The phrase ‘a recession is coming’ has attained a mantra-like quality in recent times, reflecting the prevailing belief that a downturn in the economy is imminent.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

However, taking a stance in opposition to the doom sayers, billionaire Steve Cohen is keeping an optimistic outlook. “I’m making a prognostication — we’re going up,” Cohen said recently. “I’m actually pretty bullish.”

That might be a bold statement to make right now, but it’s not as if Cohen has had no success in taking the fearless route. He has led his Point72 asset management firm and built his fortune – ~$17.5 billion of it – using a high-risk/high-reward strategy. So, evidently, Cohen knows a thing or two about investing.

But Cohen has also been doing more than just talking. Putting his words into action, he has been confidently loading up on a pair of stocks recently – splashing out millions on them.

We ran these stock picks through the TipRanks database to gauge the Street sentiment toward these names as well. It appears that Cohen receives the analysts’ backing here, as both are rated as Strong Buys by the analyst consensus. Let’s find out why.

Global Payments (GPN)

The first Cohen-approved name we’ll look at is Global Payments, a leading worldwide provider of payment technology and solutions. With a strong global reach spanning across more than 170 countries, the firm offers a wide range of payment processing services to businesses of all sizes. GPN’s payment solutions allow for seamless transactions across various channels, including in-store, online, and mobile platforms, and the company’s offerings include payment processing, fraud prevention, analytics, and customer engagement tools.

The company surpassed expectations when it delivered results for 1Q23 at the start of the month. Revenue climbed by 6% year-over-year to $2.29 billion, beating the consensus estimate by $280 million. Likewise, on the bottom-line, adj. EPS of $2.40 outpaced the $2.31 anticipated on the Street.

Importantly, the company raised its outlook, too, increasing its 2023 revenue projection to the range between $8.635 billion to $8.735 billion. This exceeds the consensus estimate of $8.60 billion. Furthermore, adjusted EPS is expected to be in the range of $10.32 to $10.44 compared to the $10.31 the analysts had in mind.

Cohen must have been pleased with the readout. He bought 487,500 shares in Q1, more than doubling his GPN position. He currently holds a total of 951,900 shares, worth over $94.2 million.

Despite the quarterly outperformance, the shares fell following the print, and that is most likely due to the company announcing that CEO Jeffrey S. Sloan will be stepping down on June 1.

However, that is not really an issue for Raymond James analyst John Davis, who writes: “While the timing of the announced CEO transition was surprising and certainly isn’t ideal, we have a high degree of confidence in incoming CEO Cameron Bready and don’t expect much to change. All told, we believe execution is now back at the forefront, and we continue to see a path for $12+ in FY24 EPS as EVO is integrated ($125M synergy target reiterated) and capital deployment returns (~3.2x leverage by year-end).”

“Simply put,” Davis went on to add, “with the stock trading at just 9x our updated FY24 EPS, despite mid-teens+ normalized EPS growth, we think GPN offers one of the most compelling risk/reward opportunities across our large cap coverage.”

Quantifying that stance, Davis rates GPN shares an Outperform (i.e. Buy) while his $156 price target implies investors will notch returns of ~58% over the coming year. (To watch Davis’ track record, click here)

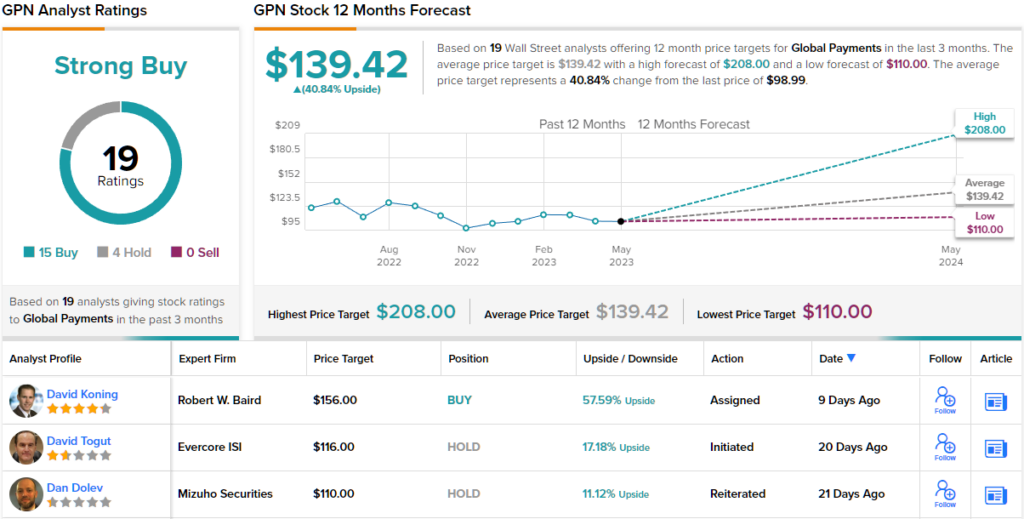

No fewer than 19 of Wall Street’s analysts have sounded off on GPN and their reviews break to 15 Buys and 4 Holds, for a Strong Buy consensus rating. The stock is currently priced at $98.99 and the $139.42 average price target suggests it has room for ~41% growth by the end of next year. (See GPN stock forecast)

