While the summer months are proving to be less lucrative for stock market participants, the overall trend this year has been up. The reason for the rally has been primarily down to AI hype, with various cultural commentators predicting this tech’s impact could be as big as that of the Industrial Revolution.

But not all are quite as hyperbolic. There are grumblings on Wall Street that we are now entering an AI-driven bubble, with some prominent market watchers claiming the rally might not be sustainable while outlining a bearish outlook for the markets.

But if we are entering a bubble, then going by a past recommendation of one investing legend, investors should take advantage. “When I see a bubble forming, I rush in to buy, adding fuel to the fire,” goes one of George Soros’s well-known quotes. “That is not irrational.”

Soros is one of Wall Street’s all-time greats and one of the world’s most successful hedge fund managers ever with a personal fortune of ~$6.7 billion, so it’s always worth taking a look at what he’s been loading up on.

And that’s precisely what we’ve done – delving into a couple of stocks he’s recently put his money on. Using TipRanks’ database to find out what the analyst community has to say, we learned that each ticker boasts Buy ratings and considerable upside potential. Let’s take a closer look.

Aercap Holdings (AER)

First up on our Soros-endorsed list is AerCap Holdings, a prominent player in the global aviation leasing industry. The company specializes in aircraft leasing and fleet management services and boasts an extensive and diverse portfolio whilst serving a broad range of airlines worldwide, including Etihad, Emirates, El Al and many others. Some numbers give an idea as to its size; the company possesses 1,733 aircraft, more than 300 helicopters and around 1,000 engines, all making it one of the world’s largest aviation leasing firms.

It’s a value proposition that served the company extremely well in its recently reported Q2 print. Revenue climbed 15% year-over-year to $1.92 billion, while beating Wall Street expectations by $110 million. Adjusted net income for the period reached $596 million, amounting to $2.56 per share and trumping the prognosticators’ forecast by $0.50.

Looking ahead, the company raised its full year 2023 adjusted EPS outlook to the range between $8.50 – $9.00 (vs. $7.00 to $7.50 beforehand) and in an investor pleasing move authorized a new $500 million share repurchase program.

Soros didn’t want to miss out on an opportunity. Snapping up 305,824 shares during Q2, his hedge fund gave the holding a 58% boost. With the fund’s total position in AER now standing at 841,249 shares, its value comes in at $51 million.

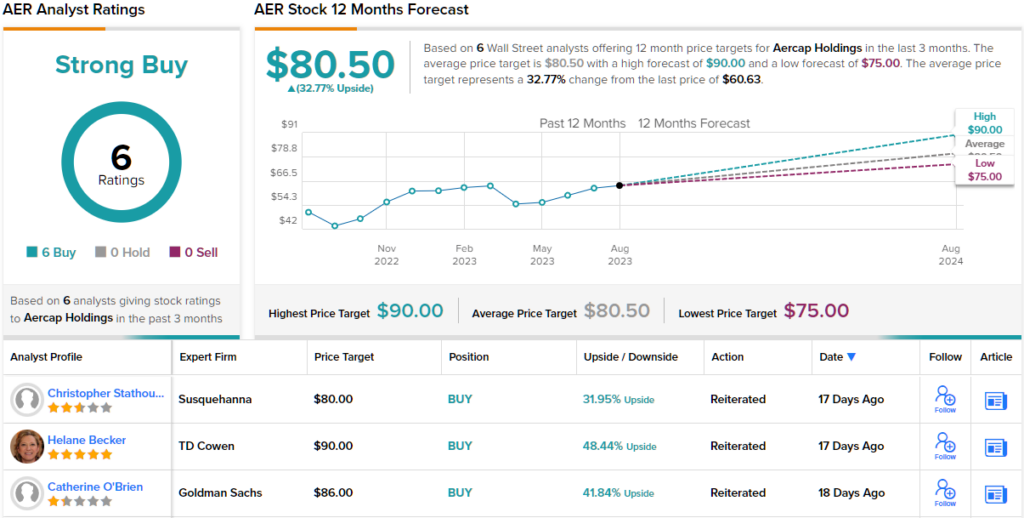

This positive stance is also echoed by Goldman Sachs analyst Catherine O’Brien. Citing the Q2 earnings release, the analyst remains confident in the company’s future prospects.

“June Q results included positive updates to drivers that underpin our Buy rating and point to continued robust demand for aviation assets,” O’Brien said. “First, the company generated record gains… Second, the company’s portfolio basic lease yield continues to improve at a slow but steady rate, coming in at 11.2% in the June Q vs. 11.1% in Mar Q and 10.9% in Dec Q 2022. As a reminder, only a small percentage of the fleet turns over each quarter, so continued improvement in portfolio yield likely speaks to a larger rate of change in incremental lease rates.”

