With the Q1 earnings season around the corner, TipRanks provides investors with a tool that can help predict the upcoming earnings report – TipRanks’ Website Traffic Tool. It offers information on how a company’s website domain performed over a specific time frame.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Using this tool, we zeroed in on two video game stocks, Roblox (NYSE:RBLX) and NetEase (NASDAQ:NTES), that witnessed considerable growth in web traffic in the first quarter.

After a sluggish 2022, the video game industry is expected to benefit from the improving gaming scenario this year. As per Statista, the global video game market’s revenue is expected to grow at a five-year CAGR of 7.89% to $521.6 billion by 2027.

Let’s take a closer look at the above two companies’ fundamentals and Q1 earnings prospects.

Roblox Corp.

Roblox provides an online gaming platform where users can explore fictional worlds in 3D while developers can develop and publish games. The company is benefitting from the rising interest of users in the 17 – 24 age group due to their higher propensity to spend money on the platform’s premium content.

Additionally, the company’s initiatives to enhance the user experience should drive bookings, which will ultimately contribute to Roblox’s expanding bottom line.

According to the tool, Q1 global visits to roblox.com were up 131.7% from the last year’s quarter and grew 55.5% sequentially. In the first quarter, about 428.7 million unique users visited Roblox’s website, including 280.1 million on desktop devices and 148.6 via mobile units.

Roblox is scheduled to report its first-quarter 2023 numbers on May 10, 2023.

On TipRanks, Roblox has a Moderate Buy consensus rating based on nine Buys, five Holds, and four Sells assigned over the last three months. At $43.81, the average RBLX stock price target implies a downside potential of 3.1%.

NetEase, Inc.

The China-based company provides online game services and develops PC, mobile, and licensed games from other developers. The efforts made by NetEase to work with well-known companies in the industry, such as ActivisionBlizzard (ATVI) and Microsoft (MSFT), should help attract more users to its platform.

The company’s expansion into non-gaming spaces, such as education firm Youdao Inc. and digital music provider Cloud Music Inc., may also increase opportunities for future growth.

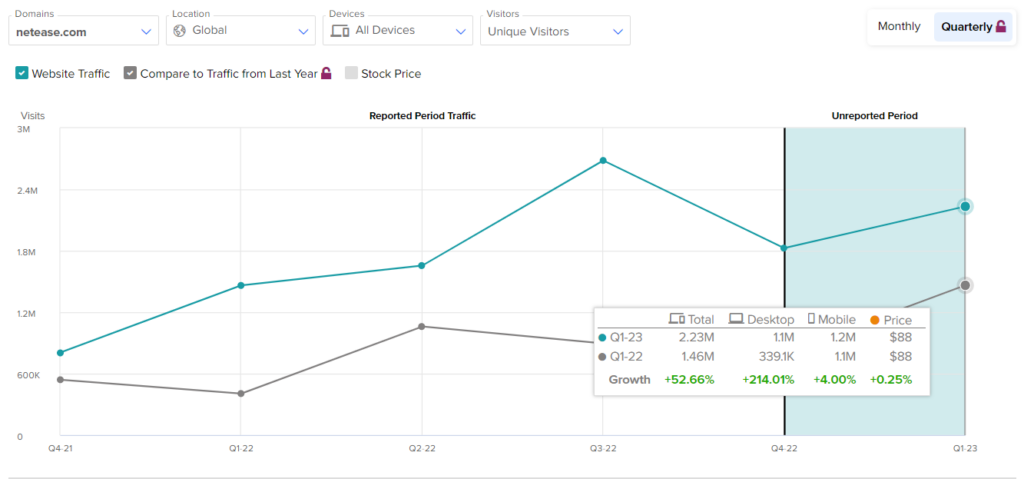

As per the tool, visits to netease.com were up 52.7% year-over-year during the reported quarter. The company’s website traffic jumped to 2.23 million unique visits from 1.46 million in the year-ago quarter. Also, Q1 visits climbed 22.3% sequentially.

The company is expected to release its Q1 results on May 17, 2023.

Overall, Wall Street is optimistic about NTES stock. It has a Strong Buy consensus rating based on four unanimous Buys. The average price target of $114.50 implies 30.1% upside potential from current levels.

Ending Thoughts

According to web traffic statistics, both RBLX and NTES experienced strong business growth in Q1. Also, it points to an encouraging top-line performance in the upcoming first quarter.

Website traffic trends are only one part of your stock research. TipRanks offers easy access to key information such as analyst forecasts, insider and hedge fund transactions, stock analysis, and more, which can guide investors in making data-driven investment decisions.