Wall Street analysts have been busy lowering recommendations and price targets across the broader basket of stocks. Undoubtedly, recession fears are growing as we head into yet another round of earnings. Though many pin 2023 as the year we’ll fall into a recession, markets may be ready to focus on the ensuing rebound by year’s end.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Markets are a difficult beast to predict, especially as the stronger dollar acts as a bit of a headwind. In any case, the most resilient firms have more than what it takes to make it through any “mild” or “short-lived” recessions. Wall Street’s “Strong Buy” or “Moderate Buy” recommendations are a great place to look for those seeking decent upside and reasonable value.

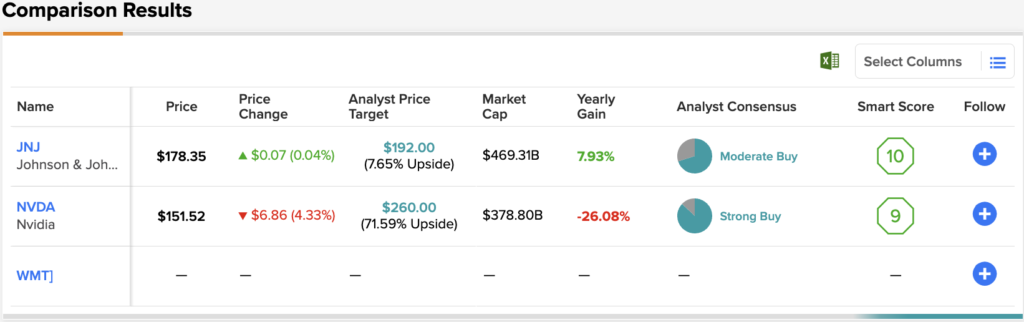

In this piece, we used TipRanks’ Comparison tool to check out three Buy-rated blue-chip stocks that Wall Street may be reluctant to turn against, even as economic storm clouds begin moving in.

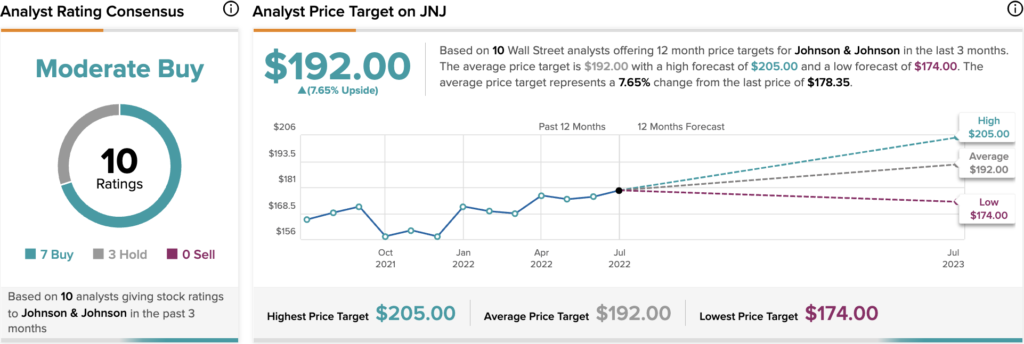

Johnson & Johnson (JNJ)

Healthcare tends to hold its own quite well when the economy begins to slump, and consumers begin cutting back on discretionary purchases. When it comes to health and pharma names, it’s tough to top Johnson & Johnson, which can use its size to its advantage.

The $469 billion behemoth is off to a relatively decent start, up 4% year-to-date, while the broader S&P 500 (SPX) is in a bear market. The 0.63-beta stock boasts a 2.53% dividend yield, making it a great name to hide from broader market volatility in the second half. Still, the 24-times trailing earnings multiple is quite frothy. Investors will pay up for the defensive aspect of the firm at these levels. Still, Wall Street is standing by JNJ stock, as its likely to hold its own should market volatility continue into 2023.

Looking ahead, Johnson & Johnson is going full-speed with its pharmaceutical pipeline, which has shown promise. With $60 billion in sales targeted by 2025 and a wide range of drugs to look forward to, Johnson & Johnson seems to have a better risk/reward than its smaller peers, many of which depend on certain clinical trials for their success.

