Every investor has his own ‘trick’ for finding the right stocks, but sometimes it’s best to just turn to the experts. Wall Street’s professional stock analysts have built their reputations on the quality of their stock calls – their accuracy, and the returns that their calls would generate if you base your portfolio on them. And by these criteria, no one on the Street stands higher right now than analyst Mark Lipacis of Evercore.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Lipacis, an expert on the tech sector, holds the #1 rating from TipRanks, from more than 8,900 analysts surveyed. So, when Lipacis recommends a stock, investors should pay attention.

And lately, the Street’s best analyst is betting on two chip stocks. According to the TipRanks database, these are names with Strong Buy consensus ratings, and double-digit upside potential. Let’s give them a closer look, and find out just why you may want to follow Lipacis’ lead on them.

Allegro MicroSystems (ALGM)

We’ll start with Allegro MicroSystems, a chip maker that specializes in integrated circuits (ICs), particularly for various sensors and application-specific analog power systems. These chips have proven essential in the automotive industry, where they are vital components of autonomous driving systems. In addition, Allegro’s chips have found application in electric vehicle charging systems, industrial regulators, and various motors and motorized conveyor systems, and the company has expanded its customer base to include industrial factories, and energy and infrastructure providers.

Allegro works on the fabless model; that is, the company designs its chips, and builds the prototypes, while farming the regular production runs out to dedicated semiconductor chip foundries. This model allows Allegro to focus on design and marketing, creating the best possible fit of chip products to end users. Allegro boasts more than 10,000 global customers, including more than 50 OEMs in the auto industry. The company has shipped out more than 11 billion sensors in its lifetime, has over 650 US patents protecting its intellectual property – and claims that the average vehicle on the road today has 9 Allegro chips installed.

That’s a sound foundation for a chip company, and Allegro beat the forecasts in its last quarterly earnings report, for the fiscal fourth quarter of 2024 (March quarter). The company showed quarterly revenues of $240.58 million. While down more than 10% year-over-year, this figure was $5.63 million better than had been anticipated. The company’s non-GAAP earnings, at $0.25 per share, were 4 cents over the forecast. For the full year 2024, Allegro posted revenues of $1.05 billion, a company record.

Looking at Allegro’s combination of products and performance, top analyst Lipacis is impressed. He particularly notes the company’s successes in expanding its products into additional industries. Lipacis writes, “We view ALGM a Tectonic Shift play, as a key supplier into the emerging IoT market which we expect to grow to 10s of billions of units. ALGM is a top EV play, but we believe increased silicon content in ICE-based vehicles is underappreciated by investors making it one of the best growth stories in the analog/MCU complex. We expect OpMs to expand 1,500bps over the next 5 years. We see the relative P/E sustaining 50% premium vs. S&P 500 amid solid FCF/Shr growth from $0.41 in ’23 to $1.38 in ’25.”

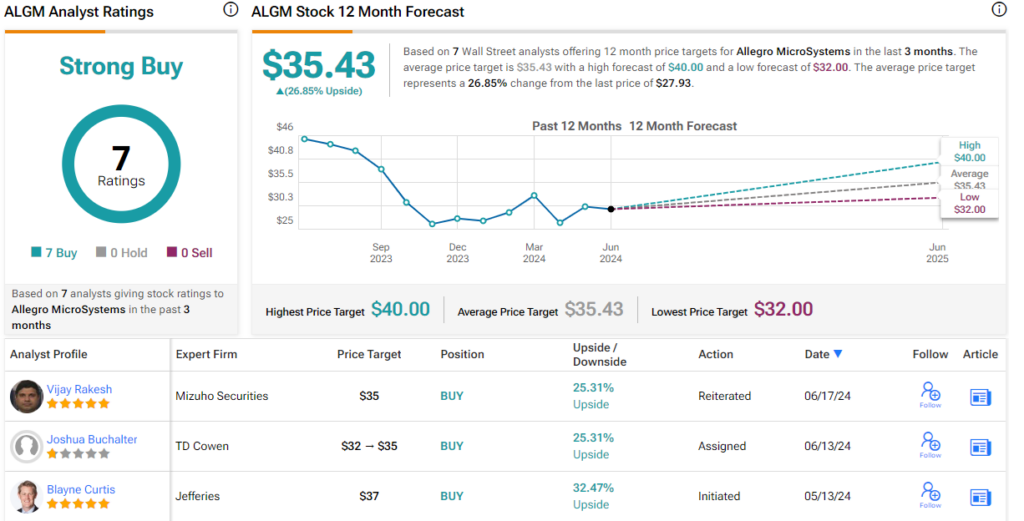

Going forward, Lipacis rates this stock as Outperform (Buy), and his $36 price target implies a one-year upside potential of 29%. (To watch Lipacis’ track record, click here)

Overall, the Strong Buy consensus rating on ALGM stock is unanimous, based on 7 positive analyst reviews set in recent weeks. The shares are priced at $28.24, and their $35.43 average target price indicates room for a 25% upside in the next 12 months. (See ALGM stock forecast)

Marvell Technology (MRVL)

The second stock we’ll look at is Marvell, a $60 billion mid-sized semiconductor chip maker – and it says something about the sheer size of the chip industry that Marvell, which is an order of magnitude larger than Allegro, does not even crack the top-twenty largest chip companies. Nevertheless, Marvell is an important player when it comes to semiconductor chips. The company is known for its focus on Data Processing Units, and its product lines have found popularity in a variety of AI-related fields: data centers, storage accelerators, and network carriers.

Marvell’s product lines are used by AI developers, cloud software providers, wireless carrier companies, and auto makers. The company is known for its history of deep expertise and breakthrough innovations, leading to cutting-edge chipsets, which are used by leaders in a wide range of tech fields. Marvell likes to boast that its products are integral to recent advances in the AI and autonomous vehicle fields, and the chips are also found in accelerated computing, advanced storage systems, and networking security.

Marvell is perceived in the industry as a mid-sized player that is on its way up, and its financial results for 1Q25 were in line with expectations. The top line, of $1.16 billion, and the non-GAAP EPS of 24 cents per share, both met the forecast; we should note that the revenue figure was down 12% from the prior year quarter.

That y/y drop in revenue did not faze Lipacis, who definitely takes the view of Marvell as a company on the rise. Lipacis notes that the company has a strong – and growing – addressable market in its niche, and that it presents an alternative product to larger competitors. He says of the company, “We view MRVL as a Parallel Processing play offering both custom AI accelerators and high speed networking silicon for datacenter applications… MRVL views its TAM as increasing to $75bn in 2028 from $21bn in 2023, or a 29% CAGR, with the biggest growth coming from Accelerated custom compute, Interconnect and switching. Given AVGO’s dominance in the industry, we believe customers want MRVL to succeed and that MRVL will gain share as it executes on its product portfolio.”

These comments support Lipacis’ Outperform (Buy) rating on the stock, and his price target of $91 suggests a 12-month upside of 28%.

The Street as a whole gives MRVL shares 26 recent ratings, that feature a lopsided split of 25 Buys to 1 Hold, all backing up a Strong Buy consensus rating. The shares are currently trading for $71, and their $91.09 average target price points toward a 28% increase on the one-year horizon. (See MRVL stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.