Investors will never stop looking for the best time to enter or exit the markets, but it is a very difficult move to get right. As fabled investor Peter Lynch has put it, “Far more money has been lost by investors preparing for corrections, or trying to anticipate corrections, than has been lost in corrections themselves.”

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

With this in mind, Ari Wald, the Head of Technical Analysis at Oppenheimer says a better way to assess where the market is at is to follow the trend. More specifically, from a technical point of view, to look at how much the S&P 500 is trading above or below its 200-day average (200DMA). And sometimes when looking at the charts, overbought conditions might still represent a bullish signal.

“The best returns have, not surprisingly, occurred when the index is deeply oversold (>10%) below its 200DMA,” notes Wald. “However, the index has also posted above-average returns when trading >10% above its 200DMA; as is currently the case.”

In fact, Wald makes the case that the S&P 500 is still on track to reach 4,600, amounting to another 6% uptick from here.

Meanwhile, Oppenheimer analysts have been pointing out two stocks that can ride this trend and they are not the only ones showing confidence in these names. Running these tickers through the TipRanks database we find that both are rated Strong Buys by the analyst consensus. Let’s see why they might be two stocks to bet on the continuation of a rising trend.

Uber Technologies (UBER)

We’ll start with a household name and a transportation industry disruptor. Uber introduced a new and innovative business model that challenged traditional taxi services. By leveraging technology and the power of mobile apps, Uber transformed the way people hail and experience transportation. Its platform provided a more convenient, accessible, and often more affordable option for riders, while also offering additional income opportunities for drivers.

Over the years, Uber has expanded its services beyond its original remit. The company introduced UberEats, a food delivery platform, while it has also ventured into other areas such as freight transportation with Uber Freight.

UBER shares have put in an excellent showing this year, up by 75% so far, a trend that continued following the release of the company’s Q1 results in early May. Gross Bookings increased by 19% year-over-year to $31.4 billion while revenue rose by 27.5% y/y to $8.8 billion, while beating the Street’s call by $90 million. EPS of -$0.08 improved on the $0.27 delivered in the same period a year ago and edged ahead of Street expectations – by $0.01. The company delivered record free cash flow of $549 million and signaled it expects profitability to keep on expanding in Q2.

Oppenheimer’s 5-star analyst, Jason Helfstein, notes the strong year-to-date performance, but touts Uber as still being a “top large-cap pick” and thinks there are strong catalysts ahead.

“We believe UBER will continue to benefit from a spending shift from goods to services normalizing, exposure to the strongest consumer categories, and return-to-work tailwinds,” Helfstein explained. “Shares stand to benefit from impending S&P 500 inclusion as soon as December. We expect Uber will be eligible to enter the index this December after reporting expected GAAP profitability in 3Q23, bringing TTM GAAP net income positive. Index inclusion generally increases demand for a stock, forcing mutual and index fund buying.”

These comments form the basis for Helfstein’s Outperform (i.e., Buy) rating, while his $65 price target suggests shares will climb ~50% higher over the coming year. (To watch Helfstein’s track record, click here)

Overall, this is a rare stock with a lot of coverage where everyone is in agreement. Based on a unanimous 30 Buys, UBER claims a Strong Buy consensus rating. At $52.18, the average target makes room for 12-month gains of 20%. (See Uber stock forecast)

Simulations Plus (SLP)

We’ll stay in tech for our next Oppenheimer-backed name but look at a company operating in an entirely different segment. Simulations Plus provides simulation and modeling software aimed primarily at the pharma and biotech sectors.

The company offers a wide range of software solutions that help researchers and scientists predict and optimize the behavior of drugs, assess their safety and efficacy, and streamline the drug discovery process. The company’s flagship product, GastroPlus, is a software package used for the simulation and modeling of gastrointestinal absorption, pharmacokinetics, and pharmacodynamics of drugs. Simulations Plus also offers additional software tools such as ADMET Predictor, DDDPlus, and MedChem Studio, which aid in various aspects of drug discovery and development.

These products helped revenue increase by 6% to $15.8 million in the most recent print, for the second quarter of fiscal 2023 (February quarter), although the figure slightly fell behind the consensus estimates. There was better luck on the bottom-line as EPS of $0.20 trumped the $0.18 expected by the analysts. Looking ahead, the company stuck to it full-year revenue guide of $59.3 – $62.0 million (amounting to a 10-15% increase) and EPS outlook of $0.63 – $0.67.

More recently, SLP has been expanding its remit and moving into oncology and immunology via the $15.5 million acquisition of competitor Immunetrics. That is a good move, says Oppenheimer analyst Francois Brisebois, who expects more M&A action ahead.

“Given SLP’s history of successful and disciplined M&A, we see the acquisition as a real positive as it should strengthen its quantitative systems pharmacology offering (QSP). With FY3Q23 right around the corner (FY3Q22: 7/6/22), we expect additional color around guidance impact shortly,” Brisebois explained. “Given M&A’s historical importance to SLP’s growth, we believe the company’s continued strong cash position ($115.3M as of end of FY2Q23: February) and the accretive nature of acquisitions position it well for continued M&A down the road.”

To this end, Brisebois rates SLP shares an Outperform (i.e., Buy), unsurprisingly in light of his comments, and sets a $67 price target that suggests a 47% one-year upside for the stock. (To watch Brisebois’s track record, click here)

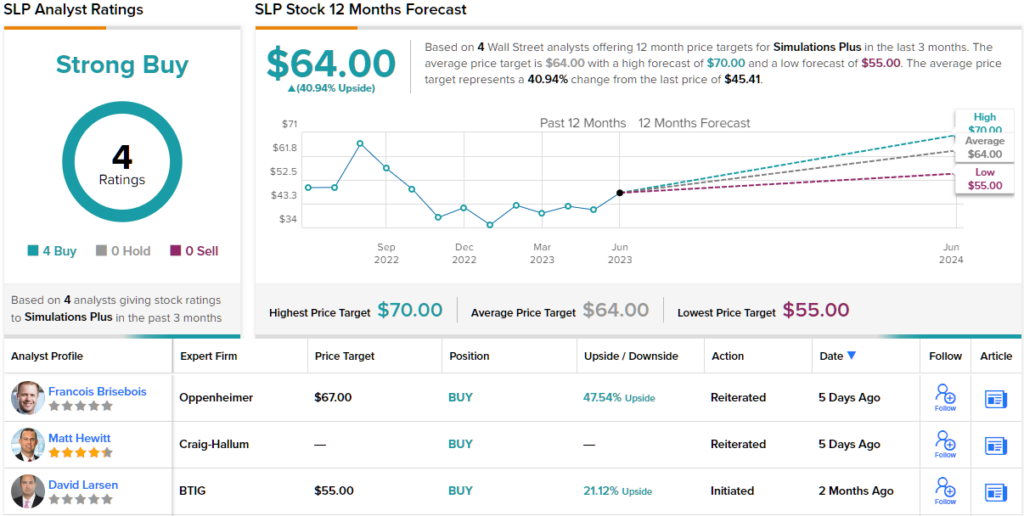

3 other analysts have recently waded in with SLP reviews and they also tout its strong credentials, making the consensus view here a Strong Buy. The forecast calls for one-year gains of ~41%, considering the average target stands at $64. (See SLP stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.