With a renewed focus on sustainability, the push among blockchain miners like Marathon Digital (NASDAQ:MARA) to incorporate renewable energy sources into its energy-intensive business is commendable. However, this “whataboutism” (deflecting criticism by pointing to others’ flaws or issues) ironically might only worsen the power consumption dilemma. As well, it detracts from the core headwind impacting the sector. Therefore, I am tactically bearish on MARA stock.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Is MARA Stock Really a Sustainable Blockchain Investment?

From its website, Marathon claims that it’s one of the largest and most efficient miners of the benchmark cryptocurrency. Additionally, the leadership team stressed that the company would seek a greater renewable energy mix. On paper, it’s a much-needed initiative. From a resource stewardship perspective, management’s go-green sentiments deserve applause. However, the directive risks being an example of “whataboutism,” deflecting legitimate criticisms.

Certainly, MARA stock and the broader crypto-mining complex have incurred much criticism in the past regarding energy consumption. Citing data from the Cambridge Center for Alternative Finance (CCAF), Harvard Business Review (HBR) noted that the leading crypto by market capitalization consumes 0.55% of global electricity production. That’s roughly equivalent to what small nations like Malaysia or Sweden consume.

To be fair, HBR points out many misconceptions about crypto mining and its energy consumption. For one thing, if the virtual currency sector becomes a viable alternative to fiat currencies, the cost of energy may be worth it. After all, printing money also imposes a significant environmental impact. Moreover, the popularity of cryptos can incentivize mining entities to build out renewable energy infrastructures.

However, as a PBS report pointed out, “Even when mining plants run on renewable energy, critics say, they often exploit existing clean energy resources at the expense of ordinary consumers, who are then forced to buy more expensive, and often dirtier, power.”

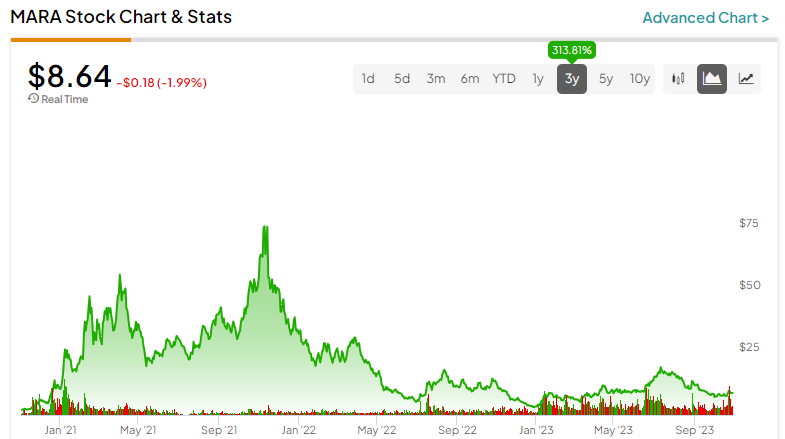

As for the incentivization for renewable energy infrastructure buildouts, the problem stems from a lack of predictability. It’s not just that cryptos tend to be extremely volatile. Rather, crypto miners tend to share a relatively strong direct correlation with benchmark coins and tokens.

Given the wild ebb and flow, miners can’t reliably trust the sector. Thus, it’s doubtful they can effectively build out renewable energy infrastructures.

Marathon Digital Suffers from a Possible Relevancy Dilemma

Now, under the best of circumstances, it’s possible that more mining entities will enter the space. Subsequently, societal and economic pressures may force miners to invest in renewable energy systems. So long as crypto valuations keep rising, MARA stock and its ilk should benefit. Simultaneously, more dollars will enter the renewable technology ecosystem. However, that’s not how cryptos work, and that presents a relevancy dilemma for Marathon and its peers.

As stated earlier, cryptos currently and historically offer a volatile canvas. Thanks to the extreme cyclicality, mining enterprises must be financially stout to weather long periods of limited upside action. It’s not unlike a bear eating up to enter hibernation. Unfortunately, not many business entities can survive such a lull, which is also unpredictable.

More critically, as the cost of blockchain mining rises, society at large may question the relevance of cryptos. Yes, they do provide an alternative to fiat-based transactions. However, such transactions do not come with any legal protections.

In contrast, the use of credit cards and other fiat-related mechanisms impose their fees and other inconveniences. Nevertheless, those inconveniences and costs exist mainly to provide essential services, such as the right to dispute fraudulent charges.

Should the costs of running the blockchain ecosystem begin to compete with standard fiat mechanisms, end users may question the risk-reward proposition.

Financials Tell the Tale

What’s more problematic for MARA stock is that it’s difficult to see a viable path forward. Last year, the company posted a net loss of nearly $687 million. That’s to be expected because the crypto ecosystem crumbled in 2022.

However, at the end of 2021, Marathon still posted a net loss. True, it was down to “only” $37.1 million but it was a red-inked figure. In other words, even under the best of circumstances – with cryptos hitting record-high valuations – the miner wasn’t profitable.

Moving forward, if a recession materializes, the crypto sector will likely tumble. Under this scenario, Marathon would have to wait possibly years for the next bullish cycle.

Is MARA Stock a Buy, According to Analysts?

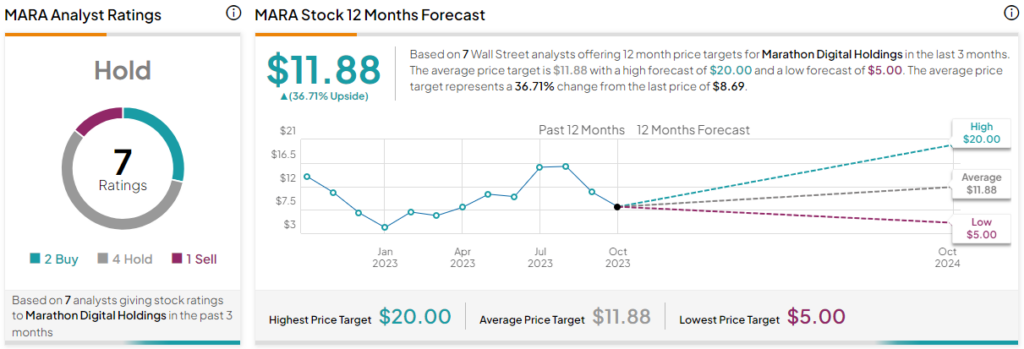

Turning to Wall Street, MARA stock has a Hold consensus rating based on two Buys, four Holds, and one Sell rating. The average MARA stock price target is $11.88, implying 36.7% upside potential.

The Takeaway: MARA Stock Faces a Cruel Irony

Although Marathon’s efforts to incorporate renewable energy centers on sustainability goals, the end result may be a greater negative environmental impact. Further, rising costs associated with the broader blockchain ecosystem may compete with costs associated with already-existing fiat mechanisms but without their legal protections. That might make MARA stock face a relevancy dilemma, of which prospective investors should be cognizant.