Amazon (AMZN) might be scaling back its logistics investments after overestimating demand in the post-pandemic era, but the company is still investing heavily in one specific area – that of long-term storage.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Last week, the company announced AWD (Amazon Warehousing & Distribution), a new solution which lets sellers use new, purpose-built facilities for the storage of bulk inventory and automated distribution. There are no limits to the amount users can store at these warehouses, and when inventory is running low, products are automatically sent to Amazon’s fulfillment centers.

The new service is part of Amazon’s effort to provide a solution to what it terms the “three biggest pain points” for sellers in warehouse and distribution. These are the high costs of storage, the lack of capacity and complex fee structures.

Retail and Technology might still be the two main drivers of Amazon’s business, but Baird analyst Colin Sebastian thinks the continued efforts to build out 3PL (third-party logistics services) represent a “massive market opportunity,” which he believes could “disrupt legacy 3PL businesses.”

How big a market is this? The analyst previously noted that 3PL has a TAM (total addressable market) worth $500 billion. “Since then,” says Sebastian, “Amazon effectively built out freight forwarding, contract logistics and delivery.”

Akin to how AWS services were gradually added, Sebastian anticipates significant enterprise customers will come on board for its 3PL offering, making Amazon a “strong competitor in the market,” and giving some serious headaches to legacy transportation and logistics companies such as UPS and FedEx.

“Just as AWS was able to save companies from the capital and operating costs of owning on-premise IT infrastructure that was often underutilized and technologically constrained,” the analyst further expounded, “Amazon is providing similar on-demand solutions for manufacturers/ retailers in need of logistics services (or, as Amazon calls it: Supply Chain-as-a-Service).”

Good news for Amazon, then, but what does it all mean for investors? Acknowledging the strength of the company’s forward plans, Sebastian rates Amazon shares an Outperform (i.e. Buy), and his $150 price target suggests an upside of ~16% for the year ahead. (To watch Sebastian’s track record, click here)

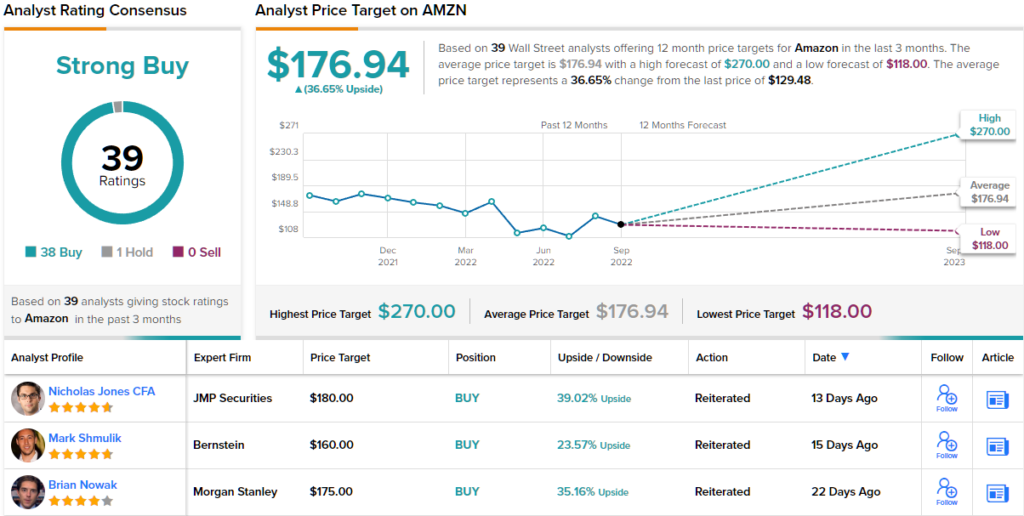

The Street’s average target is a more exuberant $176.94, which suggests shares have room for 39% growth over the coming months. While one analyst remains on the fence regarding the ecommerce giant’s prospects, all 38 other recent reviews are positive, making the consensus view here a Strong Buy. (See Amazon stock forecast on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.