Investing doesn’t always need to be complicated, and investors don’t necessarily need to use complex strategies to be successful. Take, for example, the Vanguard Total Stock Market ETF (NYSEARCA:VTI), a simple, uncomplicated ETF that has produced excellent returns for its investors for many years. Let’s take a closer look at this long-term winner.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

What is VTI’s Strategy?

VTI is a popular ETF from low-cost index fund pioneer Vanguard that boasts a massive $318.5 billion in assets under management (AUM). This AUM makes VTI the fourth-largest ETF in the stock market today. As the name suggests, VTI seeks to track the performance of the entire U.S. stock market (by investing in its underlying index, the CRSP U.S. Total Market Index).

So, rather than investing in one theme or sector of the market, or even one major index like the S&P 500 (SPX) or the Nasdaq (NDX) for that matter, VTI goes a step further and invests across the entire spectrum of publicly-traded U.S. companies. This means that VTI holds over 3,800 U.S. stocks, including small-cap, mid-cap, and large-cap companies.

What I like about this strategy is that VTI leaves no stone unturned, and it gives investors the ability to harness the power and innovation of the entire breadth and depth of U.S. publicly-traded companies in their portfolios using one vehicle.

VTI has been around since 2001, so it has had plenty of time to compile a consistent track record, which we will cover later in this article.

Over 3,800 Holdings

As alluded to above, VTI holds an incredible 3,837 stocks, making it incredibly diversified. Furthermore, its top 10 holdings make up just 25.9% of the fund, adding to this diversification. Below, you’ll find a table of VTI’s top holdings using TipRanks’ holdings tool.

As you can see, Apple (NASDAQ:AAPL) is VTI’s largest holding, with a 6.5% weighting, which makes sense, as Apple is the world’s biggest company by market cap. As you can surmise from this overview, VTI’s top holdings currently look somewhat tech-centric, although this isn’t by design. These were already some of the largest companies in the market, to begin with, and after the incredible gains that many of these companies have posted so far in 2023, they are back to dominating the market.

That’s why the so-called “magnificent seven” of Apple, Microsoft (NASDAQ:MSFT), Amazon (NASDAQ:AMZN), Nvidia (NASDAQ:NVDA), Alphabet (NASDAQ:GOOG) (NASDAQ:GOOGL), Meta Platforms (NASDAQ:META) and Tesla (NASDAQ:TSLA) all rank in VTI’s top 10 positions.

However, unlike some tech or broader-market ETFs where these mega-cap tech stocks combine to make up half of the fund or more, they only account for just under a quarter of VTI’s assets, so VTI’s positioning isn’t exposing investors to undue risk in this handful of names.

VTI also goes well beyond these tech behemoths — Warren Buffett’s Berkshire Hathaway (NYSE:BRK.B) and health insurer UnitedHealth Group (NYSE:UNH) take up the other two spots in the top 10, and beyond the top 10 holdings, the fund becomes much more omnivorous.

Energy giant ExxonMobil (NYSE:XOM), financials like JPMorgan Chase (NYSE:JPM), Visa (NYSE:V), and Mastercard (NYSE:MA), and additional healthcare names like Eli Lilly (NYSE:LLY) and Merck (NYSE:MRK) all occupy spots within VTI’s top 20 holdings.

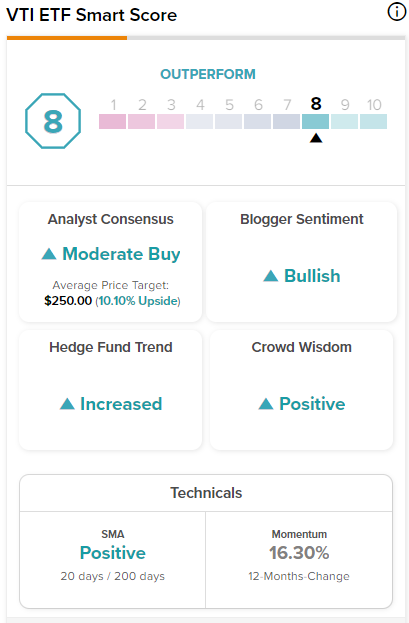

VTI’s top holdings feature some strong Smart Scores, as well as some less compelling ones. The Smart Score is a proprietary quantitative stock scoring system created by TipRanks. It gives stocks a score from 1 to 10 based on eight market key factors. A Smart Score of 8 or better is equivalent to an Outperform rating.

