Investors have been having a hard time navigating markets, as ongoing interest rate hikes and a suffering economy make it harder for them to know where to park their cash.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

While the disinflationary process has begun, with inflation steadily coming down, the Federal Reserve has not quite yet ceased aggressive interest rate hikes for the coming months.

At the start of February 2023, the federal funds rate stood at 4.50% to 4.75% after the central bank raised interest rates by 0.25%. This marked the eighth rate hike since monetary tightening started back in March 2022.

Nonetheless, talks on whether the policy rate could further increase have since cooled amid the SVB collapse. However, further rate increases could be re-introduced later in the year as central banks try to dampen red-hot inflation. So, here are a few spots where you can park your money in the meantime.

High-Quality Companies with Lots of Cash

Often, companies that have high cash reserves and a low debt-to-equity (D/E) ratio will benefit more from higher interest rates. This gives them better legroom amid high uncertainty and unforeseen economic conditions.

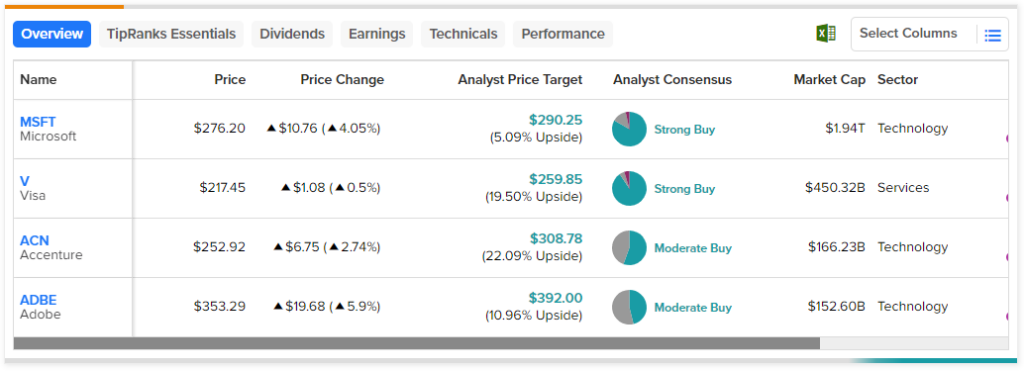

Household names in this category include Microsoft (NASDAQ:MSFT), Visa (NYSE:V), Accenture (NYSE:ACN), and Adobe (NASDAQ:ADBE), among other high-profile names.

Dividend-Yielding Healthcare Stocks

Companies operating in the healthcare sector often remain resilient in the face of a greater economic downturn, including rising interest rates and recession risks, since healthcare is a necessity.

Often, these companies reinvest in long-term initiatives while providing dividend payouts to their stakeholders at the same time.

A company in this category includes Medtronic (NYSE:MDT), which has a 3.4% dividend yield and has raised its dividend for 45 consecutive years.

Payroll Processing Stocks

Another option would be to look at payroll processing companies, which often hold large reserves of cash and tend to see increased growth during times of higher or above-average interest rates.

For starters, some of these companies hold a large “float” or OTP (other people’s money) that they are allowed to invest. Seeing that these companies hold funds for other people, it allows them more legroom to extend their portfolios, and they can use these funds in the meantime to invest in now higher-yielding assets that mature over several years.

Another factor is that these companies feature competitive advantages. Businesses that pay for their HR and payroll services are often burdened by the challenges of switching to a different provider, so it’s easier for them to stay at the same company for several years.

Payroll processing holds out strong purely because these companies have a solid business model that can help them ride out market uncertainty. This category is less-celebrated than others and sees less popularity among other high-yielding stock picks.

Some of the names investors can consider adding to their portfolios include Paychex (NASDAQ:PAYX), Automatic Data Processing (NASDAQ:ADP), Xerox (NASDAQ:XRX), and Paylocity (NASDAQ:PCTY).

Financial Stocks

Banks and other financial institutions, including brokerage firms, enjoy higher profits amid higher interest rates. As credit becomes increasingly expensive and less available, more consumers tend to rely on cash reserves, and when they do use credit, they end up paying more interest.

These activities often see banks and brokerage firms experiencing higher earnings through more interest income, leading to bigger profit margins.

Other factors that can be added to this calculation include fees, commissions, and other service charges, which tend to be higher during times of above-average interest rates.

Stocks to consider include the likes of JPMorgan Chase & Co (NYSE:JPM) and Goldman Sachs Group (NYSE:GS), both of which operate in the U.S. and globally.

Floating Rate Bonds

Another financial instrument to look at is short-term floating bonds, which can help decrease risk and portfolio volatility. Bonds that have a shorter maturity period or are purchased at coupon rates will help investors maximize returns in times of higher interest rates, as the interest rate of these floating bonds will increase as long as the market rate increases.

These financial instruments are often purchased in collaboration with other investment vehicles, so it’s best to consider how you can pair these and other options in a well-balanced portfolio that delivers positive returns and growth.

It can be tricky to enter at the right time, so it’s best to have a foolproof investment strategy at hand when considering floating bonds.

Final Thoughts

Amid ongoing economic uncertainty and bearish market sentiment, investors often consider safer options to help cushion their portfolios against any sudden economic downturns. More so, with interest rates climbing and the central bank holding a hawkish position, it makes conditions increasingly tricky to navigate, going forward.

In this regard, investors need to set a forward-looking strategy that will help them ride out tumultuous conditions but still see their portfolios steadily grow. The investing options listed above can help investors achieve this.