Credit card giant Visa (NYSE: V) has long made a career around being everywhere you want to be. Now, Visa is making fresh headway on being everywhere you want to be and allowing you to do more when you get there. A new deal sent V stock slightly higher in today’s trading session so far.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Visa’s latest move is making investors happy. The move in question is a new program called “Installments enabled by Visa,” and it’s about what it says it is. The new move allows multiple businesses throughout Canada—including Simons, Soft Moc, and Canada Computers—to accept installment payments for their various goods.

Visa isn’t doing all this alone, however. Visa will be working with Nuvei (NASDAQ: NVEI) and Tender Retail. Nuvei’s retailer network in Canada will offer some of the first businesses to use the service. Tender Retail, meanwhile, will offer up some of its payment solutions to complete the connection.

Visa’s move might be exactly what’s needed to help it fend off the worst of the recession. That kind of defensive ploy makes me feel a lot better about Visa’s chances. Though certainly, Visa will have its problems, its seeming recognition of this fact makes me bullish, going forward.

Investor Sentiment is Reasonably Bright

While investor sentiment at Visa isn’t perfect, many of its metrics are looking quite sound. Currently, Visa has a 9 out of 10 Smart Score on TipRanks. That’s the second-highest level of “outperform.” It suggests a very strong probability that Visa will ultimately outperform the broader market.

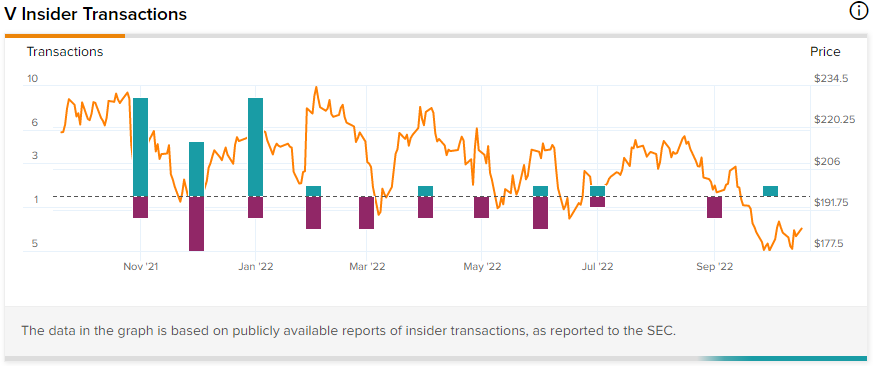

While this picture is clearly in Visa’s favor, the same can’t really be said among Visa’s insiders. Insider trading at Visa has been Sell-weighted in recent months, though there are still buyers. The last informative transaction took place seven months ago when director Robert Matschullat sold $234,976 worth of stock.

The aggregate tells a conflicted story as well. In the last three months, investors bought shares once but sold twice. The entire month of July featured no transactions at all. As for the last 12 months, insiders bought shares on 28 occasions but sold them on 25.

Much of Visa’s insider purchases came in this time last year into early 2022. After January 22, insiders only bought five times. Insiders sold off fairly regularly, however.

Stock Math: A Growing User Base in a Down Economy Equals a Good Plan

First, let’s address the elephant in the room. Visa is going to get hit hard by an economic downturn. Visa depends on consumers for a good portion of its income. All those people with credit card balances paying interest to Visa are much of what keeps Visa going.

People are pulling in on their spending. That’s going to reduce the amount of outstanding balance and, in turn, reduce the amount of interest paid. That’s lower revenue for Visa, but Visa likely saw that coming and thus brought out an installment plan system to help goose the consumer back to shopping. Shopping consumers are paying customers for Visa as well.

Also, installment plans are more valuable for businesses. Studies going as far back as 2018 find that installment plans encourage shopping. One study noted that 35% of polled consumers were more likely to buy when monthly installment payment plans were offered. That number held up well; in 2019, a study found that 31% wouldn’t have made a recent purchase without installment payments.

Payment plans have also been found to improve customer loyalty, which in turn encourages repeat business. It also improves access to bigger purchases; customers enjoy being able to only pay so much today to get something that might cost several times that amount.

Thus, Visa’s newest move into payment plans will likely not only help businesses, but it will also help Visa itself. Businesses that might have considered doing more business with Mastercard (NYSE: MA) or another credit card line might reconsider and stick with Visa, thanks to the payment plan.

Granted, Visa is still going to lose some ground to the souring economy. For some consumers, no amount of payment plan will keep them in the fold. This is particularly true as food prices continue their upward climb and gas prices do likewise. Yet, by offering that payment plan, Visa may prevent some losses.

With Visa clearly doing what it can to preserve its income stream and those of its client businesses that accept Visa payments, Visa makes an excellent case for sticking with it. That’s going to help preserve revenue and give Visa an edge.

There are some unusual signs of weakness in Visa, however. Most notable of these was its net income growth over the past five years, which was actually lower than that of the broader industry (10.8% growth compared to 14.4% growth for the industry). Still, there are plenty of other signs of life, like its current valuation in relation to price targets and the fact that it retains about 77% of profits to reinvest in the company.

Is V Stock a Buy or Sell?

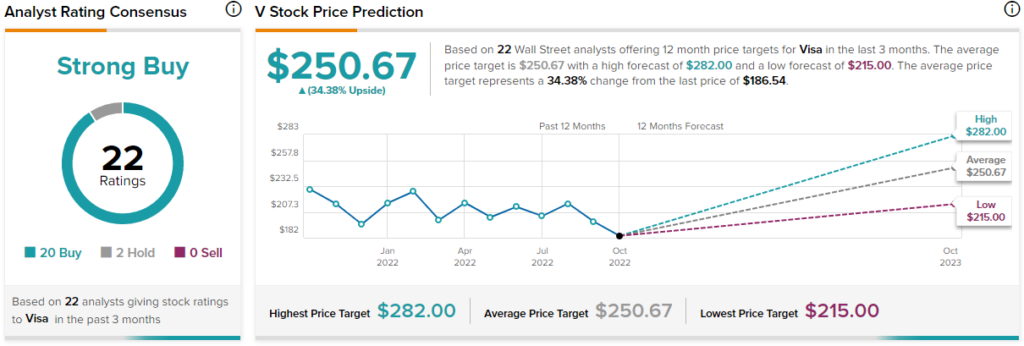

Turning to Wall Street, Visa has a Strong Buy consensus rating. That’s based on 20 Buys and two Holds assigned in the past three months. The average Visa price target of $250.67 implies 34.4% upside potential.

Analyst price targets range from a low of $215 per share to a high of $282 per share.

Conclusion: Maybe the Best Credit Card Company

It’s going to be a rough few months for credit card companies. Visa will be no exception, but Visa also has several points supporting it, going forward. That payment plan strategy may be the best of these, but it’s hardly alone.

Visa is currently trading well below its lowest price targets, which offers a solid buy-in point. It’s also offering stable dividends despite economic uncertainty. Better yet, it’s offering these dividends with a comparatively small slice of its earnings, which means plenty of reinvestment capability.

An economic downturn will hit Visa and hit it hard. However, Visa has also taken steps to protect itself from the worst of those hits. That makes Visa a pretty attractive investment, and that’s why I’m bullish overall.