Walmart stock (NYSE:WMT) has rallied significantly following its stock split in February. Shares have recorded gains of about 21.6% over the past year, with the stock split appearing to have powered this rally to some extent. That said, the lack of any tangible impact from the stock split in Walmart’s underlying financials has resulted in shares trading at a premium valuation. Combined with the stock offering underwhelming capital returns, translating to a thin margin of safety for current investors, I am neutral on WMT stock.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Has Walmart’s Stock Split Actually Contributed to the Recent Rally?

Basically, on January 30th, Walmart announced that it would be splitting its stock 3 to 1, which took effect on February 26th. Shares jumped on the news, charting a gradual upward trajectory from there. It’s not surprising, as stock splits often signal optimism among investors about a company’s prospects. Further, splits tend to make a stock more accessible to retail investors by reducing the nominal price per share, allowing for easier trading for those investing modest sums regularly.

Nevertheless, it’s essential to acknowledge that despite the overall excitement surrounding stock splits, these share price rallies are primarily driven by the psychological impact they wield on investors, not an actual effect on financials. A company’s intrinsic worth and overall financials remain unchanged.

Consequently, if a stock split fuels a share price rally but the underlying assumptions about a company’s future financials remain stable, its valuation multiples go up. Walmart appears to be a prime example of this very scenario. Despite the recent share price rally, earnings growth expectations remain modest. This suggests an increased risk profile with a reduced margin of safety for current investors, in my opinion.

Valuation Expansion Outpaces Earnings Growth Projections

Although investor confidence in Walmart strengthened in recent months, Wall Street’s earnings forecast remains unchanged. Consequently, the current growth estimates fail to align with the stock’s expanded valuation.

To illustrate, Wall Street anticipates that Walmart’s EPS will grow at a compound annual growth rate of 6.8% (CAGR) over the next five years, which is more or less in line with the company’s historical average. For context, over the past decade (2014-2023), Walmart’s EPS grew at a CAGR of 5.8%, so this estimate seems reasonable.

However, Walmart’s valuation appears notably inflated. In particular, Walmart stock is now trading at a forward P/E of 25.4x, which appears to be rich, given that this multiple has hovered in the high teens to low 20s over the past decade. A premium seems unjustified today, especially with interest rates at historic highs.

Underwhelming Capital Returns Evaporate Margin of Safety

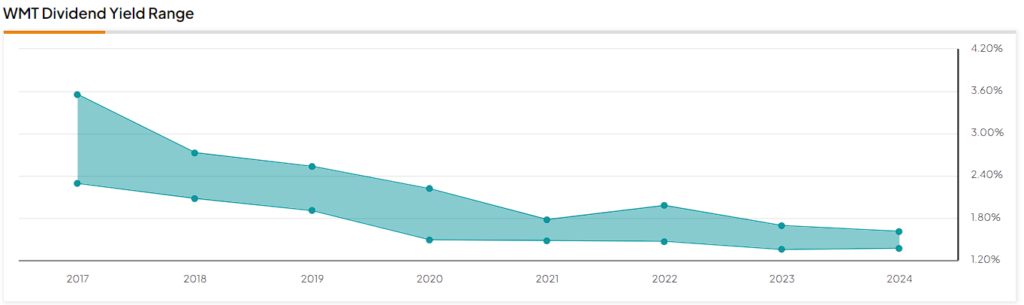

Another reason that Walmart’s investment case concerns me at the stock’s current levels is that its underwhelming shareholder returns evaporate any margin of safety. The stock’s recent rally has led to a forward dividend yield of just about 1.4%, which can hardly excite anyone these days.

It’s not like Walmart grows payouts rapidly either, with the dividend per share having grown at a CAGR of 1.95% over the past decade. The latest hike of nearly 9% was more attractive, but I doubt this is going to be a lasting growth rate, moving forward. Consequently, despite Walmart boasting a legendary dividend growth track record, including 51 years of consecutive annual increases, there is little reason to hold the stock for its dividend today.

Walmart’s stock buyback profile fails to compensate here as well. The company repurchased $2.8 billion worth of stock last year, which translates to a buyback yield of under 0.6%. Even if we assume Walmart allocates close to $10 billion in buybacks per annum, as was the case in FY 2022 and 2023, the company would only be able to reduce its share count by 2% at its current market cap.

Therefore, I believe that Walmart’s relatively weak capital return profile doesn’t offer any margin of safety at the stock’s current levels. Combined with what appears to be an inflated valuation in the current macro environment, a valuation compression to more reasonable levels could prove to be a significant headwind to the stock.

Is Walmart Stock a Buy, According to Analysts?

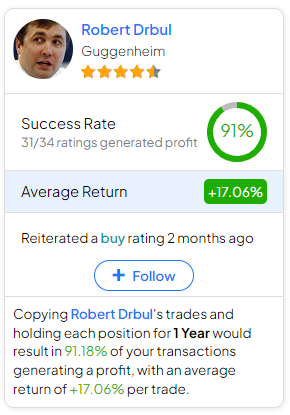

Despite Walmart’s valuation seeming pricy, Wall Street remains bullish on the retail giant. The stock features a Strong Buy consensus rating based on 25 Buys and three Holds assigned in the past three months. At $65.73, the average WMT stock price target implies 10.2% upside potential.

If you’re wondering which analyst you should follow if you want to buy and sell WMT stock, the most profitable analyst covering the stock (on a one-year timeframe) is Robert Drbul’ of Guggenheim, with an average return of 17.06% per rating and a 91% success rate. Click on the image below to learn more.

The Takeaway

Overall, it seems that Walmart’s recent stock split may have contributed to the rally. However, it’s essential to look beyond the surface. Outside of the optimism surrounding stock splits, it’s important to remember that they mostly have a psychological effect rather than a tangible impact on a company’s financials. For this reason, I believe that Walmart’s recent rally isn’t quite justified.

The stock’s current valuation is likely inflated, outpacing Wall Street’s modest earnings growth estimates. Additionally, its underwhelming capital returns, including a relatively low dividend yield and limited stock buyback impact potential, can’t save investors against the possibility of a valuation multiple compression. Therefore, I don’t believe that investors should chase the stock at its current levels.