZeneca over the next 12 months.

Discover new investment ideas with data you can trust

Read full Disclaimer & Disclosure