Apple (NASDAQ:AAPL) stock just needs a little push to move into $3 trillion market-cap territory. The stock needs to hit $190.73 to do so.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Reaching that valuation will be vindication of sorts, says Wedbush analyst Daneil Ives, who notes that not all financial prognosticators have been backing the tech giants’ chances of ongoing success. Those don’t include Ives, however, who thinks the company – and stock – is primed for further growth ahead.

“The Apple bears and skeptics continue to scratch their heads as many have called for Apple’s ‘broken growth story’ this year in a tougher backdrop to which we firmly believe the exact opposite has happened with Cupertino heading into a massive renaissance of growth over the next 12 to 18 months,” the 5-star analyst bullishly said.

Key to this growth will be annual services revenue approaching $100 billion in FY24, all the while growing double digits. Considering that in FY20, the services revenue was around half that amount, that is a “jaw dropping trajectory” and puts Apple on course to reach a “fair valuation” in the $3.5 trillion range by FY25 with the bull case version even landing at $4 trillion.

According to Ives, the Street is also underestimating the boost about to be provided with the release of the iPhone 15 this fall, as around 25% of Apple’s user base have not upgraded their iPhones in more than 4 years.

Not to mention, there’s the upcoming launch of the mixed reality Vision Pro headset that will set in motion the next phase of growth. Ives is convinced this will mark the initial stage of a larger plan by Apple to establish a comprehensive app ecosystem driven by generative AI. This ecosystem will have “thousands of use cases across fitness, health, sports/movies via Apple and partner (e.g. Disney) content, and a myriad of other areas just starting to take shape with developers.”

All told, Ives’ maintained an Outperform (i.e., Buy) rating on the shares, backed by a $220 price target. That figure makes room for additional gains of 16% over the coming months. (To watch Ives’ track record, click here)

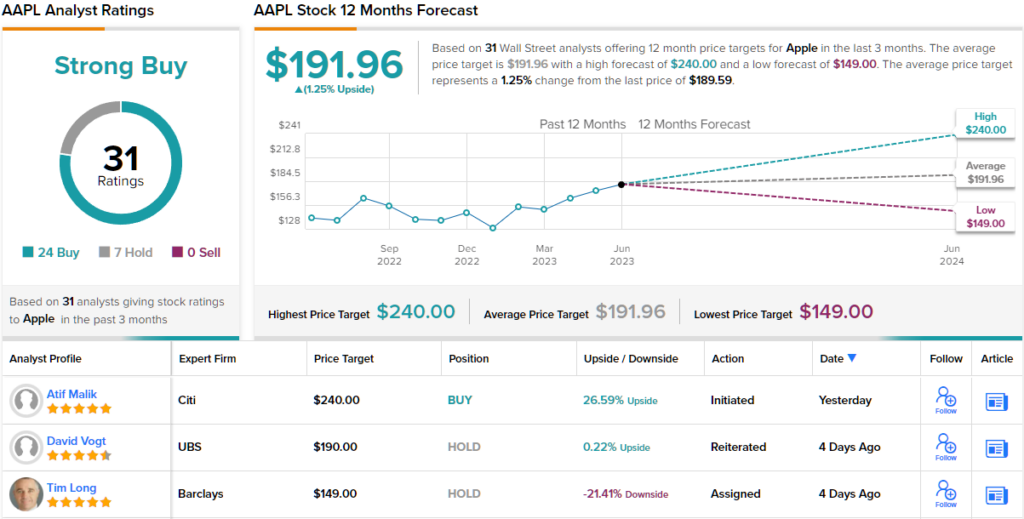

Elsewhere on the Street, the stock garners an additional 23 Buys and 7 Holds, all coalescing to a Strong Buy consensus rating. However, the $191.96 price target implies shares have almost reached their full valuation. (See Apple stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.