Plenty of financial traders are prepared for liftoff, but I wouldn’t bet too much money on a moon shot with Virgin Galactic (NYSE:SPCE) stock. I am neutral on SPCE stock because Virgin Galactic’s upcoming space mission is already a known factor and because the company has demonstrated a willingness to dilute the current shareholders.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Headquartered in California, Virgin Galactic specializes in private space tourism. The company was among the first publicly-listed U.S. businesses seeking to send people who aren’t professional astronauts into space.

Of course, this doesn’t mean that everybody actually gets to fly beyond the Earth’s atmosphere. A space-flight ticket with Virgin Galactic costs hundreds of thousands of dollars, and there’s a waiting list. This might sound like a terrific business model for Virgin Galactic, but be sure to check the hard facts before getting on board with SPCE stock.

Investors Gear Up for Virgin Galactic’s Big Flight

When financial traders are buzzing on social media about an upcoming event, my contrarian instincts tell me to stay away. Nonetheless, I must admit it’s exciting to count down the hours until Virgin Galactic sends three crew members into space tomorrow.

Reportedly, there will be a live stream of Virgin Galactic’s spaceflight, known as Galactic 01, at 11:00 a.m. Eastern time on June 29. I won’t lie to you; I’ll probably watch it while it’s happening. Assuming it goes off without a hitch, this will be Virgin Galactic’s first commercial spaceflight, and it’s set to last for 90 minutes.

You won’t see any wealthy tourists on this particular mission. Rather, its purpose is for a three-person crew from the Italian Air Force and National Research Council of Italy to conduct scientific experiments. That might not sound ultra-exciting, but this spaceflight is long-awaited, as Virgin Galactic has previously expected that it would commence its commercial service in space during the first half of 2020.

I have no objection to human spaceflight and scientific research. However, as a prospective investor, I know that the financial markets are highly efficient, and Virgin Galactic’s upcoming spaceflight is already a known factor. The only thing that’s currently unknown is whether the mission will be successful, but there’s no reason for anyone to believe that the 90-minute spaceflight would go awry.

Share Sales Could Bring Virgin Galactic Stock Back Down to Earth

As we’ll discover in a moment, analysts aren’t ultra optimistic about SPCE stock. I can see why, as Virgin Galactic’s financial situation isn’t stellar, and the company evidently isn’t reluctant to sell its shares to raise capital.

Let’s start with the basics. For the first quarter of 2023, Virgin Galactic posted a loss of $0.57 per share, which was worse than the consensus estimate of a loss of $0.52 per share. Furthermore, Virgin Galactic’s quarterly revenue of $392,000 was far below Wall Street’s estimate of $1.37 million.

Now, we’re starting to get a picture of why SPCE stock is down so much over the past couple of years. Virgin Galactic has been unprofitable quarter after quarter for years, and investors are finding out that a private spaceflight business can be quite expensive to run. Indeed, it’s so capital-intensive that Virgin Galactic reportedly enacted a share offering valued at $300 million and recently disclosed plans to raise $400 million through another share sale.

Is SPCE Stock a Buy, According to Analysts?

As it turns out, Wall Street isn’t particularly enthusiastic about Virgin Galactic. SPCE is a Moderate Buy based on zero Buys, four Holds, and three Sell ratings. The average Virgin Galactic stock price target is $3.81, implying 19% downside potential.

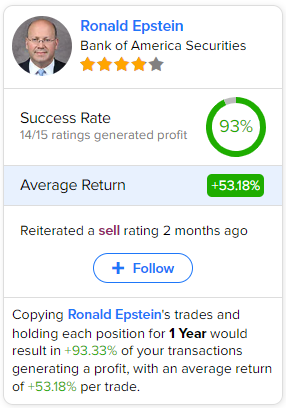

If you’re wondering which analyst you should follow if you want to buy and sell SPCE stock, the most accurate analyst covering the stock (on a one-year timeframe) is Ronald Epstein of Bank of America (NYSE:BAC) Securities, with an average return of 53.18% per rating and a 93% success rate. Click on the image below to learn more.

Conclusion: Should You Consider SPCE Stock?

Actions speak louder than words, and it’s clear from Virgin Galactic’s actions that the company won’t hesitate to issue and sell millions of shares. This suggests that Virgin Galactic may be desperate to raise capital and that the company might dilute the current shareholders at some point in the future.

Sure, Virgin Galactic stock is catching a bid today. However, this may be an instance of “buy the rumor, sell the news.” The news is slated to happen tomorrow, so I’m exercising caution with SPCE stock and don’t feel that eager traders should consider a long position now.