Dan Loeb, founder and CEO of the New York-based asset management firm Third Point, has built a reputation for active investing and staking out aggressive market stances – and it’s a strategy that has worked for him. Since founding his fund in 1995, Loeb has built it into a Wall Street giant, with some $16 billion in total assets under management.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

While Loeb may be aggressive in his investment tactics, he keeps himself firmly rooted in reality, and his recent client letter has taken clear note of the way that economic conditions have worsened since the early summer. US inflation remains high, and core CPI is rising month-to-month, while across the Atlantic, the UK is facing a potential financial self-immolation after PM Liz Truss’s economic plan imploded in a spectacular fiasco that hammered the pound.

But even in today’s volatile conditions, Loeb is finding opportunities, noting: “We are seeing very attractive valuations, particularly assuming an economic scenario short of financial Armageddon, and are taking up exposures as we speak…”

So, let’s dig into the details of two stocks which make up a big chunk of Third Point’s portfolio. Evidently, Loeb sees these as quality stocks, but he’s not the only one showing confidence in these names; according to the TipRanks database, Wall Street’s analysts rate both as ‘Buys.’

Ovintiv Inc.(OVV)

We’ll start in the energy industry, where Ovintiv is a major player in the hydrocarbon exploration and production operations, with assets in the Texas Permian basin, the Oklahoma Anadarko fields, and the Montney formation on the British Columbia-Alberta border. Ovintiv, which has a market cap of $13 billion, has benefited greatly from the current inflationary environment, especially the increases in prices for oil and natural gas, and has seen 8 quarters in a row of rising revenues.

Along with high revenues, Ovintiv has also seriously outperformed the overall markets – where we’ve seen a general bear this year, OVV stock is up 59% year-to-date.

Ovintiv will report its Q3 results in early November, but a look at the company’s Q2 financial release gives a good picture of its current strength. Revenues in Q2 came to $4.04 billion, and net income was reported at $1.36 billion. Management reported that the company had its highest quarterly cash flow and free cash flow in more than 10 years, with the first metric at $1.22 billion and the second at $713 million.

These solid results led Ovintiv to double its capital return percentage to shareholders, from 25% to 50% of non-GAAP free cash flow. The increase took place one quarter earlier than had been planned; cash returns to shareholders, through base dividends and share buybacks combined, reached $200 million in Q2. Ovintiv is guiding toward $389 million capital returns for Q3.

A cash cow like Ovintiv, capable of delivering strong returns for investors both in cash and in share appreciation, is sure to attract attention from heavy hitters – and Dan Loeb first bought into OVV in Q1 of this year. In Q2, he increased his holding by 172%, buying 3.87 million shares of the stock. His stake in the company, as of August 15, totals 6.12 million shares and is worth over $323 million.

This stock also drew the attention of Jefferies’ Lloyd Byrne. The 5-star analyst is impressed by Ovintiv and writes: “We like OVV’s portfolio of top tier multi-basin assets with a balanced production portfolio, capital allocation optionality, and the price realization advantage associated with the multi-basin premium assets… OVV has continued to trade at a discount to the peer group, despite quality assets, improved balance sheet, strong management and return of capital strategy.”

Along with his upbeat stance, Byrne rates the stock a Buy. His price target, at $75, implies a one-year upside potential of ~42%. (To watch Byme’s track record, click here)

Overall, the bulls are definitely running on this stock. Ovintiv has 10 recent analyst reviews, and they are all positive – for a unanimous Strong Buy consensus rating. The shares are priced at $52.66 and have an average price target of $67.60, suggesting an upside of ~28% in the next 12 months. (See OVV stock forecast on TipRanks)

Colgate-Palmolive Company (CL)

The next stock we’re looking at is Colgate-Palmolive, one of the most recognizable names in the field of household cleaning goods, personal care items, and even pet care supplies. Colgate-Palmolive is best known for its eponymous products – the lines of Colgate toothpastes and Palmolive dish soaps. This is one of the classic defensive niches, as the company deals in product lines that consumers will still need even in a hard recessionary environment. With that in mind, Colgate-Palmolive has posted revenues above $4 billion in each of the last 8 quarters.