Axonics Modulation Technologies (AXNX)

For our next Cohen-sanctioned name, let’s pivot to a different kind of tech proposition: Axonics. Axonics is a medical technology company specializing in the development and market introduction of solutions for the treatment of various urological and pelvic health conditions.

The company offers two main products. The first is the Axonics System, which is a sacral neuromodulation (SNM) therapy. This implantable neurostimulation device is specifically designed to provide long-term relief for patients suffering from overactive bladder (OAB), fecal incontinence, and urinary retention. The second product is Bulkamid, a gel treatment specifically developed for female stress urinary incontinence.

These products contributed to a 46% year-over-year revenue growth in Q1, reaching a total of $70.7 million and surpassing the Street’s forecast of $64.4 million. The earnings per share (EPS) came in at -$0.19, also outpacing the consensus estimate of -$0.29. Furthermore, the company raised its full-year revenue guidance from the previous $342 million to $348 million, representing a 27% increase compared to 2022.

That, however, was evidently not good enough for investors, who might have been looking for a bigger increase to the outlook and sent shares down following the results’ publication.

Yet, Cohen must have seen enough to please him when researching this firm. He opened a new position in Q1 by scooping up 1,070,500 AXNX shares. At the current trading price, these are worth almost $54.8 million.

The company also has a fan in Piper Sandler analyst Adam Maeder, who finds the depressed share price appealing.

“We continue to see a favorable set-up for AXNX looking ahead, particularly at these valuation levels,” the 5-star analyst said. “We believe AXNX continues to operate at a high-level, and we see numbers comfortably set for both Q2 and FY: 2023 with the potential for upside to materialize. With shares currently trading at a discount to other high-growth medtech assets, we see an attractive entry point into the stock, and we’d be buyers on any weakness.”

Accordingly, Maeder rates AXNX shares an Overweight (i.e., Buy) while his $84 price target implies the stock will be changing hands for a 64% premium a year from now. (To watch Maeder’s track record, click here)

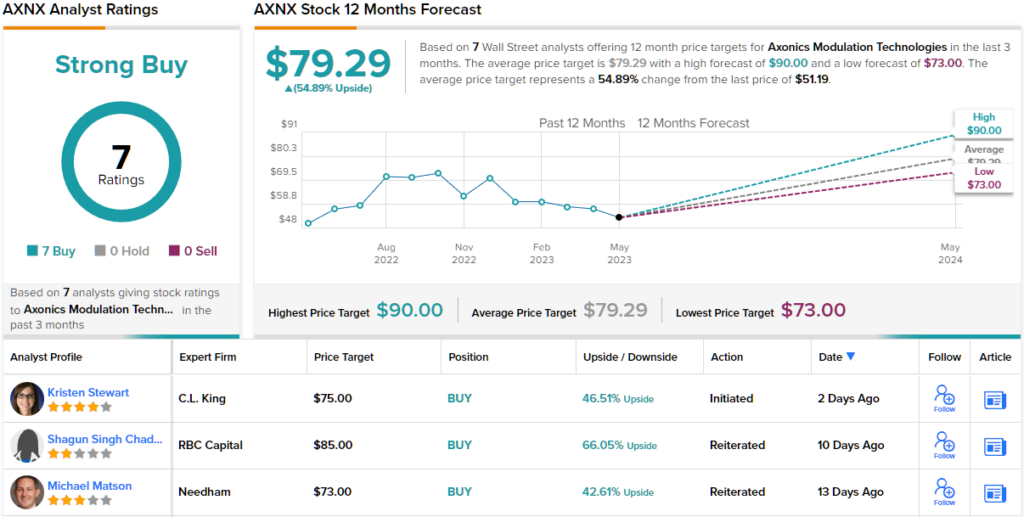

Overall, AXNX stock gets the Street’s full support. All recent reviews – 7, in total – are positive, naturally making the consensus view here a Strong Buy. The forecast calls for one-year gains of ~55%, considering the average target clocks in at $79.29. (See AXNX stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.