ETFs allow investors to diversify their capital without much effort. Fund managers either take an active approach and carefully monitor individual positions or align their funds with established benchmarks. Vanguard is one of the leading firms that specializes in these types of funds. This article will dive into two popular Vanguard funds, one of which is tech-heavy, while the other is tech-exclusive: the Vanguard Growth ETF (NYSEARCA:VUG) and the Vanguard Information Technology ETF (NYSEARCA:VGT).

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

I am bullish on both of these funds, but it’s important to know the nuances of each fund before getting started. This article will examine their similarities and differences so you can decide which one makes sense for you.

Both Funds Have Performed Well in the Long Term

Both of these funds have been neck-and-neck over the past year. VGT is up by 48.2%, while VUG has gained 47.8%. There is a larger gap between the funds when looking at five-year performances. While VGT gained 166.1% during that time, VUG was only up by 121.6%.

Even though VGT has been the clear winner over the past five years, it’s hard to complain about the performance of either of these funds.

Investors don’t even have to worry much about these funds’ expense ratios eating away the returns. Vanguard is well-known for having low expense ratios for its funds, and the brokerage firm certainly delivers for these picks. VUG has a 0.04% expense ratio, while VGT has a 0.10% expense ratio.

How Much Do You Like Microsoft and Apple?

There’s more to VUG and VGT than Microsoft (NASDAQ:MSFT) and Apple (NASDAQ:AAPL). However, these two stocks are the largest positions in both funds by wide margins.

VUG offers more portfolio diversification for assets outside of these two tech giants. Microsoft makes up 13.2% of the fund’s total holdings, while Apple consists of 12.2% of the fund’s total assets. More than a quarter of VUG’s total holdings are in those two stocks.

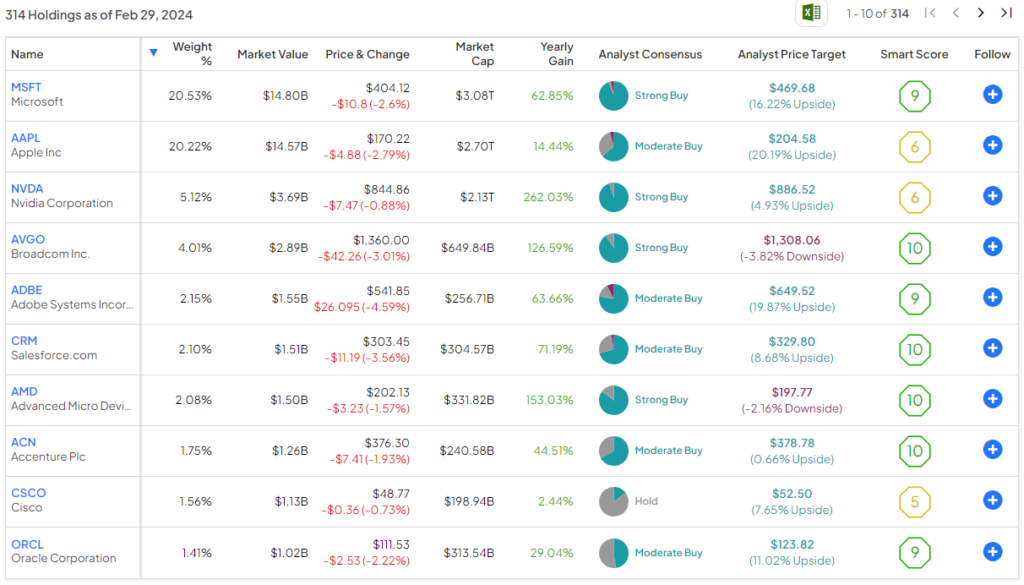

VGT is even more lopsided toward those tech conglomerates. The fund has 20.5% of its total assets in Microsoft and puts 20.2% of its capital into Apple. Those two stocks make up more than 40% of VGT’s total holdings.

VUG has the remaining members of the Magnificent Seven within its top 10 holdings. However, VGT deviates from this trend. Nvidia (NASDAQ:NVDA) is the only other Magnificent Seven stock within the fund’s top 10 holdings, as you can see below.

VUG Has Been Catching Up

While the five-year returns imply VGT is the better pick, this is a classic case of past results not guaranteeing future success. Although VGT has a big lead for that time horizon, VUG has outperformed it over the past six months. VUG is also the year-to-date winner, with a 10.5% return compared to VGT’s 8.6% return.

I believe this trend will continue for a few reasons. The first reason is Apple stock. Although shares are up by 320% over the past five years, they are only up by 14.4% over the past year. Apple stock is actually down by 4% over the past six months.

