There’s no one way of achieving success in the stock market and different strategies can be used to attain the basic goal: seeing big returns on an investment.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Talking of big returns achieved via divergent styles, then we can look at the techniques used by legendary investors such as Warren Buffett and Ken Griffin.

Both have had huge success but adhere to different tactics. Buffett made his reputation by favoring value investing, seeking out equities underappreciated at the time and then watching as the market catches up. Meanwhile, making good use of his love of mathematics, Griffin is a proponent of quantitative investment methods.

However, that does not mean that both paths do not cross at times. In fact, delving into both market sages’ portfolios, we find that they are both making some big bets on the same names.

So, we decided to check out 3 stocks held by both and see why they are such fans. By running these names via the TipRanks database, we can also get an idea for how Wall Street’s cadre of analysts see the future shaping up for these equities. Let’s check the details.

Snowflake Inc. (SNOW)

For our first Buffett/Griffin favorite, we’ll head to the tech sector, where we find Snowflake, a prominent data warehousing company known for revolutionizing the way organizations store, manage, and analyze their data in the cloud.

Snowflake offers a cloud-based data platform that provides businesses with a scalable and flexible solution for their data needs. The company’s key innovation lies in its architecture, which separates data storage from compute resources, allowing users to scale their data warehouses dynamically according to their specific requirements. This unique approach has made Snowflake a preferred choice for organizations looking to harness the power of data analytics without the complexities of traditional on-premises data warehouses.

Snowflake’s platform is designed to handle vast amounts of structured and semi-structured data, making it a versatile tool for data analytics, machine learning, and business intelligence applications and its usage has been growing at a fast pace. In the second quarter of fiscal 2024 (July quarter), revenue grew by 35.5% year-over-year to reach $674.02 million, while beating the consensus estimate by $11.74 million. Likewise, adj. EPS of $0.22 outpaced the forecast by $0.12.

While those results exceeded expectations, there have been concerns amongst some investors about growth slowing down. For Q3, the company guided for product revenue between $670 to $675 million, up 28% to 29% compared to the same period a year ago but decelerating sequentially, and the midpoint, below the analyst estimate of $674.9 million.

Meanwhile, Buffett has been heavily invested here for a while and currently owns 6,125,375 shares worth $923 million. As for Griffin, he bought the majority of his stack in Q2, and his 838,521 shares command a market value of more than $126 million.

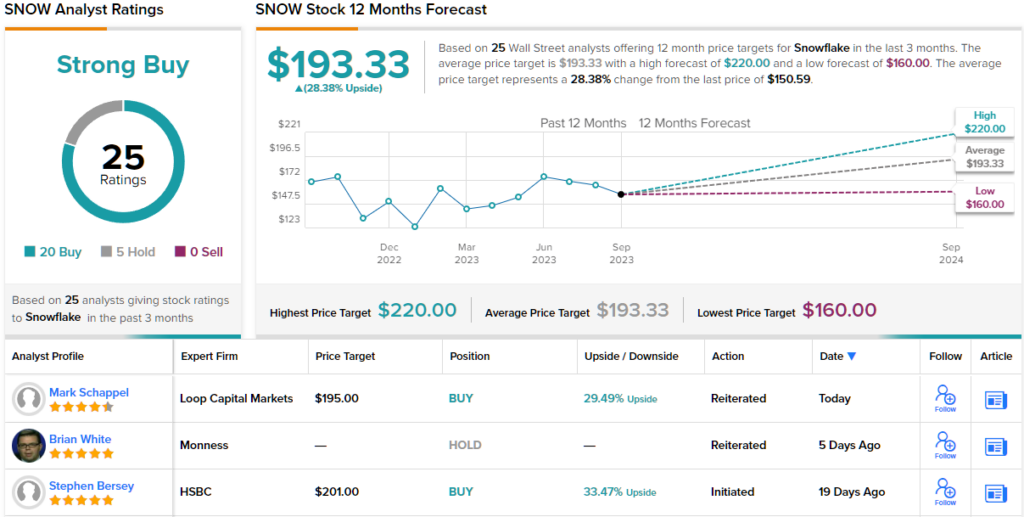

HSBC analyst Stephen Bersey has no concerns around slowing growth, and claims Snowflake is set to be a prime beneficiary of AI’s rise.

