If you’re looking to create a diversified portfolio of equities, it’s hard to beat the Vanguard Total Stock Market ETF (NYSEARCA:VTI) as a starting point. This all-encompassing fund holds positions in over 3,800 stocks. Below, we’ll discuss this popular ETF and the many advantages it offers to investors.

What is VTI ETF’s Strategy?

While there are S&P 500 (SPX) ETFs that invest in the 500 stocks that make up the S&P 500 (essentially 500 of the largest companies listed on U.S. exchanges), VTI takes things a step further. It invests in all of the stocks trading on U.S. exchanges, including large-, mid-, and small-cap stocks. This offers investors unparalleled diversification and exposure to the power of the entire U.S. economy and reduces single-stock and single-sector risk.

This passively-managed index fund is one of the most popular ETFs in the market. With a massive $315 billion in assets under management (AUM), VTI is the fourth-largest ETF in the world.

VTI’s Portfolio

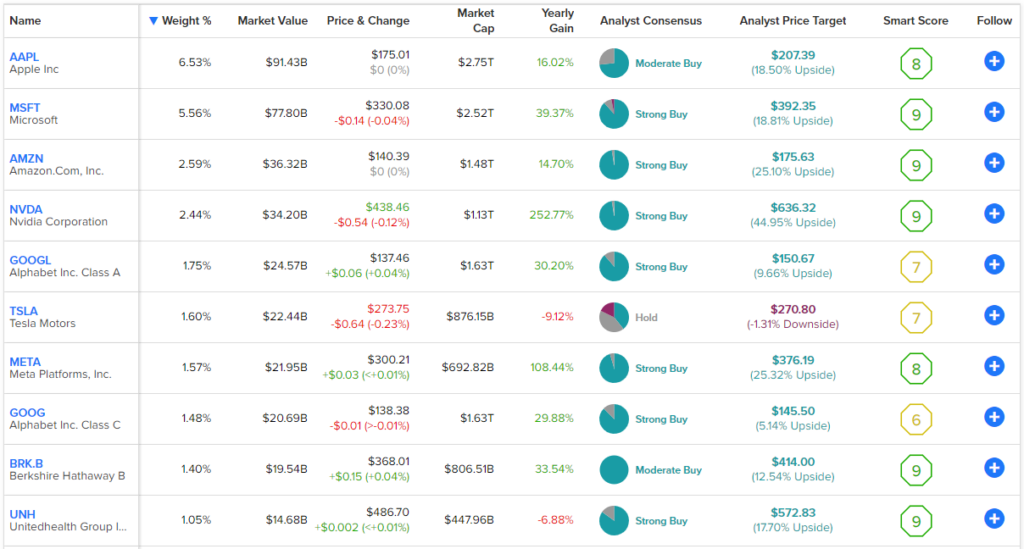

VTI holds 3,818 positions. Even better, its top 10 holdings account for just 26% of assets, meaning that there isn’t much concentration risk here. Below, you’ll find an overview of VTI’s top 10 holdings using TipRanks’ holdings tool.

As you can see, VTI’s top 10 holdings are made up of the mega-cap tech stocks that dominate the U.S. market, including Apple (NASDAQ:AAPL), Microsoft (NASDAQ:MSFT), Amazon (NASDAQ:AMZN), Nvidia (NASDAQ:NVDA), Alphabet (NASDAQ:GOOG) (NASDAQ:GOOGL), Tesla (NASDAQ:TSLA) and Meta Platforms (NASDAQ:META).

Technology is the largest sector of the U.S. stock market, so it’s unsurprising that these tech giants occupy such prominent positions within the fund. Altogether, the technology sector has a 30.1% weighting within the ETF, but there is plenty more to VTI beyond tech. Other substantial segments include the consumer discretionary sector at 14.4%, the industrial sector with a 13.0% share, followed closely by the healthcare sector at 12.6%, and finally, the financial sector accounts for a 10.5% weighting.

Outside of the technology sector, other prominent holdings include the likes of Warren Buffett’s Berkshire Hathaway (NYSE:BRK.B), health insurer UnitedHealth Group (NYSE:UNH), energy majors like ExxonMobil (NYSE:XOM) and Chevron (NYSE:CVX), and pharmaceutical giants like Johnson & Johnson (NYSE:JNJ), Eli Lilly (NYSE:LLY), Merck (NYSE:MRK), and AbbVie (NYSE:ABBV).

