There are headwinds in store for the oil industry, but a new report from Wells Fargo suggests that there are still plenty of sound options for investors. The bank sees demand as slowing, although not turning fully negative, and refining as an area of strength. The outline is simple enough: supply is sufficient, and end-product fuels should attract investor attention.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Summing up this outlook, Wells Fargo analyst Sam Margolin writes, “We pick stocks based on return of capital trends, which have historically driven sector-wide share price performance. Since capital returns are in turn driven by commodity prices within cycles, this characterization might be considered an overly complex way of just saying energy stocks move with oil prices. But we find that to be a bit of a cop out, particularly ahead of potentially lower oil prices in the near to medium term. O&G stocks can deliver attractive through-cycle total stock return via dividend CAGR, achieved by a combination of dividend burden management (buybacks), balance sheet care, disciplined reinvestment, diversification, and idiosyncratic factors like project timing, cost recovery built into Production Sharing Contracts (PSCs), and regional considerations.”

Margolin puts this stance into practice with some concrete stock recommendations, selecting two energy stocks to buy in what is shaping up to be a challenging market. Opening up the TipRanks platform, we’ve found that both of these Wells Fargo picks have ‘Buy’ ratings from the Street – but that Wells Fargo sees much better upside than the average. Here are the details.

ExxonMobil (XOM)

The first Wells Fargo energy pick we’ll look at is ExxonMobil, one of the world’s largest oil companies – and the corporate descendant of John D. Rockefeller’s famous Standard Oil Company. ExxonMobil is a perennial part of the world’s top-five largest oil and gas companies; its current market cap of $478 billion ranks it second, and makes it the largest of the US-based oil firms. The company generated $349.6 billion in total revenue last year and paid out $16.7 billion in total dividends.

ExxonMobil’s core business is the exploration, discovery, and exploitation of hydrocarbon energy resources, primarily crude oil and natural gas. This is backed up by extensive operations in the production and distribution of the refined products and fuels that are essential in today’s industrial world. These businesses have made ExxonMobil one of the world’s largest corporate producers of oil and gas, as well as a leader in such industries as petrochemicals, industrial chemicals, and plastics.

In recent months, ExxonMobil has been expanding its production capabilities, in addition to boosting its refining capabilities. In September, the company expanded its output in its Guyana offshore projects, opening a seventh development that will have an output capacity of 150,000 barrels of oil per day. Earlier this month, the company signed a preliminary deal in Iraq for development of that country’s Majnoon oil field near the southern city of Basra. On the refining side, ExxonMobil in September opened new refining capacity in Singapore, using first-of-its-kind technology to enhance the production of high-value products such as lubricant base stocks. The new tech targets fuel oils and other “bottom-of-the-barrel” crude products for conversion to higher-value end products that will improve profitability.

Looking ahead to its Q3 results, expected on October 31, ExxonMobil is predicting high profits from both crude oil production and refining operations. The company’s crude oil profits will get an earnings boost of as much as $300 million from higher crude prices; the refined products are expected to generate between $300 million and $700 million in additional profits due to improved margins.

Looking back at the company’s 2Q25 results, we see that ExxonMobil had $85.51 billion in total revenues. This was down 12% year-over-year, but it came in just over $1 billion better than had been expected. At the bottom line, the company’s EPS of $1.64 was 8 cents per share better than the forecast.

For investors seeking an immediate return, ExxonMobil pays out a reliable dividend. The company has not missed a quarterly payment since 1995, although it will adjust the payment to keep it in accord with prevailing conditions. The last payment, declared on August 1 and paid out on September 10, was for 99 cents per share. At that rate, the dividend annualizes to $3.96 per share and gives a forward yield of 3.5%.

Sam Margolin, in his write-up of ExxonMobil for Wells Fargo, takes a bullish stance, citing several factors. He says of the stock, “We are Overweight rated on XOM. Our rating reflects: 1) XOM’s industry-leading balance sheet profile and extensive Downstream footprint provide a defensive buffer in a softer oil price environment; 2) its capital/development program offers significant flexibility, supporting sufficient headroom for competitive dividend CAGR; 3) structural cost reductions, Permian production ramp, and long-cycle LNG growth enhance optionality, positioning XOM to outperform despite commodity headwinds.”

That stated Overweight (Buy) rating comes along with a $156 price target that points toward a 39% gain for the shares on the one-year horizon.