“We believe that Snowflake has demonstrated impressive growth and operating leverage, and we think that the company will deliver turnover and EPS growth above peers for the foreseeable future,” the 5-star analyst said. “The company’s products present a strong value proposition, in our view, as they are focused on an important part of the enterprise technology stack, large dataset management and analysis.”

“Notably, we have embedded a tailwind to revenue into our estimates, driven by an increase in global investment spend on AI to capitalize on the recent breakthroughs in the vertical. We see Snowflake as one of the early beneficiaries to this increase in spending as the company’s product portfolio is focused on the critical component of AI, large datasets,” Bersey went on to add.

Conveying his confidence, Bersey’s Buy rating is backed by a $201 price target, suggesting SNOW shares will climb ~34% higher over the next 12 months. (To watch Bersey’s track record, click here)

Tech names like Snowflake have no trouble catch analyst reviews – and there are 25 such reviews on record for SNOW shares. They break down to 20 Buys and 5 Holds, for a Strong Buy consensus view. At $193.33, the average target implies gains of 28% could be in the cards for the coming year. (See Snowflake stock forecast)

DaVita Inc. (DVA)

We’ll turn now from tech to healthcare and look at DaVita, one of the largest providers of kidney care services in the United States, serving over 200,000 patients across more than 2,800 dialysis centers. The company also has several hundred others located in 10 countries.

DaVita is renowned for its patient-centric approach, focusing on delivering high-quality, personalized care to individuals suffering from chronic kidney disease and end-stage renal disease. The company offers a range of services, including in-center hemodialysis, peritoneal dialysis, home hemodialysis, and nutritional support, with the aim of improving patients’ quality of life and managing their condition effectively.

All that combined to deliver a Q2 report boasting beats both on the top-and bottom-line. Revenue of $3 billion represented a 2.4% year-over-year increase and beat Street expectations by $50 million. At the same time, adj. EPS of $1.94 came in ahead of the forecast, by $0.21.

Buffett remains long and strong here. He is the owner of 36,095,570 shares, which at the current price are worth $3.36 billion. Griffin’s holdings are more “modest,” with most purchased during Q2. His DVA holdings total 1,286,177 shares, amounting to $120 million.

