It’s two years out from the COVID lockdowns, and some patterns are becoming clear. One that was not anticipated was a surge in reshoring of basic industries. The pandemic era highlighted vulnerabilities in our supply chain, and the government responded with a push to bring manufacturing back onto US shores.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

That push has included federal subsidies and incentives, but the motive remains simple: to reduce our dependence on foreign suppliers for everyday goods. The incentives have not been evenly applied, however, and some industries are benefiting more than others.

Scott Wren, the global market strategist at Wells Fargo, has taken notice of this trend and remarked, “Our favorable rating on the Industrials sector reflects our belief that increased infrastructure and reshoring spending is here to stay for the foreseeable future.”

With this in mind, we used the TipRanks database to pinpoint two industrial stocks that have earned Buy ratings from Wells Fargo analysts, each with the potential for an upside of at least 40% going into next year. Let’s dive in.

In recent years, ‘clean’ and ‘green’ have become watchwords for the energy industry. There’s a growing awareness that many of our basic economic activities are damaging the environment and that changes are needed to reduce pollution emissions and waste, as well as to clean up old messes. Chart Industries, the first company on our list, operates in the clean energy sector, offering a portfolio of cryogenic products used throughout the liquid gas supply chain, from upfront engineering to routine service and maintenance, and ongoing repair.

With a history tracing back to 1859, Chart Industries has established itself as a global leader in providing cryogenic and heat transfer technology essential for the storage and transport of liquefied gases. Leveraging this expertise, Chart has carved out a solid niche in the LNG (liquefied natural gas) economy, known as the cleanest of the fossil fuels.

Earlier this year, Chart further expanded its capabilities by completing the acquisition of Howden. Howden is a global provider of air and gas handling products and services and is now a subsidiary of Chart. The acquisition transaction was valued at $4.4 billion.

Chart’s performance in the second quarter of 2023 marked the company’s first full financial quarter after the acquisition. The total sales revenue reached a company record of $908.1 million, reflecting a growth of more than 10% year-over-year, albeit falling short of the forecast by $64.27 million. The firm’s non-GAAP earnings figure, reported as an EPS of $1.19, exceeded expectations by 28 cents.

This performance, and the company’s expansion, formed the core of Roger Read’s take on Chart. The 5-star analyst, covering the company for Wells Fargo, explained his stance: “The completion of the Howden acquisition, LNG exposure, participation in the Energy Transition/Energy Security, and deleveraging initiatives support a return to historical valuation and a positive outlook. Additional divestitures could support a further strengthening of the balance sheet… Longer term, we think GTLS remains one of the more interesting and attractive opportunities to participate in the twin opportunities of Energy Security and the Energy Transition.”

These comments supports Read’s Overweight (i.e. Buy) rating on the stock, and his price target, set at $226, implies the shares will gain 41% heading into next year. (To watch Read’s track record, click here)

Overall, Chart Industries gets a Strong Buy rating from the analyst consensus, based on 9 recent analyst reviews, which include 7 Buys and 2 Holds. With a trading price of $159.87 and an average target price of $202.63, GTLS boasts a potential gain of ~27%. for the year ahead. (See GTLS stock forecast)

ON Semiconductor (ON)

Next up is ON Semiconductor, a mid-sized player in the semiconductor chip industry – and when you think that a ‘mid-sized chip maker’ has a near-$40 billion market cap, that gives an indication of just how big the chip industry is. ON makes a wide range of silicon semiconductor chips but specializes in chips for automotive, industrial, medical, aerospace, and 5G applications.

While many chip makers are ‘fabless,’ that is, they design the chips and make the prototypes while farming out the production lines to specialized factories, ON Semiconductor works at both the design and manufacturing sides of the business. The company has 40-plus design centers operating in 19 countries, along with 19 manufacturing facilities in 9 countries. The Arizona-based firm has been active in protecting its intellectual property through the patent process and generated $8.3 billion in total revenues last year, for 24% year-over-year growth.

In its most recent quarterly report for 2Q23, the company beat the analyst forecasts. Total revenue reached nearly $2.1 billion, remaining relatively flat year-over-year and surpassing estimates by $74 million. At the bottom line, the non-GAAP EPS of $1.33 was down by one cent from the year-ago value of $1.34, but it exceeded expectations by 12 cents. In an important breakdown, the company’s revenues from chip sales to the automotive sector increased by 35% y/y, exceeding $1 billion.

ON’s performance, particularly its hefty increase in automotive sector sales, caught the attention of Well Fargo’s 5-star analyst, Gary Mobley, who wrote of the company, “We continue to believe in the automotive semiconductor cyclical & secular theses. To put it succinctly, we believe the automotive semiconductor opportunity for ON can’t be ignored (note: ON derives ~50% of revs from auto today & potentially 55% by FY24). We continue to favor ON shares based on: 1) compelling valuation (20.0x NG EPS); 2) mgmt’s cont’d focus on re-aligning resources toward auto/industrial end mkts; 3) execution on a fab lite footprint; and 4) SiC optionality ($1.0B in FY23 rev)…”

Looking forward, Mobley rates ON an Overweight (i.e. Buy), and his $130 price target implies a one-year upside potential of 45%. (To watch Mobley’s track record, click here)

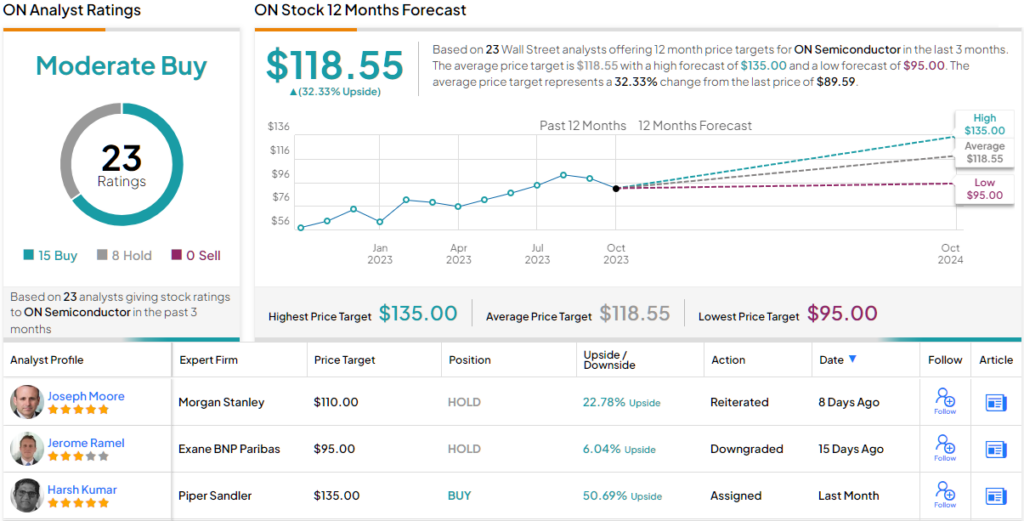

Overall, ON shares get a Moderate Buy rating from the Street’s consensus, based on 23 recent reviews that include 15 Buys and 8 Holds. The shares are trading for $89.59 and their $118.55 average target price indicates room for 32% appreciation in the coming year. (See ON stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.