Virgin Galactic Holdings (NYSE: SPCE) stock is a cash vacuum whose value proposition makes no sense from an investor’s point of view.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

In late 2021, I wrote a short article alerting investors that Virgin Galactic stock should be avoided as the company’s business model suffers from fundamental issues. The stock was trading close to $20 at the time. Then, in early February 2022, I followed up on my thesis, explaining why Virgin Galactic stock was bound to see further downside moving forward, urging investors to avoid the stock. Shares had already fallen to $9.72 at that point.

Fast forward almost a year later, and I am unsurprised to see that Virgin Galactic is trading at just under $5.00, with the stock even declining as low as $3.24 at its 52-week lows. Yet, nothing has since occurred that has made me want to change my mind about Virgin Galactic’s future prospects. The numbers make no sense, and the company is set to keep destroying shareholder value with no shame. Accordingly, I am bearish on the stock.

No Path to Profitability

The fundamental problem with Virgin Galactic is that it has no path in sight in terms of turning a profit. There is no business model to do so in the first place.

The company claims that its value proposition comes from offering customers a spaceflight with the ability to view Earth from space along with a few minutes of weightlessness. To demonstrate that the flight itself is achievable in the first place, founder Sir Richard Branson and his team traveled to the edge of space and back utilizing VSS Unity back in June 2021.

The fact that the flight was a success, however, has nothing to do with the possibility that these flights can operate at scale, let alone allow the company to actually attract enough customers that want to spend $450,000 just so they can claim they have been in space.

Since that flight, Virgin Galactic has lost hundreds of millions of dollars, has postponed the introduction of a second suborbital spaceship, and it appears to have not sold any tickets other than the initial 600-700 reservations from 2021.

While investor interest has increased lately since the company stated that its commercial service remains on track to begin in Q2 of this year, this doesn’t define the frequency potential of these flights. For example, if the company can perform three flights per month (as it plans on doing to get started) and each flight can accommodate six passengers, it would take just over three years just to fulfill its current reservations before booking any additional revenues. Even then, there is no way the company can generate enough cash flow to cover its ongoing losses, which have been widening.

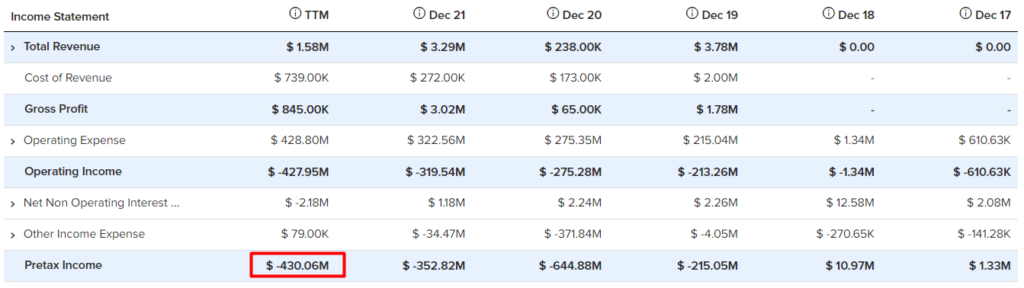

In its most recent Q3-2023 results, the company posted a net loss of about $146 million, more than triple the $48 million net loss in the third quarter of 2021. In fact, Virgin Galactic has lost more than $430 million over the past 12 months alone, with losses widening quarter-over-quarter.

Virgin Galactic would need to find nearly 1,000 people willing to spend $450,000 each just to cover these losses, let alone turn a meaningful profit.

No Cash Means More Dilution

It’s no surprise that with no revenues and such massive losses, Virgin Galactic is draining its cash reserves. The company currently has cash of about $1 billion, which at the current loss run rate would last just about two years before bank balances reach $0.

The only way for SPCE to avoid shutting down shop by then is by issuing more debt and/or equity. In fact, last year, the company raised $425 million via debt. The interest in these notes is not substantial, at 2.5%, but they are convertible into shares, which could translate to massive future dilution for common shareholders.

However, that seems to be of no concern for management, as Virgin Galactic’s share count has already increased by a scary 40% since the stock’s IPO. The company is printing stock and issuing debt to stay afloat, and this is set to continue for quite some time as there is no near-term catalyst to bring in revenues. In other words, shareholders are bound to be diluted to oblivion, with no margin of safety against further share losses and reverse stock splits.

Is SPCE Stock a Buy, According to Analysts?

Turning to Wall Street, Virgin Galactic has a Moderate Sell consensus rating based on one Buy, two Holds, and four Sells assigned in the past three months. At $4.71, the average Virgin Galactic stock forecast implies 5.1% downside potential.

The Takeaway

In my view, Virgin Galactic’s business model is a sham with no prospects of ever turning a profit, or at least not before shareholders have been diluted catastrophically. It doesn’t matter if the company will be making quite a bit of money 10 years from now if the share count has tripled by then.

In a rising-rates environment, and especially having hardly any revenue, it’s likely that nobody will lend the company money in a non-dilutive offering, which basically takes away the stock’s potential to deliver value to shareholders in its current state.

Unless management lays out a clear plan for growing its revenues and demonstrates a significant increase in bookings along with a clear ability to handle future flights, I would urge investors to avoid this money-vacuum stock.