Johnson & Johnson is a great defensive play to own for a recession. Though the hefty price of admission leaves a lot to be desired, don’t count on Wall Street to lower their price targets at the same pace as most other stocks.

Wall Street remains bullish, with the average analyst price target of $192, implying 7.7% upside from today’s levels.

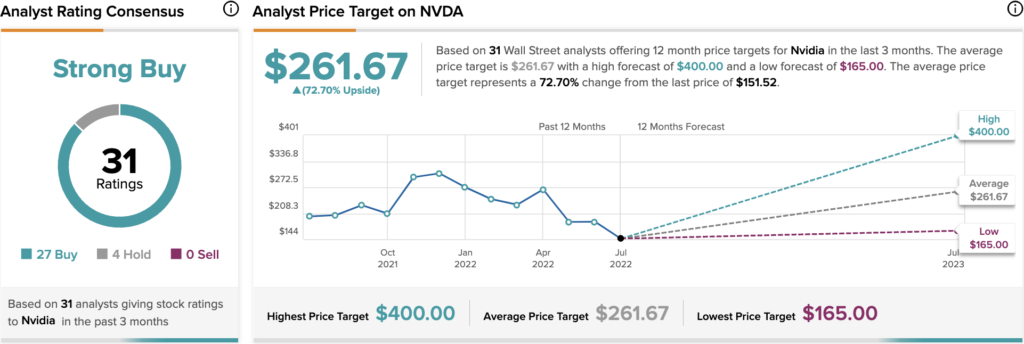

Nvidia (NVDA)

Nvidia lost more than half its value from peak to trough, yet Wall Street maintains its “Strong Buy” rating. Although semis deserve to trade at a discount, it’s hard to lower the bar on Nvidia, with its magnificent innovations that put it miles ahead of its peers. Nvidia isn’t just a graphical powerhouse; it’s a top-of-the-line player feeling the tailwinds from the rise of AI and other technological innovations.

Despite being a hardware firm warranting a discount, Nvidia’s innovative capabilities are the source of its moat. Its CEO Jensen Huang is hard to bet against, even as the broader economy heads south.

Earnings growth has slowed pace in recent quarters. However, it’s hard to imagine that Nvidia is about to turn into a stalwart anytime soon. Recent innovations, including the H100 and Grace superchip could easily reignite growth numbers come the next expansionary cycle. Further, demand still remains robust, perhaps robust enough to navigate Nvidia stock through another storm.

The main knock against Nvidia is the valuation. The stock trades at 40.7 times trailing earnings and 13.4 times sales. Even with cutting-edge GPUs, as the Nasdaq falls, so too will Nvidia stock.

Turning to Wall Street, analysts are staying bullish, with the average Nvidia price target of $261.67, implying 72.7% upside.

Walmart (WMT)

Retail sluggishness has weighed on the top retail kingpin, but that’s at no fault of management. Walmart is still fully-focused on doubling down on e-commerce, and with that could accompany multiple expansion over the next three years.

In the meantime, investors will stay worried over the impact of inflation and slowing growth. What many may be discounting is Walmart’s ability to take share from pricier retailers when times get tough. Indeed, it’s hard to match Walmart’s prices. Its purchasing power translates to a greater ability to absorb the margin hit of high inflation. It can also raise prices without causing too much sticker shock.

At the end of the day, it’s firms like Walmart that can win over customers, which may discover the value of sticky services like Walmart+. Indeed, Walmart has been under pressure alongside most other firms amid recent market-wide woes. In any case, Walmart’s tech-savvy and value proposition can help WMT stock avoid a substantial blow by Mr. Market.

The 27 times trailing earnings multiple is quite hefty, though. At these heights, a lot of tech-savvy potential seems to already be baked in. In any case, Wall Street is staying very bullish, with the average Walmart price target of $156.11, implying 25.5% upside.

Conclusion

Wall Street is quickly souring on many S&P 500 stocks, although these three names could fare well, come a recession. As a result, many analysts won’t be as quick to downgrade them. Still, no stock is immune from a downgrade if this bear market worsens. At the end of the day, economic downturns tend to result in many babies being thrown out with the bathwater.

Read full Disclosure