Last week, Walgreens Boots Alliance (NASDAQ:WBA) shocked the dividend investor community by announcing a 48% cut in its quarterly dividend, ending 47 years of consecutive annual increases. Despite its reputation as a dependable dividend growth pick, the move has eroded trust among the company’s income-oriented shareholder base. Nonetheless, I believe that management’s shifting focus toward balance sheet improvement should drive gains, moving forward. Thus, I’m now bullish on the stock.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The Dividend Cut: A Long Time Coming or a Suprise?

The reduction in Walgreens’ dividend has sent shockwaves through the community of income-focused investors. Going through the threads of various investing forums discussing the dividend cut clearly shows this panic. The shock comes not just from the stock’s legendary track record of increasing dividends but also because it’s part of the Dividend Aristocrats Index.

This elite index, housing 67 (66 after WBA is out) distinguished companies from the S&P 500 (SPX) with an impressive track record of elevating dividends for at least 25 consecutive years, is a testament to its constituents’ financial strength and stability. Thus, the repercussions of Walgreens’ dividend cut extend beyond individual investors, impacting ETFs linked to the Index, such as the ProShares S&P 500 Dividend Aristocrats ETF (BATS:NOBL), which must now recalibrate without Walgreens.

Such occurrences are exceedingly rare within the realm of Dividend Aristocrats, typically known for their sound capital allocation strategies and resilient, recession-resistant business models. Due to its pharmacies’ essential and recession-proof nature, Walgreens has historically demonstrated an ability to sustain dividend growth despite challenging economic downturns. Thus, management’s choice to reduce the dividend seems rather perplexing, especially since global economic uncertainty has eased lately.

That said, anybody who had bothered to take a look into Walgreens’ financials knew that a dividend cut was a long time coming. The persistent decline in the company’s gross and operating margins over the years, attributed to heightened competition and innovation in medicine delivery, coupled with the substantial debt on its balance sheet, served as apparent signs. A prime illustration of the industry’s shifting landscape is Amazon’s (NASDAQ:AMZN) entry into the pharmacy business.

Seeing Beyond the Noise: The Dividend Cut Could Spell Upside

Walgreens’ dividend cut has generated a lot of noise surrounding the stock and significant investor dissatisfaction. The stock experienced a sharp decline on the day of the news, compounding its existing downward trajectory throughout the past year.

However, rather than perceiving the dividend cut as a negative development, I advocate for a more optimistic perspective. Viewing this event as a potential catalyst for positive change, investors may discover opportunities for upside potential. Specifically, a reduction in dividend outflows should now allow the company to improve its balance sheet significantly, which could, in turn, lead to bullish momentum, given the stock’s depressed valuation.

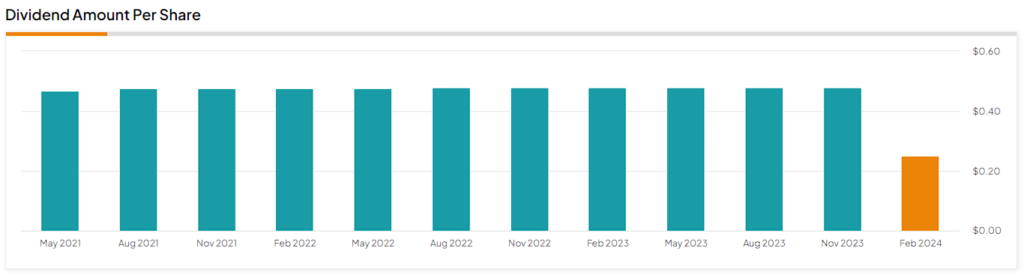

To better articulate the impact of the dividend cut, let’s delve into the context. At its previous quarterly dividend rate of $0.48, the company was paying out $415 million per quarter, translating to an annual outflow of $1.66 billion.

The company managed to cover the dividend until Fiscal 2022, when it generated $2.17 billion in free cash flow. However, the scenario took a downturn in Fiscal 2023 as free cash flow plummeted to $665 million, which was particularly unsettling, given the looming shadow of a $33.7 billion debt burden (including lease liabilities).

With its decisive 48% reduction in the dividend, the company is now positioned to not only meet its dividend obligations but also allocate funds towards bolstering its balance sheet. The revised annual dividends translated to an $863 million outflow. Simultaneously, consensus estimates for Fiscal 2024 point to an anticipated free cash flow of $1.15 billion, signaling enough cash generation to sustain both the adjusted shareholder returns and the debt reduction efforts.

So now, you have a stock trading at about 7x its forward earnings and at 1.1x its book value while offering a 4% dividend yield and paying down debt. This blend presents a much more compelling investment case than earlier, potentially prompting a reassessment by Wall Street. Such a reassessment could lead to a positive shift in valuation, paving the way for upside.

Is WBA Stock a Buy, According to Analysts?

Sentiment on Walgreens Boots Alliance stock varies notably among Wall Street analysts. The stock now features a Hold consensus rating based on two Buys, seven Holds, and two Sell ratings assigned in the past three months. Also, at $25.60, the average Walgreens stock price target implies 0.1% downside potential.

If you’re looking for a reliable analyst to guide your decisions on buying and selling WBA stock, Lisa Gill from JPMorgan (NYSE:JPM) stands out as the most accurate over a one-year period. She features an average return of 26.36% per rating and an impressive 89% success rate.

The Takeaway

In conclusion, Walgreens’ unexpected dividend cut may have unsettled income-focused investors, especially considering its status as a Dividend Aristocrat. However, a simple look at the company’s financials reveals the necessity of this move, driven by declining margins and substantial debt.

Rather than viewing the cut as wholly negative, you may recognize it as a strategic decision to enhance its balance sheet. Trading at a seemingly attractive valuation while opening room for debt reduction, the stock now forms an interesting investment case with possible upside prospects.