Waste Management (NYSE:WM) is leading the waste industry by employing an efficient business model and maintaining its growth trajectory. The company’s valuation, however, raises some significant concerns, leading me to a neutral rating.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Waste Management is a comprehensive waste services provider in North America, aiming to service commercial, industrial, municipal, and residential customers. At the end of 2022, the company operated 259 landfills, 337 transfer stations, and 97 recovery facilities.

Vertical Integration and services diversification constitute major advantages for an industrial company like Waste Management, as they allow for the creation of economies of scale. In turn, economies of scale help manage costs more effectively (leading to wider margins). During the current inflationary environment, effective cost management is a key factor that sets a company apart from its competitors. Economies of scale also raise barriers to entry for aspiring competitors, rendering the company’s market-leading position even stronger.

Recent Results and Stock Performance

Over the past year, Waste Management has seen its stock price increase by 6.6%, outperforming the broader market, which is down by nearly 6%, despite elevated volatility. At its current price, WM stock pays a 1.7% dividend yield.

For the fourth quarter of 2022, WM’s results slightly missed expectations in terms of revenue ($4.93 billion for Q4) and earnings of $499 million. Still, overall results appeared relatively strong, with both revenue and earnings increasing year-over-year. Management also guided for mid-single-digit growth in 2023.

A Diverse and Growing Revenue Mix

Apart from successfully implementing a vertical integration and diversification strategy, WM also maintains a diverse revenue mix that originates from the company’s ability to serve a number of different customers. Waste Management serves commercial, industrial, and residential customers through collection services. Collection operating revenue is well-diversified, with commercial clients accounting for $5.45 billion in revenue for 2022, industrial for $3.68 billion, and residential for $3.34 billion.

Waste Management’s operating revenue is also supported by Landfill revenues of $4.6 billion, Transfer revenues of $2.1 billion, and Recycling revenues of $1.7 billion. It’s worth noting that all operating revenue streams for WM have recorded growth since 2020 and also on a year-over-year basis compared to 2021. This indicates both strong industry momentum going forward as well as a very targeted and efficient business model.

As companies grow more environmentally cautious and regulations around environmental matters become stricter, WM’s Recycling segment could be a major growth driver, as it currently represents a rather small percentage of overall revenue.

For the next few years, analysts expect WM to continue steadfastly on its growth trajectory. Revenue is expected to surpass $20.5 billion in 2023 and $21.5 billion in 2024.

Keeping Costs Under Control

Managing costs through the scaling of operations and efficient management has been a positive attribute of Waste Management for many years now. Despite persisting inflationary pressures, the company has managed to keep its operating expenses at 62.4% of revenue in 2022, only slightly increasing by 0.4% from 2021.

Labor costs amount to 17.5% of revenue or $3.45 billion, and they represent the largest cost item for the business. Next in line come subcontractor costs of $2.0 billion and maintenance & repair costs of $1.22 billion.

Waste Management also bears SG&A expenses that include labor and professional fees, as well as provisions for bad debts. In total, SG&A expenses for 2022 reached $1.94 billion (or 9.8% of revenue), increasing by around $80 million from 2021, yet amounting to a smaller percentage of revenue (down to 9.8% from 10.4%).

The company has increased its capital expenditures since 2020, from $1.63 billion to 2.58 billion in 2022, targeting growth opportunities primarily in recycling and renewable energy projects while also supporting existing operations (replacing aging assets and increasing efficiency & innovation). For 2023, management expects to spend between $2.0 and $2.1 billion in CapEx for existing operations and $1.1 billion in new projects.

A Recession-Proof Business?

The United States is one of the largest waste-producing counties in the world. From industrial to residential and other waste, the industry is very large and expected to keep growing for the foreseeable future.

While it could be argued that industrial waste generation has some inherent cyclicality, as decreased utilization of industrial facilities during recessionary periods can be observed, residential and commercial waste generation has not. As the population increases and consumption also stays at high levels, commercial and residential waste service providers will have to continue providing services for large volumes of waste.

A Look Into the Balance Sheet

It is common in the industrial sector for companies to carry a lot of debt in order to finance capital expenditures and often M&A transactions. At a $67.2 billion market cap, the company currently maintains a $15.0 billion total debt balance and a small $0.35 billion cash balance. While WM’s debt is significant and interest payments hurt profitability margins, it is still at a reasonable amount considering the company’s profitability. Nevertheless, it’s something investors should keep track of.

Examining WM’s Dividend Prospects

As stated above, Waste Management pays a 1.7% dividend yield, which is very close to the market and sector average. The company’s dividend growth performance, however, is somewhat better than average. Distributions to shareholders have increased at an 8.8% CAGR over the past five years, while growth has accelerated over the last year to 13.0%.

While the firm’s cash payout ratio is a bit over 50%, strong operating cash-flow generation ($4.54 billion in 2022, higher than the $4.34 billion in 2021) appears adequate to cover any future payments as well as expected increases.

The company is also slowly decreasing its outstanding shares over time, putting excess cash flow to use and further enhancing shareholders’ returns. Through share repurchases, WM’s share count has decreased from 434 million in 2017 to 407 million as of the last filing. In 2022, WM allocated $1.5 billion toward buybacks.

Is WM’s Valuation Overblown?

Despite its many desirable attributes, Waste Management’s current valuation multiples imply that a very steep premium must be paid by potential investors to own the stock. At a P/E ratio of almost 30x, an EV/EBITDA ratio of 4.2x, and a P/S ratio of 3.5x, WM trades significantly higher than both sector and market average multiples. The current P/E and P/S ratios are also higher compared to the company’s own historical multiples.

Is WM Stock a Buy, According to Analysts?

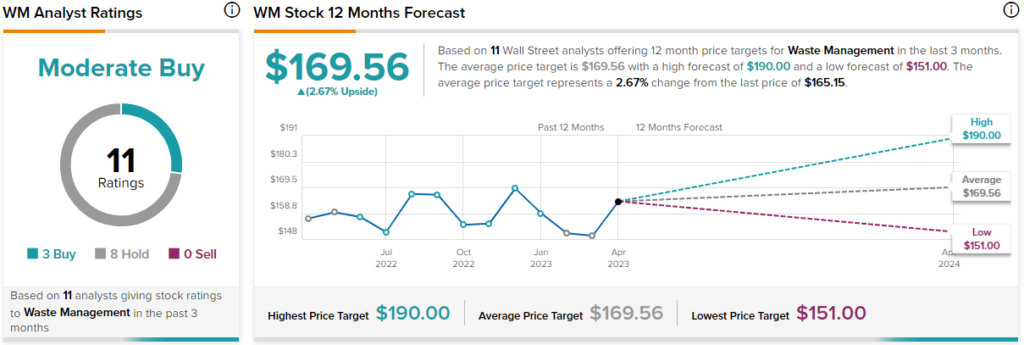

Turning to Wall Street, WM has a Moderate Buy consensus rating based on 11 Buys and eight Hold ratings assigned over the past three months. The average WM stock price forecast of $169.56 represents a 2.7% upside potential.

The Takeaway

Waste Management is a company that could occupy a spot in many investors’ wishlists as it combines a strong business model with efficient operations, profitability, and moderate growth. However, at this point in time, its valuation indicates that returns in the medium term might prove to be underwhelming.