Visa stock (NYSE:V) appears positioned to sustain double-digit growth for years to come. The payments network giant experienced a modest revenue slowdown last year, causing some investors to believe that its growth would fall into the single digits. However, Visa’s most recent results came in strong, indicating that double-digit growth is once set to prevail. Wall Street, in fact, forecasts that this trend will stay in place for years to come, bolstering Visa’s bullish case. Therefore, I am bullish on V stock.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Q2 Results: Visa Sets the Stage for Another Great Year

Visa’s Fiscal Q2 results reignited investor confidence in the stock. The company’s growth remained in the double digits, a trend that appears set to be sustained moving forward despite earlier signs of a potential slowdown. Particularly, with Visa’s top line trending down consistently in earlier quarters, many investors were expecting that Visa’s full-year revenue growth would fall below the double digits. Looking at each quarter’s revenue growth between Q4 of 2020 and Q1 of 2024, you’d certainly get that impression.

- Q4-2020: 28.6%

- Q1:2021: 24.1%

- Q2-2021: 25.5%

- Q3-2021: 18.7%

- Q4-2021: 18.7%

- Q1-2022: 12.4%

- Q2-2023: 11.1%

- Q3-2023: 11.7%

- Q4-2023: 10.5%

- Q1-2024: 8.8%

Fortunately, Visa’s Q2-2024 results reversed this slowdown. Its growth bounced sequentially, reaching 9.9%, while the ongoing momentum points toward further gains in the second half of the fiscal year. To elaborate on this quarter’s results, Visa’s revenue growth was driven by certain key factors. These mainly included robust payment volume, an increase in processed transactions, and a notable rise in cross-border volume.

Regarding payments volume, Visa recorded an 8% increase year-over-year on a global scale, which was consistent with Q1 growth. Processed transactions also saw an 11% year-over-year increase, highlighting the steady increase in the number of transactions Visa’s network handled. Lastly, cross-border volume, excluding intra-Europe, grew by 16% year-over-year in constant currency, reflecting a thriving tourism and travel industry overall.

These increases, in turn, drove Service revenue up 7% year-over-year, which was closely aligned with the 8% growth in constant-dollar payments volume from Q1. The increase in processed volumes also boosted Data Processing revenue by 12%. Finally, cross-border transaction growth drove International Transaction revenue growth of 9%, although this was somewhat offset by softer currency volatility compared to last year.

Given its current momentum, management now expects revenue growth in the low double digits for the second half of the year, thus propelling Visa’s full-year revenue growth into the double digits as well. On the one hand, total payment volume growth is now projected to come in in the high single digits instead of the previously forecasted low double digits.

This reflects certain trends in Asia, which have been slower than anticipated. On the other hand, cross-border volume, ex-intra-Europe, is projected to continue growing robustly in the mid-teens, with e-commerce strength offsetting the weaker travel-related cross-border volume in Asia.

Therefore, Wall Street expects Visa’s full-year revenue to grow by 10% to $39.5 billion. Importantly, consensus estimates point toward sustained double-digit top-line growth at least through Fiscal 2026, evaporating earlier concerns regarding a potential slowdown in the single digits.

Growth, Valuation, Support Bullish Case

Considering Visa’s ongoing growth trajectory and favorable estimates, coupled with its current valuation, I am confident in the strength of its bullish outlook. Essentially, Visa’s high-margin, scalable business model enables margin expansion over time, amplifying net income growth beyond revenue growth. Mixed with the company’s periodic stock buybacks, Wall Street anticipates a compound annual growth rate (CAGR) of 13.2% in earnings per share (EPS) over the next five years. To me, this implies that the stock’s forward P/E of 25.5x is quite attractive, particularly given Visa’s moat and overall qualities.

Is Visa Stock a Buy, According to Analysts?

Regarding Wall Street’s view on the stock, Visa has a Strong Buy consensus rating based on 19 Buys and three Holds assigned in the past three months. At $316.63, the average Visa stock price target implies 18% upside potential.

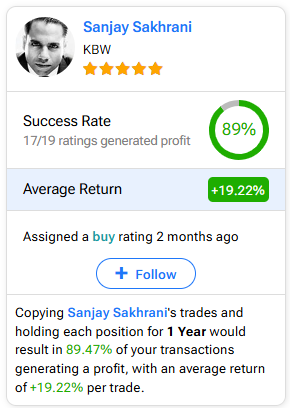

If you’re unsure which analyst you should follow if you want to buy and sell V stock, the most profitable analyst covering the stock (on a one-year timeframe) is Sanjay Sakhran from KBW, with an average return of 19.22% per rating and an 89% success rate. Click on the image below to learn more.

The Takeaway

Visa’s robust performance and promising growth outlook stress its potential to maintain double-digit revenue growth in the years ahead. The company’s strong Q2 results, driven by increased payment volumes, processed transactions, and cross-border activity, have reinforced investor confidence in the stock. With Wall Street’s forecast further supporting this theme and Visa’s valuation looking quite attractive against its future estimates, its bullish case seems as strong as ever.