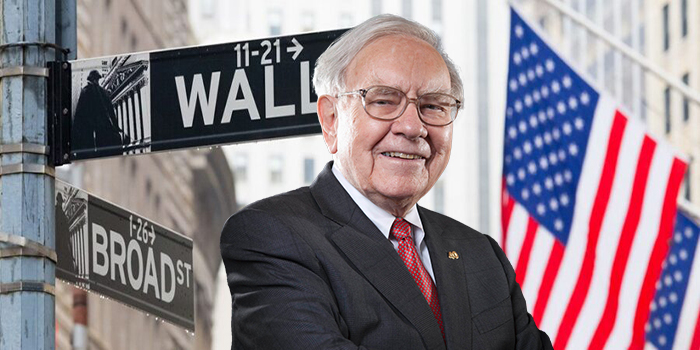

Billionaire investor Warren Buffett played a “messiah,” so to speak, in the 2008 financial crisis, and he could do so again in this year’s banking crisis. Buffett met with White House representatives last week and expressed interest in buying stocks from regional banks if they need support.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Per the discussions, the Oracle of Omaha is willing to infuse capital in struggling regional banks if required. Buffett is often looked upon as a savior of crises, since he played a crucial role in an earlier financial crisis. However, at this time, when and in which bank he would invest is not known.

The premise of his intervention is to restore faith in the banking system. To many, the current debacle is more of a “crisis of confidence” rather than a systemic problem, and his actions are important to reinstate confidence: if Buffett invests in banks now, several investors will follow suit.

Having said that, Buffett will likely make sweet deals this time too. Berkshire’s past investments have earned a fortune with a combination of lucrative preferred stock and convertible warrant investments, ensuring both regular dividends and equity stakes.

Recently, there were rumors that Buffett may be interested in buying Ally Financial (NYSE:ALLY), in which Berkshire already has the second largest, 9.9% stake. Buffett successfully leads the conglomerate of companies called Berkshire Hathaway (NYSE:BRK.A) (BRK.B). He is undoubtedly considered the greatest investor of all time and has created an abundance of wealth by making intelligent investments throughout his life.

The Fed Holds the Key to the Banking Sector’s State

Since the failure of Silicon Valley Bank (SIVB) and Signature Bank, the banking sector has witnessed a significant decline in value. Several banks have lost almost 50% to 90% of their market capitalization. Berkshire’s own financial portfolio stocks are down considerably. As of its December 30, 2022, filing, Berkshire had roughly $74 billion invested in banking, insurance, and financial companies. Of that, roughly $8 billion was lost following the SIVB bank failure.

Yesterday evening, the Fed raised interest rates by a quarter percentage point, a step widely expected by the markets. Yet, the conflicting speeches that followed collapsed the markets like a pack of cards.

On the one hand, Fed Chair Jerome Powell said that the U.S. banking system is “sound and resilient” and that the government is well prepared with tools to save depositors money going forward. On the other hand, the secretary of the Treasury asserted that the Fed will not guarantee all bank deposits.

It is noteworthy that banks borrowed more money from the Fed’s discount window in the week ending March 15 than ever before, indicating that both banks and their clients are concerned about a bank run.

Past Miracles of the Oracle

During the 2008 financial contagion, Buffett’s Berkshire seized lucrative stakes in Goldman Sachs (NYSE:GS) and Bank of America (NYSE:BAC). He even advised the then Fed Chair Hank Paulson that pouring capital into the banks would be better than buying out assets.

Berkshire invested $5 billion in GS in the form of preferred stock and warrants. Later, in 2011, his conglomerate poured $5 billion into BAC, while the world was still dodging the aftereffects of the intertwined, multi-layered derivative contracts. Both well-timed investments have earned handsome profits for the billionaire.

Not all stocks are indeed good, and it is difficult to study companies like Buffett does, especially in a crisis. But by restoring confidence in the financial sector, Buffett surely will help save some of the better companies from collapsing due to a flight to safety.