Rising recession fears and other macro challenges continue to cloud investors’ investment decisions. In such situations, investors can monitor the performance of a company’s website domain. This could assist them in analyzing how changes in consumer behavior might impact the impending earnings report and the stock price.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Using the TipRanks’ Website Traffic screener, we identified two social networking stocks with increased web visits in the most recent quarter. This indicates that both companies may deliver better financial results in their upcoming quarter.

Let’s take a closer look at two stocks with rising website trends and strong prospects.

Meta Platforms, Inc.

Mark Zuckerberg’s Meta Platforms (NASDAQ:META) provides some of the most-used apps, including Facebook, Instagram, and WhatsApp. The company recently shifted its focus from the metaverse to prioritizing the growth of its core platforms and controlling costs. This tactical shift will probably help Meta weather the impending recession. Furthermore, the likelihood of TikTok’s ban makes the company’s prospects even more promising.

On TipRanks, we notice an uptrend in Meta’s website traffic. As per the tool, visits to facebook.com increased by 24.8% sequentially during the to-be-reported quarter. The company’s website traffic jumped to 9.6 billion unique visits from 7.7 billion in the year-ago quarter. This suggests that despite a slowdown in ad sales, the company’s first-quarter results may be encouraging.

Meta is scheduled to report its first-quarter 2023 numbers on April 26, 2023.

Wall Street is optimistic ahead of the results, with a Strong Buy rating based on 40 Buys, six Holds, and three Sells. The average META stock price target of $232.52 indicates 5.5% upside potential.

Weibo Corp.

Weibo (NASDAQ:WB) is one of China’s leading social media platforms, often called China’s Twitter equivalent. Weibo is likely to have benefited from a recovery in advertising demand since the COVID-19 restriction was lifted and China’s borders were reopened in the most recent quarter.

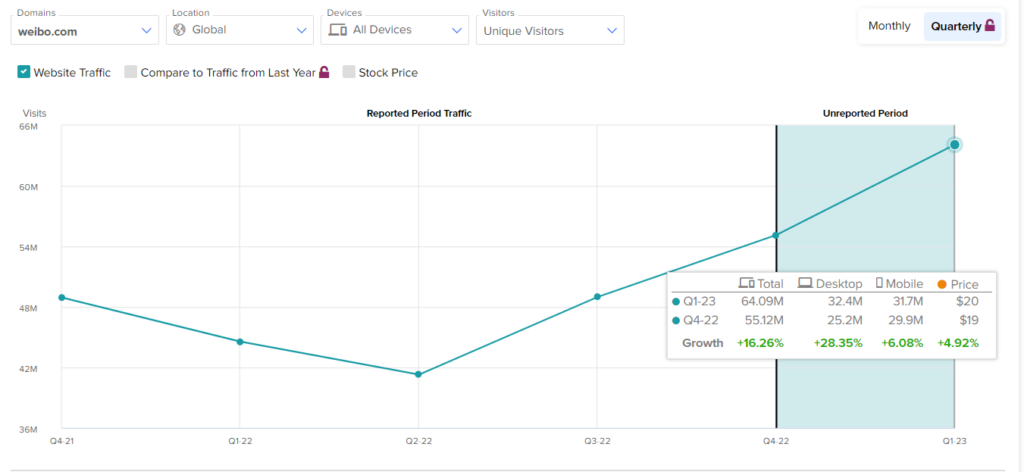

Looking at Weibo’s website clicks, the TipRanks website traffic tool reflects an upward trend. Total global visits to the company’s website represent a surge of 16.3% sequentially, indicating strong results in the upcoming quarter.

The company is expected to release its Q1 results on May 9, 2023.

The Street is cautiously optimistic about WB stock, with a Moderate Buy consensus rating based on four Buys and three Holds. The average price forecast of $24.80 implies 40.03% upside potential.

Concluding Thoughts

Website trends help in forecasting the popularity of stocks, which could help in making prudent investments to some extent. The share prices of META and WB could increase even more if their financial performance improves in the upcoming quarter.