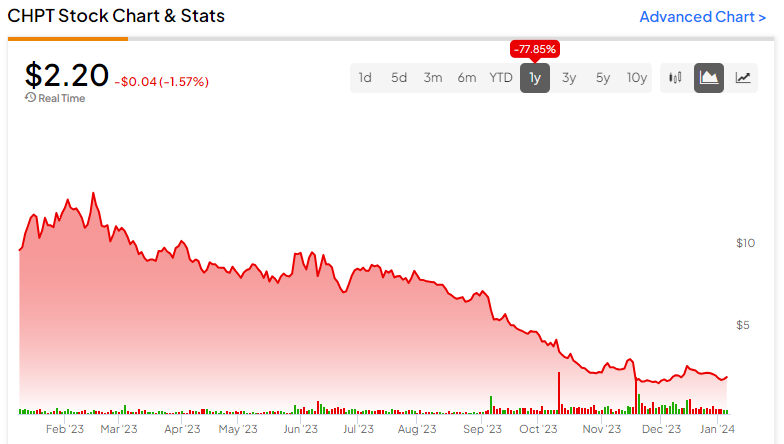

As a candidate for worst performer of 2023, it doesn’t get much uglier than ChargePoint (NYSE:CHPT). Specializing in EV charging infrastructure, ChargePoint is seemingly one of the most relevant businesses. As EVs gradually become the norm of personal mobility, the demand for public charging should rise. Unfortunately, CHPT stock suffered a loss of roughly 78% in the past year. Still, the potential materialization of monetary policy tailwinds makes me bullish on CHPT stock as a speculative idea.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Investors Should Take a Fair View of CHPT Stock

To reiterate, in just the past one-year period, CHPT stock gave up almost 80% of its value. No matter how you cut it, that’s a worrying blow. Trading at a little over two bucks, ChargePoint shares represent a steep discount (on paper) from their initial offering price of $10. Recall that the charging enterprise entered the public domain via a reverse merger with a special-purpose acquisition company (SPAC).

Also, at the height of its power, CHPT stock was racing toward the $50 level. Against that framework, ChargePoint is now a sad shell of its former self. However, the red ink wasn’t entirely based on technical irrationality.

As TipRanks contributor Steve Anderson mentioned, ChargePoint previously used a plug format that was different from the so-called Tesla (NASDAQ:TSLA) charging standard or the North American Charging Standard (NACS). With the EV pioneer leveraging tremendous influence over the sector, many automakers began switching to NACS. Unfortunately, this dynamic put CHPT stock in a bind.

To the company’s credit, ChargePoint began pivoting toward NACS, though it hasn’t been enough to save the business from a market downdraft. Due to financial performance target misses, Wall Street steadily lost confidence in CHPT stock.

Still, it’s also fair to point out that if investors believe in the wider adoption of EVs, then public charging is a must. Yes, it’s possible for consumers to charge their EVs at home. However, two major problems arise with this concept.

First, not everybody has access to a garage. According to the Department of Energy, about 63% of all occupied housing units have a garage or carport. That still leaves plenty of folks that require public charging infrastructure.

Second, improper home charging practices present fire risks. In fairness, at the moment, the risk is minuscule. However, as EVs become the domain of not just the educated and affluent, more mishaps can occur.

The Fed to the Rescue

Perhaps the biggest upside catalyst for CHPT stock centers on the Federal Reserve. Since 2022 and throughout much of 2023, the central bank imposed benchmark interest rate hikes to cool inflation. After a long period of easy money, the sudden surge in borrowing costs represented a shock to the system.

Usually, the principle is that money today is worth more than money tomorrow. You don’t need to get into the conspiratorial realm of dollar collapse theories to understand this point. For decades, the greenback has steadily lost its purchasing power. Under this paradigm, it’s better to do something with your money – invest it, even spend it – than to save it.

Unsurprisingly, then, during the worst of the COVID-19 crisis, when the Fed cut interest rates to the bone, sales of high-ticket items – especially real estate – blossomed. However, when the Fed reversed course and went the hawkish route, the purchasing power of the dollar increased relative to other currencies. And this clearly had an impact on the consumer.

Specifically, the personal saving rate rose from 3.3% in November 2022 to 4.1% in November 2023. This makes sense because the prior paradigm got reversed: a dollar today will be worth less than a dollar tomorrow. So, it would make sense to save.

However, the Fed recently hinted at interest rate cuts this year. If so, the normal paradigm of gradual inflation may return. In this framework, consumers will be more incentivized to do things with their money. That’s good for Wall Street and good for the broader retail business.

Subsequently, if more EVs hit the road, that should be a tailwind for CHPT stock.

Narrative, Not Valuation

In terms of financial metrics, ChargePoint is a difficult beast to judge. Purely on numbers, CHPT stock trades at a trailing-year revenue multiple of 1.46x. What does that exactly mean? It’s tough to decipher since the industry is a novel one. However, it runs conspicuously lower than some of its peers, such as EVgo (NASDAQ:EVGO), which trades at a revenue multiple of 1.84x.

Nevertheless, the point about CHPT stock is about the narrative. If you anticipate a wider adoption of EVs, then the realities of home ownership dictate that public charging demand will rise. Further, not everyone drives a Tesla. Plus, with the Fed possibly presenting a favorable monetary policy pivot, ChargePoint is a name to watch.

Is CHPT Stock a Buy, According to Analysts?

Turning to Wall Street, CHPT stock has a Moderate Buy consensus rating based on six Buys, 12 Holds, and zero Sell ratings. The average CHPT stock price target is $3.28, implying 49.3% upside potential.

The Takeaway: CHPT Stock Deserves a Second Look

Last year, CHPT stock ranked among the worst market performers due to industry-related challenges. However, ChargePoint’s core business remains relevant. Further, with the Fed possibly set to implement a dovish monetary policy, CHPT deserves another look.