That Buy rating is backed by an $86 price target, suggesting the shares have room for growth of ~42% over the coming year. (To watch O’Brien’s track record, click here)

Overall, AER gets the unanimous support of Wall Street’s analysts. All 6 recent reviews are positive, making the consensus view here a Strong Buy. At $80.50, the average target implies 12-month share appreciation of ~33%. (See AER stock forecast)

RenaissanceRe Holdings (RNR)

Soros is famous for many quotes, one being that ‘good investing is boring.’ It’s not known whether he was directly thinking of the insurance industry when he said that, but nevertheless, our next Soros-backed name operates in a space less suited for thrill seekers.

RenaissanceRe Holdings, often referred to as RenRe, is a reinsurance and insurance company known as a leader in natural catastrophe (nat-cat) reinsurance. Nat-cat reinsurance refers to the practice of reinsuring risks related to natural disasters such as hurricanes, earthquakes, floods, and other catastrophic events.

RenRe has earned a reputation for its expertise in assessing and managing such risks by providing reinsurance coverage to other insurance companies that want to mitigate their exposure to these types of events. By transferring a portion of the risk to RenRe in exchange for premium payments, these insurers can better manage their overall risk profile and financial stability.

The company saw a significant uptick in net investment income in Q2, reaching $292.7 million. This figure reflects a 173% growth compared to the same period in the preceding year. RenRe also marked the third straight quarter of annualized operating return on average common equity, surpassing 28%. All in all, at the bottom line, adjusted EPS of $8.79 exceeded the forecast by $1.39.

Reflecting a new position for Soros, his fund pulled the trigger on 186,648 RNR shares in Q2. At the current market price, these are worth a little over $33 million.

During Q2, the company also announced that is acquiring Validus Re from AIG for $3 billion, as part of RenRe’s efforts to become a top-5 global property and casualty reinsurer.

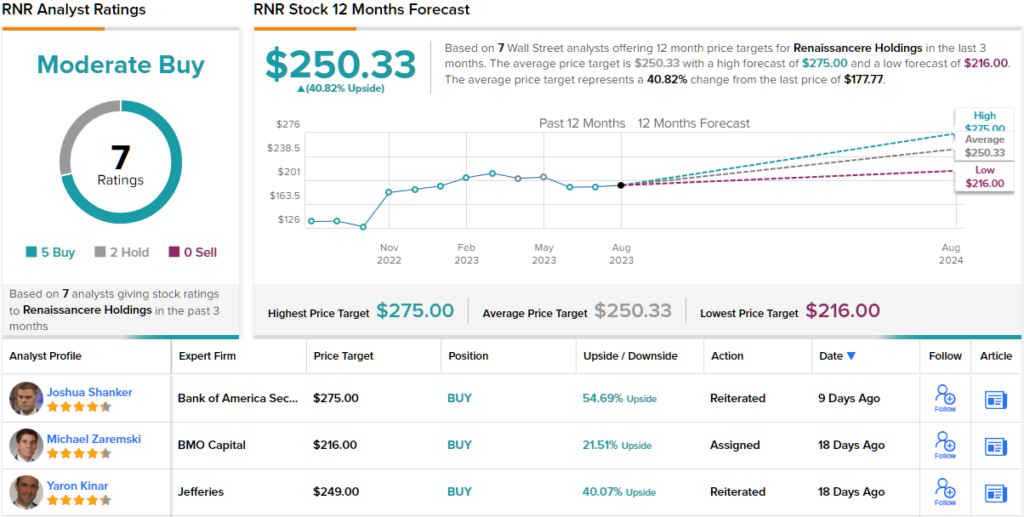

This acquisition informs Wells Fargo’s Elyse Greenspan’s positive thesis for the company. The 5-star analyst writes, “We believe Ren is positioned to continue to generate strong returns, especially if we have a normal to below normal hurricane loss year. Further, they will then bring on the accretive Validus Re deal, which could perhaps be more accretive than expected as the Validus Re portfolio has seen good growth this year, whereas Ren has set its expectations using the 2022 premium base.”

These comments underpin Greenspan’s Overweight (i.e., Buy) rating on RNR, while her $263 price target suggests returns of ~48% could be in store over the coming year. (To watch Greenspan’s track record, click here)

Overall, 4 other analysts join Greenspan in the bull camp and with the addition of 2 fence-sitters, the stock claims a Moderate Buy consensus rating. The shares are currently priced at $177.77, and the $250.33 average price target suggests it has ~41% upside ahead of it. (See RNR stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.