Following a strong 90% rally from the March pandemic lows to September’s record highs in 2020, global e-commerce giant Amazon’s (AMZN) stock has underperformed the broader equities market (as measured by the S&P 500 Index) so far this year.

Amazon stock’s 4.9% year-to-date gain for 2021 pales in comparison to the S&P’s 20% rally so far this year.

I am bullish on the innovative company’s long-term prospects right now. (See Analysts’ Top Stocks on TipRanks)

AMZN Stock to Grow

E-commerce demand’s strong show in 2020 was inevitable. Consumers had no other viable options to buy goods. However, Amazon’s near-term revenue growth rate should understandably soften from a 40%-plus run rate during the first quarter of this year.

Growth rates for the third quarter are expected to be in the mid-teens according to management’s recent guidance. Perhaps we may see similar growth rates during the second half of 2021.

Generally, sustained e-commerce business growth rates post COVID-19 are challenging targets given global supply chain bottlenecks and acute logistical challenges.

However, meticulous planning and execution by AMZN have allowed the company to continue to serve its growing customer base, even during times of crisis. The company boosted its logistics, order handling, and fulfillment capacity when the world, and third-party retailers needed its services the most.

Watch Expensive Hirings

By internalizing logistics functions and last-mile delivery services, Amazon has increased its operating cost base by a significant margin. The company has been on a massive hiring spree during the pandemic.

Increased wages, employee bonuses, and tuition fee support helped retain critical human resources in a tight labor market. However, operating and net profit margins could resultantly shrink for the most part of the next year or two.

Sustained growth combined with shrinking margins could have conflicting effects on AMZN stock price. However, there’s an ongoing transformation that could sustain expanding valuation multiples.

Business Undergoing Beautiful Transformation

Investor focus is fast turning to Amazon’s smaller, more profitable, and faster-growing business lines. This includes Amazon Web Services (AWS), a cloud computing, storage, and database services segment, as well as the company’s tweaked Advertising Services.

The two businesses combined constitute less than 15% of total revenue, yet contribute to more than half the company’s operating income. If AMZN is to positively surprise the market over the next 12 months, it’s likely that it’ll be mostly attributable to the two smaller business lines.

It’s important that AMZN stock investors watch these growth areas closely. The company’s upcoming quarterly earnings report is due next week. (See the TipRanks Earnings Calendar).

Improved customer experiences in Advertising Services, sustained demand for cloud computing post-COVID-19, and AWS’ planned infrastructure expansions into the United Arab Emirates (2022) and Israel (2023) could be new growth drivers.

It won’t be surprising to see AWS and Advertising sales grow to contribute to the majority of the company’s total revenue and earnings 10 years from now. Profit margins could expand, and so could the company’s stock price multiples.

However, there’s a nagging decline in website traffic right now.

Amazon’s Website Traffic Continues to Decline

The company is successfully remodeling its legacy e-commerce business to become more self-sustainable. Its reduced reliance on third-party logistics and fulfillment services could fortify the business. However, the company still requires sustained traffic levels to its online shopping websites (its digital real estate).