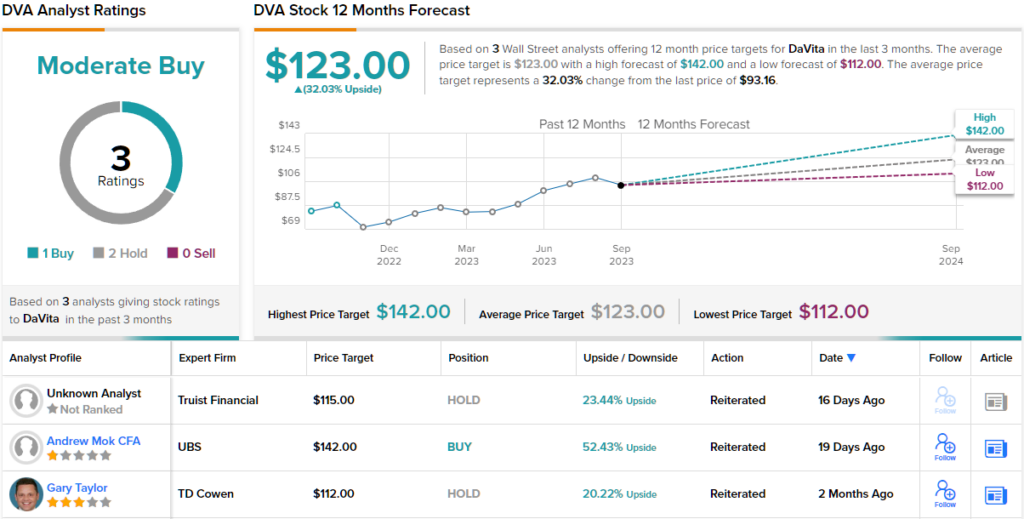

It’s the prospect of growth ahead that UBS analyst Andrew Mok says justifies investors’ attention, even though that seems to go against the Street’s current rhetoric.

“We see inflecting treatment growth in 2Q-3Q ahead of accelerating growth in 2024+. Combined with better pricing and a lower cost structure (ESA savings, closed clinics), we see numerous tailwinds that support our Street-high earnings estimates and contrarian Buy rating. Further, our differentiated view that DVA will resume share repurchase in 4Q should serve as a positive catalyst and an accelerant to 2024 EPS not reflected in consensus estimates,” Mok opined.

That Buy rating goes alongside a Street-high $142 price target, making room for 12-month returns of 52%. (To watch Mok’s track record, click here)

As Mok notes above, his positive thesis is in contrast to others right now. With the 2 additional recent ratings being Holds, the stock manages to eke out a Moderate Buy consensus rating. Nevertheless, even the doubters see the shares as somewhat undervalued; the $123 average target implies shares will appreciate by 32% on the one-year horizon. (See DaVita stock forecast)

Charter Communications (CHTR)

For our final Buffett/Griffin-backed name, we’ll switch lanes again and turn to the telecom industry to check the details on the US’s second-largest cable operator. That’s the spiel behind Charter Communications, a company primarily known for its provision of cable television, high-speed internet, and telephone services to residential and business customers across the country.

Charter’s Spectrum brand extends its services to over 32 million customers across 41 states, leveraging a vast network that covers an impressive distance of over 750,000 miles with the extensive network infrastructure and advanced technology enabling the company to deliver a wide range of digital services, including high-definition television, on-demand video, and broadband internet with competitive speeds.

CHTR stock has enjoyed the spoils of 2023’s bull market, gaining 26.5% year-to-date, and that is despite missing expectations in its most recent quarterly readout. In Q2, revenue stayed roughly the same as in the year-ago period, showing a top-line of $13.66 billion, with the figure falling shy of expectations by $180 million. At the other end of the scale, EPS of $8.05 came in $0.05 below the Street’s forecast.

Positively, during the quarter, Charter purchased 1.1 million shares of its stock for approximately $378 million. Ken Griffin was also busy buying shares, almost tripling his holdings to 527,699. This holding is currently worth more than $228 million. Buffett made no changes to his stack, which remains substantial. He owns 3,828,941 CHTR shares, worth a massive $1.65 billion.

Wells Fargo analyst Steven Cahall is also a fan, laying out why he believes the stock represents a good investment opportunity.

“We think CHTR is the clearest expression of a new normal for Cable competition,” the analyst said. “It has a strong converged bundle with Spectrum One, stable net adds due to its expansion in rural and a more aggressive video posture with programmers. We’re comfortable with ~MSD % EBITDA growth, while capex should meaningfully step-down, beginning in 2026. This makes CHTR appealing as a levered cash return story, and we think it can maintain 8-9x EV/EBITDA.”

These comments underpin Cahall’s Overweight (i.e., Buy) rating on CHTR, while his $550 price target anticipates investors will be sitting on returns of 27% a year from now. (To watch Cahall’s track record, click here)

Overall, of the 15 analyst reviews submitted over the past 3 months, 7 join Cahall in the bull camp and with the addition of 6 Holds and 1 Sell, the analyst consensus rates the stock a Moderate Buy. Going by the $493.31 average target, the stock’s one-year upside potential stands at 14%. (See CHTR stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.