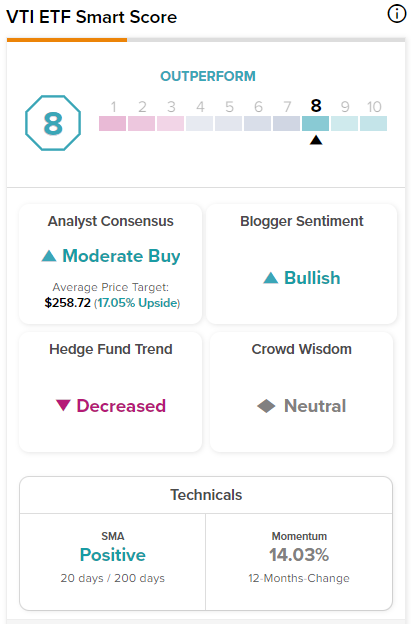

Six of VTI’s top 10 holdings feature Smart Scores of 8 or above. Meanwhile, VTI earns an Outperform-equivalent ETF Smart Score of 8. The Smart Score is a proprietary quantitative stock scoring system created by TipRanks. It gives stocks a score from 1 to 10 based on eight market key factors. A score of 8 or above is equivalent to an Outperform rating.

In addition to this strong Smart Score, VTI also enjoys relatively favorable ratings from the analyst community, as you’ll see below.

Is VTI Stock a Buy, According to Analysts?

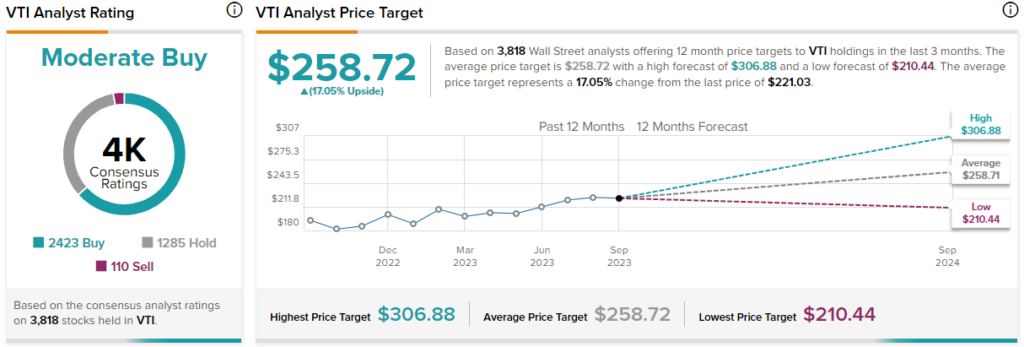

Turning to Wall Street, VTI earns a Moderate Buy consensus rating based on 2,423 Buys, 1,285 Holds, and 110 Sell ratings assigned in the past three months. The average VTI stock price target of $258.72 implies 17.1% upside potential.

Looking at Its Long-Term Performance

VTI’s comprehensive approach has helped it build up a solid track record of performance over time. VTI has returned 18.1% year-to-date and 14.8% over the past year. Over the past three years, the fund has returned a respectable 9.7% on an annualized basis.

Further out, VTI has posted double-digit total returns over the past five and 10 years on an annualized basis, with an impressive five-year annualized return of 10.2% and an even better 10-year annualized return of 12.2%.

Since its inception over 20 years ago in 2001, VTI has returned 8.1% on an annualized basis, making this fund a consistent long-term performer.

Looking at these returns on a cumulative basis illustrates the power of investing in a fund like VTI and letting the results compound over the long haul. VTI’s cumulative return over the past 10 years is 215.8%, and its cumulative return since its inception is 465.2%, meaning that an investor who put $100,000 into VTI 10 years ago would have $215,800 today and an investor who put the same amount into VTI when it started in 2001 would have $465,200 today.

Minuscule Fees

Vanguard is the firm that pioneered the idea of low-cost index funds, and VTI is another great example of this tradition. Its miniscule expense ratio of just 0.03% is among the lowest out there and means that an investor allocating $10,000 into VTI today will pay just $3 in fees over the course of the year.

Assuming that the expense ratio remains at 0.03% and VTI returns 5% per year going forward, this investor would pay just $10 in fees after three years, $17 after five years, and $39 after 10 years. These low fees help investors to keep more of the gains they make over time.

This 0.03% expense ratio is also dramatically cheaper than the average expense ratio for similar funds, which stands at 0.79%. Over the course of 10 years, an investor putting the same amount into a fund with a 0.79% expense ratio would pay a whopping $1,184 in fees. This massive difference in total costs over time illustrates why it’s important not to overlook expense ratios when choosing investments and why it’s beneficial to invest in low-cost funds like VTI.

Dividend Track Record

VTI’s dividend yield stands at just 1.5%, so most investors aren’t buying it for the income. However, this yield is roughly in line with that of the S&P 500, and it helps add to total returns over time. Additionally, VTI has been a reliable dividend payer for many years, with 21 years of consecutive dividend payments under its belt.

Investor Takeaway

VTI’s long-term track record and its broad and comprehensive group of holdings make it a great building block for an investor who is just starting out. The ETF can also be a solid option for longtime investors who simply want to add instant diversification to their portfolios.

The popular ETF’s simple strategy of investing in all stocks listed on U.S. exchanges regardless of size or sector has worked for a long time, and it’s hard to argue with the results. Furthermore, VTI’s minimal fees make it even more attractive.