Richard Branson-founded Virgin Galactic (NYSE:SPCE) is slated to report its third quarter Fiscal 2023 results on November 8, after the market closes. The Street expects the aerospace and space travel company to post a diluted loss of $0.42 per share on revenues of $1.07 million. In the prior-year quarter, SPCE posted a diluted loss of $0.55 per share on revenues of $0.77 million.

Meanwhile, the company expects third-quarter revenues to be roughly $1 million. However, SPCE projects its free cash flow to be negative $120 million to $130 million in the to-be-reported quarter.

The company successfully began commercial spaceflights in the second quarter, aiding its revenues. Plus, membership fees related to future astronauts are also expected to pump up revenues in the third quarter.

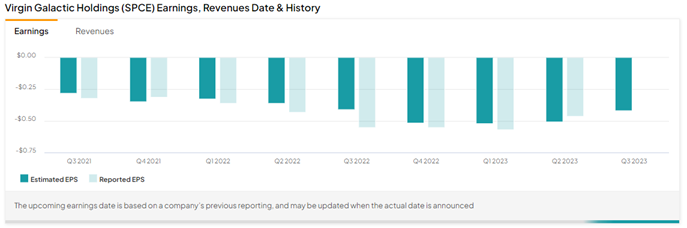

In the past eight quarters, Virgin Galactic has surpassed analysts’ consensus only twice.

What is the Forecast for SPCE Stock?

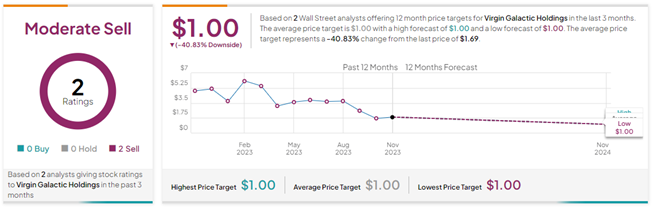

Ahead of the Q3 print, Truist Financial analyst Michael Ciarmoli cut the price target on SPCE stock to $1 from $3 while maintaining a Sell rating.

The five-star analyst’s research on the aerospace and defense sectors showed that demand, pricing, and new equipment supply trends will continue to support the sector.

Overall, SPCE stock has a Moderate Sell consensus rating based on two Sell ratings. The average Virgin Galactic price forecast of $1 implies 40.8% downside potential from current levels. Year-to-date, SPCE stock has lost 51.6%.

Insights from Options Trading Activity

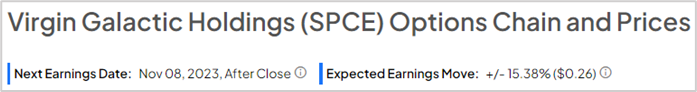

TipRanks now presents options activity to help investors plan their trades ahead of earnings releases. Options traders are pricing in a +/- 15.38% move on SPCE’s earnings. Virgin Galactic shares have averaged a (3.85%) move in the last eight quarters. In particular, the stock lost 4.35% in reaction to the Q2 2023 results.

The anticipated move is determined by computing the at-the-money straddle of the options closest to the expiration after the earnings announcement.

Learn more about TipRanks’ Options tool here.

Ending Thoughts

Virgin Galactic has begun commercial spaceflights, which bodes well for long-term revenue growth. Even so, SPCE stock could remain under pressure owing to consistent cash burn and net losses.