There are still retail stocks with upside potential, even though, with a recession on the horizon, retail sales could take another sharp turn lower. Undoubtedly, many looming retail sales pressures have likely been baked in here. Still, it’s difficult to gauge how much of a hailstorm the retail heavyweights could be in for as the Fed continues pushing rates higher.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Wall Street analysts have been cautious regarding the more discretionary retailers. Despite enduring pain in 2022, analysts aren’t yet ready to pound the table on buying the dip with such names as RH (NYSE:RH). RH is an upscale retail play and probably one of the most discretionary names in discretionary retail.

Though RH stock has a “Moderate Buy” consensus rating, the stock still has a mere 3.9% expected upside potential. Indeed, the price target downgrades for the stock keep flowing in, and this bar-lowering could continue until this market is ready to look past the damage that a seemingly-imminent recession will bring.

Sure, RH stock is more than half off from peak levels. However, the stakes of getting in a tad too early are incredibly high. As such, investors who want decent value in retail may wish to go for a more staples-focused retail play.

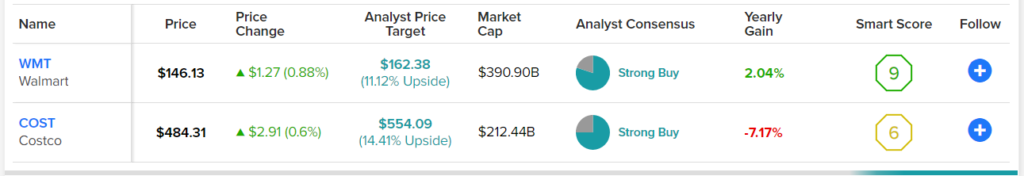

Costco (NASDAQ:COST) and Walmart (NYSE:WMT) are two retailers that have done a great job of holding their own in 2022, thanks partly to their grocery exposure and competitive prices. Though their post-recession recovery upside could be limited, I still view both retailers as intriguing options to ride out a few more waves in 2023.

In this piece, we’ll compare the two retailers and see where Wall Street stands on them in a probable recession year.

Costco (COST)

Costco stock has historically traded at a pretty lofty multiple. With rates rising, many premium-priced, growth-focused stocks have felt the hit of a valuation reset. Even after a turbulent 2022, Costco stock still trades at a rich 36.4 times trailing earnings multiple. Amid inflation and macro headwinds, though, Costco is one of few firms with some wind to its back. In 2023, the winds could strengthen as more consumers drive to great lengths to save more money.

It’s not just looming catalysts (easing margin pressures and a recession-induced bump in foot traffic) that make Costco a great play. The top wholesale retailer has done a great job keeping its members happy. With one of the better value propositions in retail, Costco looks best able to take market share amid lingering inflation and slowing economic growth.

The stock sports a low 0.77 beta, meaning Costco is slightly less volatile than the rest of the market. Should the bear market test new lows, Costco’s low beta should come in handy for jittery investors.

Costco is one of the best defensive retailers to hold going into a period of economic turbulence. Still, investors will pay up for such premium exposure.

What is the Price Target for COST Stock?

Turning to Wall Street, analysts expect continued gains. The average COST stock price target sits at $554.09. From here, that’s a nearly 14.9% gain to be had.

Walmart (WMT)

Walmart is another resilient retailer that’s used its size to its advantage. The iconic retailer is well-known for having some of the lowest prices. As inflation sticks around while employment numbers are put to the test, the path of least resistance for WMT stock, I believe, is higher.

In recent quarters, inventory challenges have taken a stride out of Walmart’s step. Still, management seems more up to dealing with inventory gluts relative to peers.

Last month, Credit Suisse praised Walmart as a defensive pick for an uncertain year. Specifically, they outlined the firm’s ability to “play offense” in difficult environments. Undoubtedly, Walmart has a lot of growth levers it can pull while the economic tides begin to fall. There’s plenty of room to run on e-commerce. Further, the firm could continue to spruce up its Walmart+ subscription offering.

Now, it’s a long shot to think Walmart+ can catch up to the likes of a Costco membership. Regardless, 2023 could be an opportunity for Walmart to gain ground over peers less competitive on price.

At 44.8 times trailing earnings, WMT stock looks expensive, but as a high-quality defensive that can swim forward in a recession year, a strong case could be made that Walmart presents compelling value.

What is the Price Target for WMT Stock?

Wall Street loves Walmart for its stability. The average WMT stock price target of $162.38 entails an 11.1% gain from here based on 20 Buys and five Holds assigned in the past three months.

The Takeaway

Not all retailers are created the same. The following grocery-heavy retail plays are great buys, according to Wall Street. Nonetheless, analysts expect slightly more upside from Costco over the next 12 months.