In the most recent quarter, 2Q22, Colgate-Palmolive showed its highest revenue total of the past couple of years, at $4.4 billion. While revenues have been gradually increasing, however, earnings have been gradually slipping; the Q2 EPS was down 13% year-over-year to 72 cents per share.

Despite the drop, the company’s earnings easily supported the common share dividend, declared last month for a November 15 Q3 payout at 47 cents per share. The annualized dividend, at $1.88 gives a modest yield of 2.6%, but the key point here is the dividend’s reliability. Colgate-Palmolive boasts that it has paid out ‘uninterrupted dividends’ going all the way back to 1895.

This classic defensive stock made a logical addition for Loeb’s Third Point, given the firm’s stated strategy of defensive investing. Loeb’s firm took out a new position with CL in Q2, buying up 1.985 million shares. At current valuations, this stake is worth well over $140 million.

Loeb laid out a series of reasons for Third Points strong buy into CL, saying: “First, the business is defensive and has significant pricing power in inflationary conditions. Second, there is meaningful hidden value in the company’s Hill’s Pet Nutrition business, which we believe would command a premium multiple if separated from Colgate’s consumer assets. Third, there is a favorable industry backdrop in consumer health, with new entrants via spin-offs and potential for consolidation.”

Looking ahead to the company’s upcoming Q3 print (October 28), Deutsche Bank analyst Steve Powers has a positive slant.

“We expect CL to report a solid set of 3Q results, with lingering gross margin pressure (a product of still-high underlying inflation and building transaction FX headwinds) offset by strong organic growth (+7.5-+8%) balanced across geographic segments and Hill’s. For full-year FY22, we see limited change to full-year EPS despite higher FX headwinds, as strong organic growth momentum, building productivity, and sequentially easing input and logistics cost pressures in 4Q should serve as offsets,” Powers noted.

The analyst summed up, “We remain positively biased on the CL story, as we see underlying improvement in Oral Care and strong momentum in Hill’s benefitting further in today’s economic climate from a consumer products portfolio skewing towards value.”

Putting these bullish comments into a number, Powers gives CL an $85 price target, indicating potential for ~20% upside in the coming year. (To watch Powers’ track record, click here)

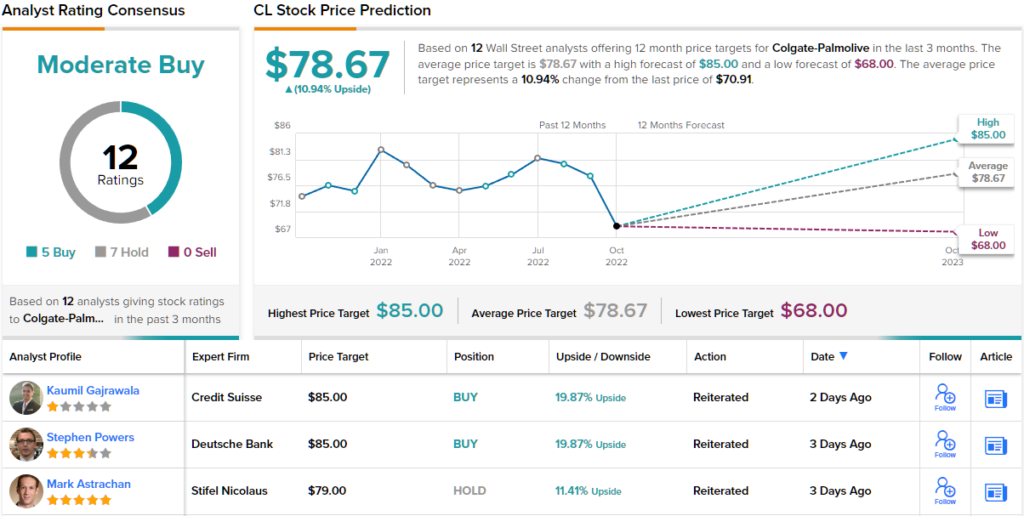

Overall, CL has a Moderate Buy rating from the Wall Street analyst consensus, based on 5 Buys and 7 Holds set in recent weeks. The stock is selling for $70.95, and the average price target of $78.67 implies an upside potential of ~11%. (See CL stock forecast on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.