It has become apparent that credit card companies stand to benefit from a recovery in travel. Last week, The Wall Street Journal reported, citing data from American Express (AXP), that in Q1, U.S. consumers spent more than 20% on travel and entertainment, adjusting for exchange rate fluctuations, as compared to the same time period in 2019. However, the report also noted that international travel and corporate travel expenditure is still not back to pre-pandemic levels.

A similar sentiment was echoed by Visa last month when it announced that the U.S. Spending Momentum Index (SMI) was 109.3 in the month of February, up from 102.4 in January. According to Visa, when the SMI “rises above 100, the consumer spending momentum is strengthening and when it falls below 100, the spending momentum is weakening as fewer consumers are spending more relative to the previous year.”

As the two credit card behemoths, Visa and Mastercard, get ready to announce their Q1 results, which stock will benefit the most from this uptick in spending? Using the TipRanks stock comparison tool, we will compare these two stocks and also look at how Wall Street analysts are expecting their earnings to turn out.

Visa (NYSE: V)

Visa is expected to announce its fiscal Q2 results on April 26. Shares of Visa have declined 6% year-to-date, which is still lower than the S&P 500 index which has fallen 10.9% in the same period.

The global payments technology giant provides transaction processing services including authorization, clearing, and settlement to financial institutions and merchants through VisaNet.

Visa is upbeat about its outlook for FY22 and expects that growth could be above pre-pandemic levels as cross-border transactions recover. The company’s management added on its Q1 earnings call that it expects a rise in revenues to accelerate to pre-pandemic levels for three reasons.

The first reason is that as digitization takes place globally across consumers and businesses, people are moving away from cash and checks for merchant payments in both the U.S. and for cross-border transactions.

Vasant Prabhu, Visa’s Vice-Chairman and CFO added that the move away from cash, check and wire transfer is accelerating “as our new flows initiative penetrate a broad range of new use cases with very large total addressable markets” and Visa experiences a “sustainable high-teens growth across our value-added services both from existing services and new offerings.”

As cross-border travel resumes and restrictions ease, in Q2, Visa anticipates “net revenues to grow at the high end of high teens in the second quarter including over 1 point of exchange rate drag.”

For FY22, the company has projected net revenues to increase at “the high end of high teens, including 1 point of exchange rate drag.” The company’s management also pointed out that as cross-border volumes rise, incentives as a percentage of gross revenues are likely to range between 25.5% and 26.5% for the year.

Robert W. Baird analyst David Koning expects that Visa’s fiscal Q2 revenues and EPS are likely to be “mildly above consensus” and expects “above-normal revenue/EPS growth for several years as travel recovers.” Moreover, the analyst believes that there is a possibility that Visa will grow faster than the S&P 500 as he expects “20%+/year EPS growth possible for a few years.”

However, the analyst anticipates that Visa’s guidance for FY22 could be “mildly trimmed to reflect Russia/Ukraine impacts.”

Last month, Visa suspended its operations in Russia and stated that for FY21, revenues driven by domestic as well as cross-border transactions from Russia comprised 4% of its net revenues while net revenues from Ukraine comprised 1%.

According to the top-rated analyst, other key positives for the stock include revenue growth in “double-digit,” cross-border travel recovery, a clean balance sheet, and other tailwinds include popularity of cryptocurrencies, the rising trend of buy-now-pay-later (BNPL), and growth in global e-commerce.

As a result, Koning is bullish on the stock with a Buy rating and a price target of $290, implying an upside potential of 39.3% to early morning trading levels on Monday.

Overall, other analysts on the Street are also upbeat about the stock with a Strong Buy consensus rating based on 18 Buys and two Holds. The average Visa stock forecast is $275.88, implying an upside potential of 32.5% from levels seen before market open on Monday.

Mastercard (NYSE: MA)

Mastercard is expected to announce its fiscal Q1 results on April 28. Similar to Visa, the company is bullish about its outlook for FY22. Mastercard anticipates that even in a base case scenario, net revenues are likely to grow “at the high end of a high teens rate on a currency-neutral basis.”

In fiscal Q1, the company has projected net revenues to increase “at the high end of a high teens rate” on a year-over-year basis reflecting a quarter-over-quarter improvement in cross-border travel spend relative to 2019.

Sachin Mehra, Mastercard’s CFO elaborated further on the company’s Q4 earnings call and stated that between 2022 and 2024, “we expect to deliver a net revenue compound annual growth rate in the high teens. This assumes an annual target market volume growth rate of 10% to 11%, cross-border travel returning to 2019 levels by the end of 2022 and doing our services revenues at a 20%-plus CAGR [compounded annual growth rate].”

Furthermore, Mastercard expects to deliver a minimum annual operating margin of 50% and has projected its earnings per share (EPS) to grow at a CAGR in the “low 20s range on a currency-neutral basis.”

Baird analyst David Koning is optimistic about MA and thinks the stock is a “long-term compounder” and believes that the company will certainly be able to grow its EPS at least in the “low-20’s%” range.

Moreover, according to the analyst, other key positives for the stock include its “solid” revenue and EPS guidance between 2022 and 2024, recovery in cross-border travel, the shift to cards and believes that MA could “slowly expand toward Visa margins of 65%+.”

As a result, Koning reiterated a Buy rating on the stock with a price target of $470 which is closer to the Street high price target of $472. The analyst’s price target implies an upside potential of 33.8% to early morning trading levels on Monday.

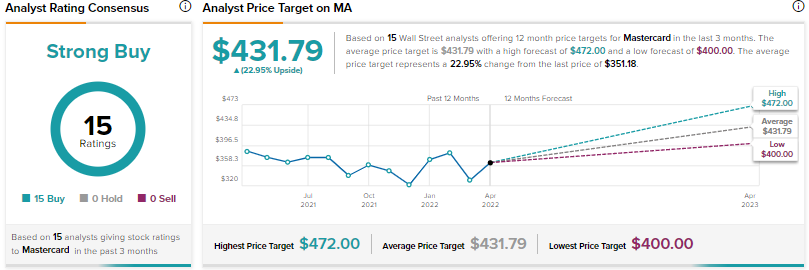

Overall, other Wall Street analysts are also bullish about the stock with a Strong Buy consensus rating based on 15 unanimous Buys. The average Mastercard stock forecast is $431.79, implying an upside potential of approximately 23% from current levels.

Bottom Line

It appears that both Mastercard and Visa are strong contenders that stand to benefit in the current macroeconomic scenario, with travel restrictions being lifted, higher consumer spending, and recovery in cross-border travel transactions.

While analysts are upbeat about both stocks, based on the upside potential over the next 12 months, Visa does seem to be a better Buy.

Learn more about the Website Traffic tool in this video by Youtube sensation Tom Nash.

Discover new investment ideas with data you can trust

Read full Disclaimer & Disclosure.