Walgreens Boots Alliance (NASDAQ:WBA) will release its Fiscal 2023 third quarter financials on Tuesday, June 27, 2023. Analysts’ earnings estimate indicates that the integrated healthcare, pharmacy, and retail company’s bottom line could return to growth in Q3, reflecting a lower headwind from COVID-19-related demand.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

WBA: Q3 Expectations

Analysts expect Walgreens to post revenue of $34.23 billion, reflecting an improvement from the prior year’s sales of $32.6 billion.

Meanwhile, analysts expect WBA to post earnings of $1.08 per share in Q3, compared to $0.96 in the prior-year quarter.

It’s worth noting that Walgreens Boots Alliance significantly benefitted from the strong demand for COVID-19-related vaccines and drive-through and OTC tests. However, the absence of those benefits in 2023 weighed on its first-half performance, wherein its bottom line declined.

Nonetheless, management expects a lower year-over-year impact from the COVID headwind in the second half, which will cushion its earnings. Further, less reimbursement pressure will support its bottom line.

Analysts Offer Mixed Reaction Ahead of Q3 Print

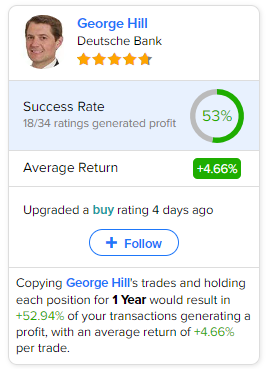

Given the expected improvement in earnings, Deutsche Bank analyst George Hill termed WBA stock a “near-term Catalyst Buy.” In a note to investors dated June 22, the analyst said that WBA’s risk/reward appears favorable. The analyst added that a sustainable improvement in its financials could lead to “multiple expansion and a modest re-rating of the shares.”

While Hill is bullish, Mizuho Securities analyst Ann Hynes recommends a Hold rating on WBA stock ahead of the Q3 print. On June 13, Hynes lowered the estimates and price target on WBA stock (to $35 from $41), citing low visibility over future earnings.

The analyst believes that headwinds related to COVID-19, margin pressure in the front-store retail sales business due to macroeconomic headwinds, and weakness in the base pharmacy prescription volume will hurt WBA’s prospects.

What is the Future of WBA Stock?

The near-term sales and margin headwinds keep analysts sidelined on WBA stock. It has received three Buy, seven Hold, and two Sell recommendations for a Hold consensus rating. Analysts’ average price target of $40.45 implies 28.82% upside potential.

Investors should note that George Hill is the most accurate analyst for WBA stock, according to TipRanks. Copying Hill’s trades on WBA stock and holding each position for one year could result in 53% of your transactions generating a profit, with an average return of 4.66% per trade.