The most awaited upgrade in the crypto world— the Ethereum (ETH-USD) Merge— is finally over. Discussions on the Merge have been going on for a number of years without any success up until now. Now that the Bellatrix update has finally paved the way for the elusive Ethereum 2.0, cryptocurrency trading platforms like Coinbase (NASDAQ:COIN) are poised to gain. However, the same cannot be said about crypto-mining GPU provider Nvidia (NASDAQ:NVDA).

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

However, before we begin to understand the implications of the Merge on the two stocks, it will be a good idea to get some background information first.

What is the Ethereum Merge?

Decentralized open-source blockchain platform Ethereum jumped on a new environmentally-friendly upgraded software on September 15. The process of merging Ethereum servers began with an update (known as Bellatrix) to the Ethereum Virtual Machine. Notably, the new system will require 99.95% lesser energy than the earlier proof-of-work mechanism to validate transaction data. The new proof-of-stake mechanism will require the validation of investors that stake Ether, Ethereum’s native cryptocurrency.

For context, staked Ether refers to the Ether tokens that have been stacked away to be used in Ethereum’s upgraded network — beacon chain.

So, what happens to the crypto-mining GPUs? Simply put, their use in Ethereum has gone kaput overnight. This is exactly what the bad news is for Nvidia.

Demand for Nvidia’s Crypto-Mining GPUs to Fall Drastically

Immediately after the Merge, the world’s most powerful ETH mining pool provider, Ethermine, shuttered its servers, making it impossible to mine Ether on the Ethereum network. This is because the GPUs that would earlier validate transaction data will now be replaced with staked-Ether investors to handle the validation.

NVIDIA has been making changes to its GPU inventories and prices since crypto went into a crisis earlier this year. Now, with the Merge finally done, the stoppage of Ethereum mining might mean demand destruction worth an estimated $10 billion. Suddenly, the chances of making a sale of the Nvidia crypto-mining GPUs to miners have diminished manifold.

How Bad Can This be for Nvidia?

Nvidia’s cryptocurrency-mining processor sales were already dwindling for the past couple of quarters. Crypto chip sales brought in “nominal” revenues for the second quarter of Fiscal 2023, which led to a 66% year-over-year decline in its OEM business unit. So, this loss is not entirely a surprise.

Also, given that OEM unit contributes only about 1.9% (as of Q2F23) of total Nvidia revenues, working on building up its other offerings like gaming GPUs, AI-chips, etc., may allow Nvidia to slowly make up for the lost revenues from crypto mining.

Is NVDA Stock a Buy or a Sell?

Wall Street recently changed its stance to a more cautious tone, with a Moderate Buy based on 24 Buys and nine Holds. Nvidia’s price target is $208.96 currently, indicating upside potential of 57.6% from current price levels.

Coinbase’s Prospects Look Bright

The advent of Ethereum 2.0 is also expected to impact crypto-related market players like trading platform provider Coinbase, albeit positively.

Coinbase had cleverly established itself as a key provider of staking services, where, as mentioned before, investors can keep aside Ether for validation on Ethereum 2.0 and earn rewards on their contribution (with Coinbase earning 25% of these rewards). This will now pay off with the Merge finally over and prove to be a major revenue booster for Coinbase.

The energy-saving factor of the Ethereum 2.0 is expected to attract more environmental, social, and governance (ESG) concerned investors to come onboard the crypto wagon. With Coinbase being the largest staking platform, things look up from both a revenue and profitability point of view. Needham analyst John Todaro estimates that Coinbase’s annual revenue from staking can reach up to $570 million a year.

Now that we are aware of these catalysts, let us turn to the rest of Wall Street and see what analysts are thinking.

Is COIN Stock a Buy or a Sell?

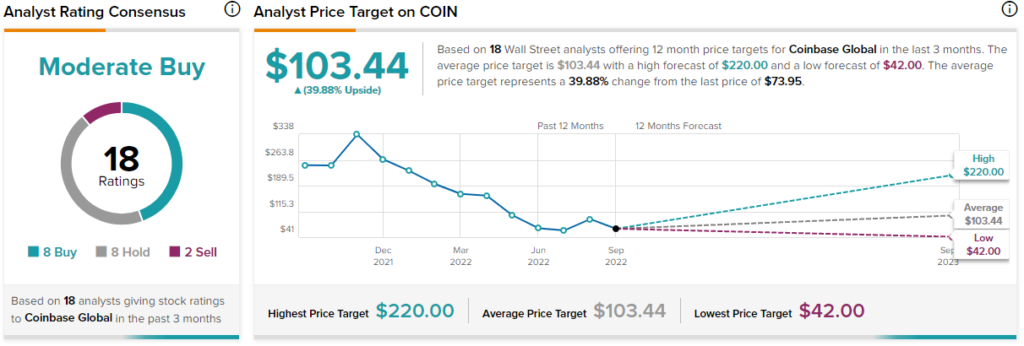

Wall Street is cautiously optimistic about COIN stock, with a Moderate Buy rating based on eight Buys, eight Holds, and two Sells. The average Coinbase stock price prediction is $103.44, indicating 39.9% upside potential from current levels.

Conclusion: Ethereum 2.0 May be a Crypto Breakthrough

Cowen analysts believe that the Merge can be a “long-term positive for sentiment” because the removal of mining can lessen the risk of another crypto bust.

Moreover, Ethereum 2.0 underscores the massive energy consumption of the proof-of-work model of data validation. For this reason, the Merge reduces the environmental regulatory risk for Ethereum and increases that of bitcoin (BTC-USD). This upgrade is also expected to pull in more activist investors onto the platform.

All in all, Ethereum 2.0 has paved the way for a more sustainable and stable crypto market, which is a welcome change after the debacle that crashed the market earlier this year.