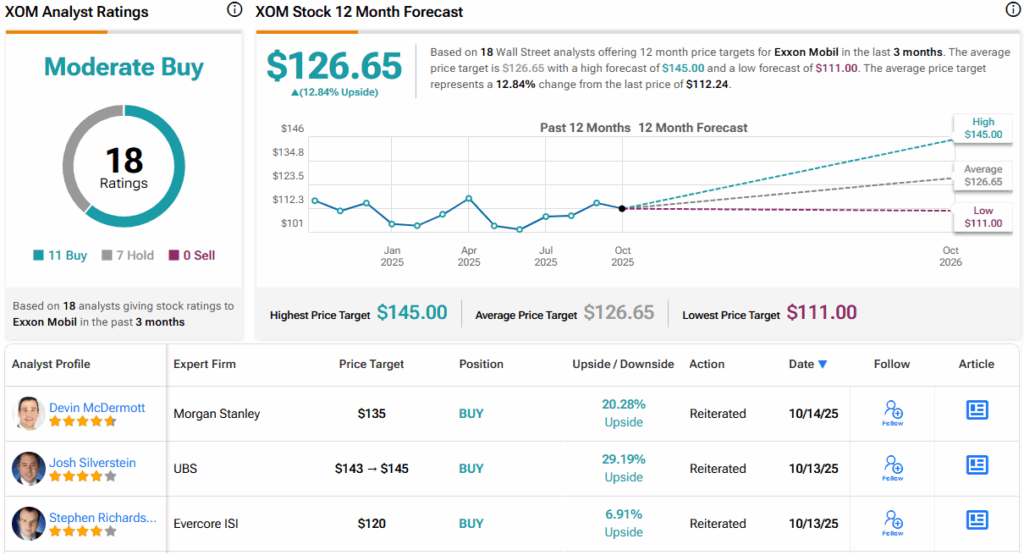

The Moderate Buy consensus rating on ExxonMobil is based on 18 analyst reviews, which break down to 11 Buys and 7 Holds. The stock is currently trading for $112.24 and has an average target price of $126.65; together, these suggest a 13% upside over the next 12 months. (See XOM stock forecast.)

Valero Energy Corporation (VLO)

Next on our list is Valero Energy, a leader in the production and distribution of refined fuels. Valero operates a network of 15 refineries in the US, Canada, and the UK, which, taken together, employ approximately 6,000 people and have some 3.2 million barrels of daily throughput capacity. Valero’s feedstock and refined products are moved through some 3,000 miles of active pipelines, and the company has storage facilities capable of holding 130 million barrels of petroleum products.

The largest parts of Valero’s operations are centered on the Gulf Coast of the US. In this oil- and gas-rich region, the company has a dense network of refineries and terminals, mainly in Texas and in Louisiana’s Mississippi Delta. These facilities produce branded gasoline, diesel, jet fuel, and petrochemical feedstocks, as well as unbranded fuels distributed across 14 states.

Valero doesn’t stop with refined fuels, however. Petroleum – crude oil – can be refined into a wide range of useful and essential products, and Valero can produce a wide array of these. Among the company’s specialty products are 45,000 barrels per day of asphalt, 28,000 barrels per day of propane, and 1.2 million tons per year of elemental sulfur. The company also produces solvents, natural gas liquids, and some 6 million tons annually of petroleum coke, an important product in the cement and steel industries.

We’ll see Valero’s 3Q25 results in a few days, on October 23, but for now we can look back at the Q2 release to get a feel for where the company stands. In the second quarter of this year, Valero generated $29.89 billion at the top line; while this was down more than 13% from 2Q24, it was also $2.73 billion ahead of the forecast. Valero’s bottom-line figure, adj. EPS of $2.28, was 51 cents per share better than had been anticipated. The company reported that its Gulf Coast throughput volume reached record levels and that the company-wide refining segment throughput, at 2.9 million barrels, represented a 92% capacity utilization rate.

Like ExxonMobil above, Valero pays out a regular dividend and has a reliable payment history going back to the 1990s. The company’s last dividend was paid out September 2 at a rate of $1.13 per share; the dividend annualizes to $4.52 per share and gives a forward yield of 2.9%.

Checking in one last time with analyst Margolin and the Wells Fargo view, we find that he is impressed by Valero’s business model and its dividend return, among other attractive features. The analyst writes, “As one of the leading Independent Refiners, VLO benefits from its simple, Gulf Coast-skewed structure, low financial leverage, and a long history of dividend CAGR/shareholder returns leadership. With the market turning bullish on refining, VLO’s expected operating performance and reduced share count position the company to revisit its historical mid-cycle valuation levels.”

These comments support Margolin’s Overweight (Buy) rating on VLO shares, and his $216 price target implies a one-year upside potential of 37%.

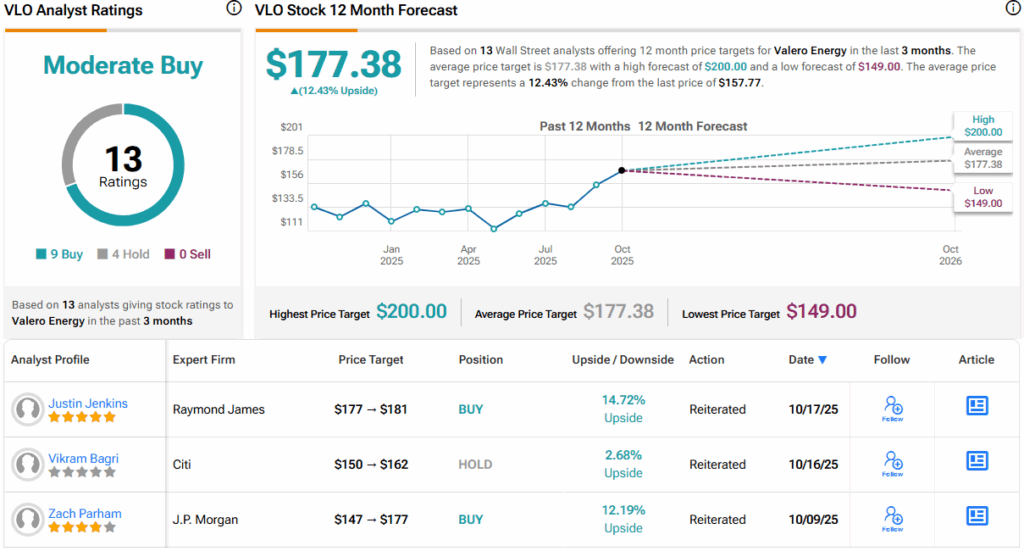

Overall, Valero is another stock with a Moderate Buy from the analyst consensus, this one based on 13 recent reviews that include 9 Buys and 4 Holds. The shares are priced at $157.77, and their $177.38 average target price indicates room for an upside of 12.5% in the coming year. (See VLO stock forecast.)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.