More than 20% of VGT’s portfolio is down by 4% over the past six months. That distinction only applies to roughly 12% of VUG’s total portfolio. Now, Apple can turn things around if the Vision Pro becomes the next big product, and I believe that product has the potential to deliver great returns. However, the rest of the company’s growth slowed down significantly and offers very limited upside other than the Vision Pro.

Another big reason VUG looks more enticing is the portfolio composition. With Apple’s growth slowing, investors have to pay more attention to the other stocks in these funds’ portfolios. While both funds have Nvidia as their third largest holding, the funds deviate from there.

VUG takes the expected approach of loading up on the Magnificent Seven stocks. That’s proven to be a good long-term decision, and those corporations have plenty of runway, excluding Tesla (NASDAQ:TSLA) for now.

I also have an issue with Cisco (NASDAQ:CSCO) being VGT’s 9th largest holding. That stock makes up 1.56% of the fund’s total assets but hasn’t budged by much over the years.

Cisco stock is down by 6% over the past five years. While its dividend puts the investment in the positive, that’s not the pick you want to see in a growth fund’s portfolio. VGT has better five-year returns, but I believe VUG is poised to perform better over the next five years.

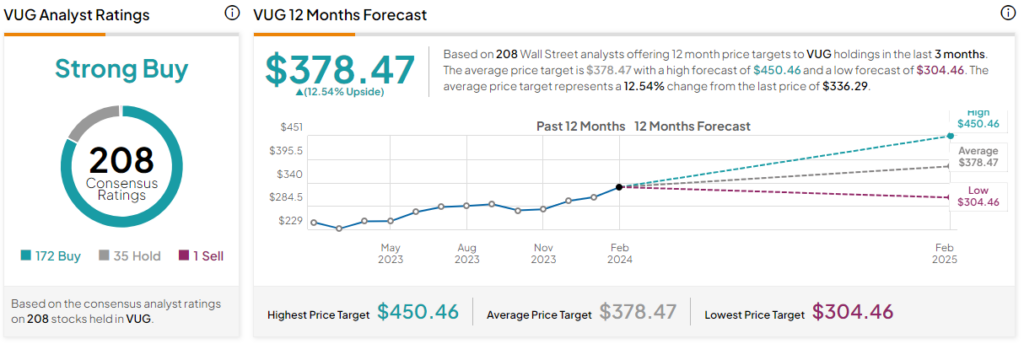

Is VUG Stock a Buy, According to Analysts?

VUG is rated as a Strong Buy based on 172 Buys, 35 Holds, and one Sell rating assigned in the past three months. The average VUG stock price target of $378.47 implies 12.5% upside potential.

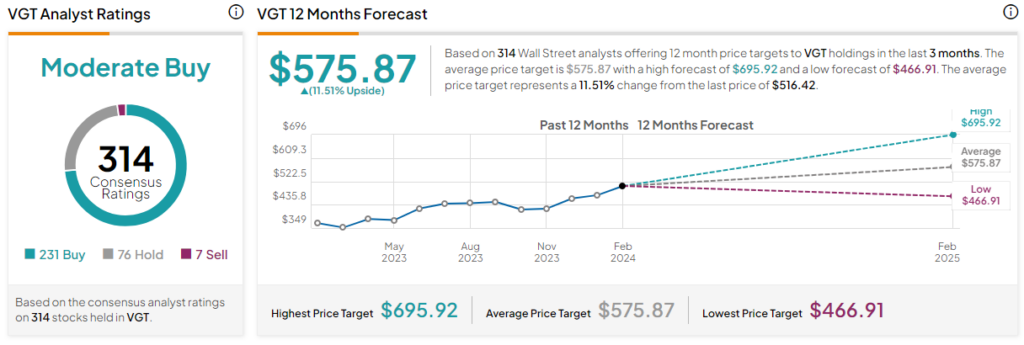

Is VGT Stock a Buy, According to Analysts?

Meanwhile, VGT is rated as a Moderate Buy, with 231 Buys, 76 Holds, and seven Sell ratings assigned in the past three months. The average VGT stock price target of $575.87 implies 11.5% upside potential. Nonetheless, analysts’ ratings suggest VUG will continue to extend its recent lead.

The Bottom Line on VUG vs. VGT

Comparing stock charts doesn’t always yield the correct answer of which fund is the better pick. That seems to be the case with these funds. VGT has the better five-year returns but was more reliant on Apple’s ascent. VUG still has significant exposure to Apple but is better prepared for a slowdown in that stock.

If Apple’s Vision Pro turns the stock into a winner again, VGT will outperform VUG, but that’s not guaranteed to happen. Both of these funds are heavily dependent on Microsoft and Apple, but it looks like VUG has better top 10 holdings than VGT.