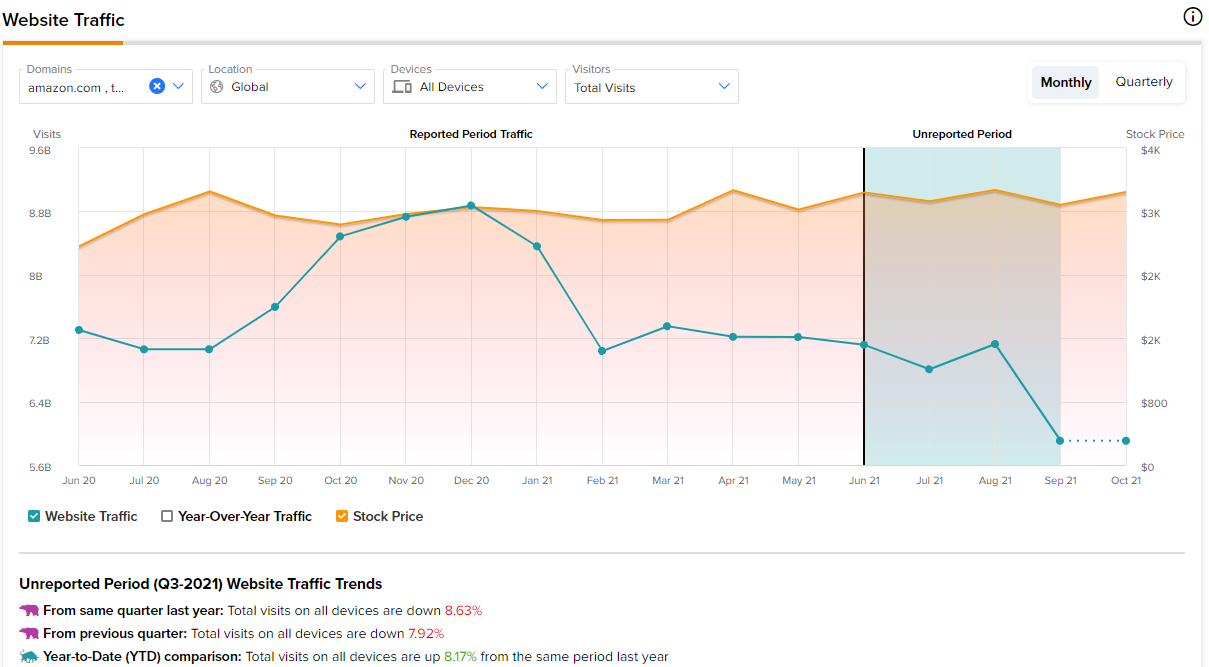

Using TipRanks’ Website Traffic tool, which analyses key website traffic volume data provided by Semrush (SEMR), Amazon saw a plunge in total website traffic volumes on its platforms globally.

Combining data from all company platforms including twitch.tv, imdb.com, and primevideo.com website visits, total website visits declined by nearly 8% during the third quarter. This was perhaps worsened by a 25% month-over-month drop in desktop traffic in September.

Demand for e-commerce services has declined since the easing of pandemic-related lockdowns. It’s yet to be seen if new online purchasing habits developed during forced stay-at-home periods stick for the long term.

As of now, declining e-commerce website traffic remains a persistent trend for most online retail businesses. This includes Etsy (ETSY). However, Alibaba (BABA) saw a trend reversal to website traffic growth during the third quarter ending on September 30, 2021.

Perhaps Amazon will see a return of online shoppers too. The upcoming festive season, and its associated shopping craze, could provide a good start.

Wall Street’s Take

Turning to Wall Street, Amazon stock has a Strong Buy consensus rating, based on 31 Buy ratings assigned in the last three months. At $4,196.80, the average Amazon price target implies 22.2% upside potential over the next 12 months.

Takeaway

This could be a good time for investors to consider AMZN stock.

Although future returns can’t be guaranteed, long-term focused investors could see much more upside over the next decade. More so as the innovative tech giant continues to beautifully transform its business.

Disclosure: At the time of publication, Brian Paradza did not have a position in any of the securities mentioned in this article.

Disclaimer: The information contained in this article represents the views and opinion of the writer only, and not the views or opinion of TipRanks or its affiliates, and should be considered for informational purposes only. TipRanks makes no warranties about the completeness, accuracy or reliability of such information. Nothing in this article should be taken as a recommendation or solicitation to purchase or sell securities. Nothing in the article constitutes legal, professional, investment and/or financial advice and/or takes into account the specific needs and/or requirements of an individual, nor does any information in the article constitute a comprehensive or complete statement of the matters or subject discussed therein. TipRanks and its affiliates disclaim all liability or responsibility with respect to the content of the article, and any action taken upon the information in the article is at your own and sole risk. The link to this article does not constitute an endorsement or recommendation by TipRanks or its affiliates. Past performance is not indicative of future results, prices or performance.