The SPDR S&P 500 ETF Trust (SPY) tracks the S&P 500 Index (SPX) and consists of over 500 large-cap U.S. stocks across a broad range of market sectors. The SPY ETF stock has advanced about 15% year-to-date thanks to the artificial intelligence (AI) rally, and remarkably, Wall Street’s top analysts see further upside potential. Moreover, based on technical indicators, SPY is a Buy near its current levels.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

SPY ETF’s Technical Indicators

According to TipRanks’ technical analysis tool, the SPY ETF stock’s 50-Day EMA (exponential moving average) is 419.94, while SPY’s price is $432.70, making it a Buy. Further, the shorter-duration EMA (20-Day) also signals a Buy.

Meanwhile, its RSI (Relative Strength Index) is 60.64, implying a Neutral signal. At the same time, the SPY ETF’s price rate of change (ROC) of 1.61 points to a bullish trend.

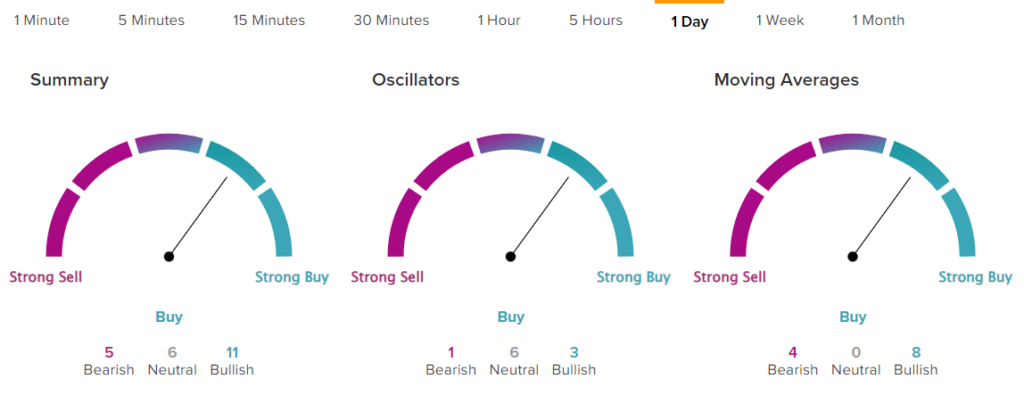

Overall, in the one-day time frame, the SPY ETF stock is a Buy, based on TipRanks’ easy-to-read technical summary signals. This is based on 11 Bullish, six Neutral, and five Bearish signals.

Is SPY a Buy, According to Analysts?

Out of the 4,290 top analysts who rated the SPY ETF’s holdings in the past three months, 60.84% assigned a Buy rating, 34.36% suggested a Hold, and 4.8% have given a Sell rating. Overall, top analysts have a Moderate Buy consensus rating on the SPY ETF. Moreover, at $482.76, the average SPY stock price target based on these recommendations implies upside potential of 11.6% at present.

It is noteworthy that these top analysts have an impressive history of helping investors generate massive returns from their recommendations. Moreover, each analyst has a remarkable success rate.

Ending Thoughts

Impressively, SPY has delivered an average annualized return of 12.1% in the past decade (as of March 2023), and the ETF’s rock-bottom expense ratio of 0.09% makes it even more appealing. Investors looking for exposure to some of its key holdings, including Apple (AAPL), Tesla (TSLA), and JPMorgan Chase (JPM), may want to consider the ETF.