Five of VTI’s top 10 holdings feature Outperform-equivalent Smart Scores, while five feature neutral ratings. VTI itself features an ETF Smart Score of 8.

Is VTI Stock a Buy, According to Analysts?

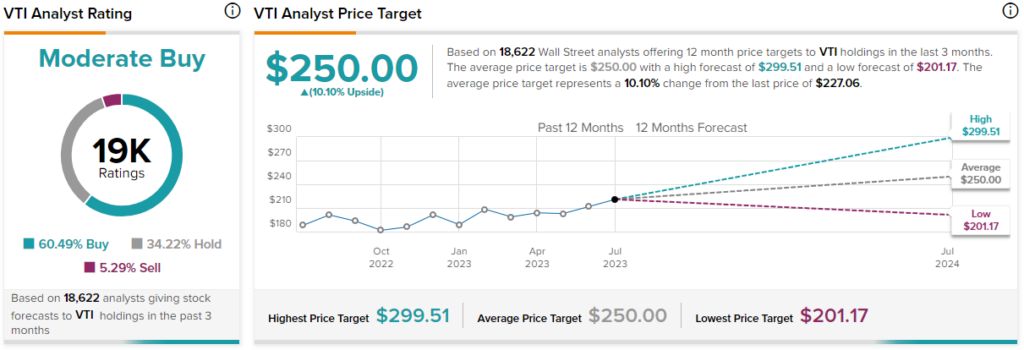

Turning to Wall Street, VTI has a Moderate Buy consensus rating, as 60.49% of analyst ratings are Buys, 34.22% are Holds, and 5.29% are Sells. At $250, the average VTI stock price target implies 10.1% upside potential.

Consistent Results

VTI has established a venerable track record over the years, proving itself to be a long-term winner for investors over a variety of time horizons. Over the past year, the fund has had a total return of 18.9%. Over the past three years, VTI has posted a total annualized return of 13.8%. Its five-year annualized return of 11.3% and 10-year annualized return of 12.3% are impressive as well. Investing in an ETF that has generated double-digit returns for an entire decade is a great way to build long-term wealth.

Since its inception in 2001, VTI has had an annualized return of 8.1%. Cumulatively, an investor who put $100,000 into VTI 10 years ago would now have $218,590 today, and an investor who put $100,000 into the ETF at its inception in 2001 would have $456,230 today, showing the power of long-term compounding.

Minimal Fees

In addition to this strong performance and comprehensive portfolio, VTI is also an appealing investment because of its minuscule fees. VTI’s rock-bottom expense ratio of just 0.03% is among the cheapest you will find with ETFs. An investor allocating $10,000 to this long-term winner would pay just a paltry $3 in fees in year one for their investment — less than a cup of coffee at many places nowadays.

Assuming the expense ratio remains consistent over time and that the fund gains 5% per year, after three years, this same investor would pay just $10 total in fees; after five years, they will have paid just $17, and after a decade their total fees would amount to just $39. Investing in ETFs with low fees like this is an important consideration because it helps investors to preserve the principal of their portfolios over time.

While it may not sound like much at first glance, the difference between VTI and its 0.03% fee and that of an ETF with a fee of 0.35%, or 0.75%, for example, is massive when compounded over time. Assuming the same parameters, an investor putting the same $10,000 into an ETF with an 0.35% expense ratio would pay $443 in fees after 10 years, while the investor putting $10,000 into the ETF with a 0.75% expense ratio would pay a whopping $871.

A Viable Cornerstone for Portfolios

VTI is not overly fancy or complicated, but it has given its investors great returns for a long time. It offers plenty of liquidity, with an average daily volume of over 2.7 million shares over the past three months, and VTI also offers a dividend yield of 1.5%.

With its comprehensive portfolio that gives investors exposure to the entire U.S. economy, its proven track record, and its minimal fees, VTI continues to be an attractive investment opportunity that investors can consider building their portfolios around.